Introduction

In the realm of financial markets, precision is paramount. When it comes to forex trading, timing is everything, and time changes can significantly impact session dynamics. The biannual Daylight Saving Time (DST) transition is one such event that warrants attention from traders worldwide. This article delves into the intricacies of DST and explores its effects on forex market sessions, providing traders with valuable insights to navigate these adjustments seamlessly.

Image: howtotradeonforex.github.io

Understanding DST and Its Impact on Global Time Zones

Daylight Saving Time is an artificial adjustment of timekeeping that aims to maximize daylight hours during the summer months. By advancing clocks by an hour in the spring and adjusting them back in the fall, DST effectively “saves” an hour of daylight. This practice has become widespread, with over 70 countries implementing DST in some form.

The implementation of DST creates a temporary shift in time zones, affecting the alignment of local times with Coordinated Universal Time (UTC). During the summer months, when DST is in effect, many countries are shifted forward by an hour relative to UTC. This means that trading sessions commence earlier in the day in certain regions and later in others, leading to changes in market activity patterns.

DST and the Forex Market

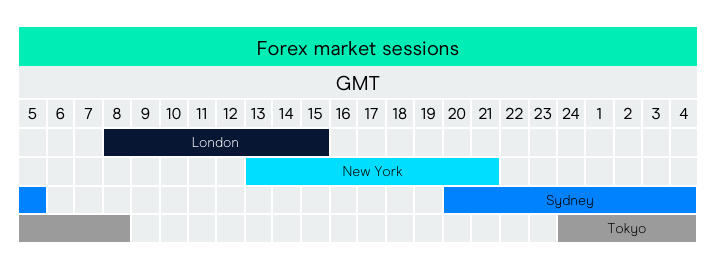

The foreign exchange (forex) market operates 24 hours a day, five days a week. It is a decentralized market where traders from different time zones converge to exchange currencies. Trading sessions are typically aligned with the business hours of major financial centers such as London, New York, Tokyo, and Sydney.

When DST comes into effect, the start and end times of trading sessions shift accordingly. For example, during summer months in Europe, the London session, which normally runs from 8:00 AM to 5:00 PM UTC, will begin at 7:00 AM UTC and conclude at 4:00 PM UTC. This adjustment can have a noticeable impact on market activity and volatility, as traders adapt to the new session timings.

Effects of DST on Forex Liquidity and Volatility

Liquidity, or the ease with which an asset can be bought or sold, is a crucial factor in forex trading. During session overlaps, when multiple markets are open simultaneously, liquidity tends to be higher, leading to tighter spreads and increased trading opportunities. DST can disrupt these overlaps, causing a temporary decrease in liquidity and potentially affecting market volatility.

Moreover, DST can influence the trading behavior of participants. Some traders may choose to adjust their trading schedules to align with the new session timings, while others may opt to trade during the overlaps to take advantage of increased volatility. These individual decisions can further impact market dynamics and create unique trading opportunities.

Image: trueforexfunds.com

Navigating Forex Trading During DST

To successfully navigate the DST time change and minimize its impact on trading strategies, traders should consider the following tips:

-

Adjust Trading Schedule: Realign your trading schedule to match the new session timings. This ensures you’re active during peak liquidity periods and minimizes potential disruptions.

-

Monitor Market News: Stay updated with market news and announcements related to DST changes. This information can provide valuable insights into how the market is likely to react.

-

Consider Market Overlaps: Identify the new session overlaps and capitalize on the increased liquidity during these times. Adjust your trading strategy accordingly to take advantage of these opportunities.

-

Manage Risk: DST can introduce increased volatility, so it’s essential to manage risk carefully. Adjust your position sizing and leverage appropriately to mitigate potential losses.

-

Stay Informed: Regularly monitor market conditions and consult reliable sources for the latest updates on DST and its impact on forex sessions. This will equip you with the knowledge to make informed trading decisions.

Dst Time Change Affect Forex Sessions

Conclusion

The biannual DST time change is an event that requires attention from forex traders worldwide. Understanding its impact on market sessions and adapting trading strategies accordingly can significantly enhance trading outcomes. By following the tips outlined in this article, traders can navigate DST seamlessly and maintain their edge in the dynamic world of forex trading.

Remember, the key to successful trading during DST is preparation. By anticipating the adjustments and adjusting trading plans accordingly, traders can leverage the opportunities presented by time changes and continue to seize profitable opportunities in the ever-evolving forex market.