In the complex world of international finance, foreign exchange (forex) reserves and the Reserve Bank of India’s (RBI) contingency reserve play crucial roles in safeguarding a country’s economic stability. While both serve as financial buffers, they differ significantly in their purpose and management.

Image: www.marketcalls.in

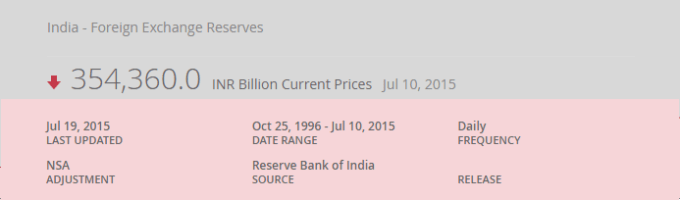

Forex Reserves

Forex reserves refer to the holdings of foreign currencies, gold, and other assets by a central bank. These reserves serve as a store of value and a means of settling international payments. Adequate forex reserves enhance a country’s ability to meet its external obligations, stabilize its currency, and mitigate external economic shocks.

RBI Contingency Reserve

The RBI contingency reserve, on the other hand, is a statutory reserve maintained by the RBI. It is a fund set aside to meet unforeseen financial emergencies and contingencies. While forex reserves are primarily managed for external purposes, the contingency reserve is used domestically to address financial crises or extraordinary events that could destabilize the Indian financial system.

Management and Utilization

Forex reserves are managed by the RBI in accordance with government policies. The central bank intervenes in the foreign exchange market to buy or sell foreign currencies to influence the value of the Indian rupee and maintain its stability. The utilization of forex reserves is primarily aimed at managing the external value of the rupee and protecting the economy from external shocks.

The RBI contingency reserve, however, is managed by the central bank’s Board for Financial Supervision (BFS). The BFS determines the appropriate level of the reserve and its utilization. The contingency reserve may be used to address domestic financial emergencies such as sudden withdrawals of funds from banks, financial market crises, or the failure of systemically important institutions.

Image: www.youtube.com

Benefits and Importance

Both forex reserves and the RBI contingency reserve play vital roles in ensuring the stability and resilience of the Indian economy. Forex reserves provide a cushion to meet external obligations, reduce the risk of currency fluctuations, and enhance investor confidence. The RBI contingency reserve acts as a safety net to mitigate domestic financial risks, protect depositors, and maintain financial stability during times of turmoil.

Latest Trends and Developments

In recent years, there has been a growing focus on enhancing the management of forex reserves. Central banks worldwide are exploring new ways to diversify their holdings and improve risk management practices. The RBI has also taken steps to strengthen its contingency reserve framework and improve its preparedness to address financial shocks.

Tips and Expert Advice

To stay informed about the latest developments in forex reserves and RBI contingency reserve management, consider the following tips:

- Monitor news and updates from the RBI website.

- Read financial publications and research reports.

- Attend conferences and seminars on international finance.

Additionally, consult with financial experts or economists for insights on the implications of forex reserves and contingency reserves on the Indian economy.

FAQ

Q: What is the difference between forex reserves and RBI contingency reserve?

A: Forex reserves are holdings of foreign currencies and assets used for international settlements and currency stability, while the RBI contingency reserve is a domestic fund for addressing financial emergencies.

Q: Who manages the RBI contingency reserve?

A: The RBI’s Board for Financial Supervision manages the contingency reserve.

Q: What are the benefits of having forex reserves?

A: Forex reserves provide a buffer against external shocks, stabilize the currency, and enhance investor confidence.

Duffrence Between Forex Reserve And Rbi Contingency Reserve

Conclusion

Forex reserves and the RBI contingency reserve are essential pillars of the Indian economy. By understanding their differences and roles, we gain a deeper appreciation for the importance of financial stability and economic resilience. As the global financial landscape continues to evolve, it is crucial to remain informed about the latest trends and developments in these key areas to ensure that our economy remains strong and adaptable to future challenges.

Are you interested in learning more about forex reserves and the RBI contingency reserve? Share your thoughts and questions in the comments below.