Free MT4 Forex RSI Divergence Indicator: Unlock Advanced Technical Trading

Image: www.nordman-algorithms.com

Introduction

In the realm of forex trading, timing is everything. Traders seek to ride market trends and capitalize on price fluctuations, and technical indicators play a crucial role in providing insights into market behavior. One powerful tool that can help you identify potential trading opportunities is the Relative Strength Index (RSI) Divergence indicator.

This comprehensive guide will introduce you to the MT4 Forex RSI Divergence Indicator, a free and indispensable tool for any serious trader. We’ll explore how this indicator works, its significance in technical analysis, and how you can effectively apply it to your trading strategy.

Understanding RSI Divergence Indicator

The Relative Strength Index (RSI) is a momentum indicator that measures the strength of a trend based on the closing prices of a security. It oscillates between 0 and 100, with values above 70 indicating overbought conditions and values below 30 signaling oversold conditions.

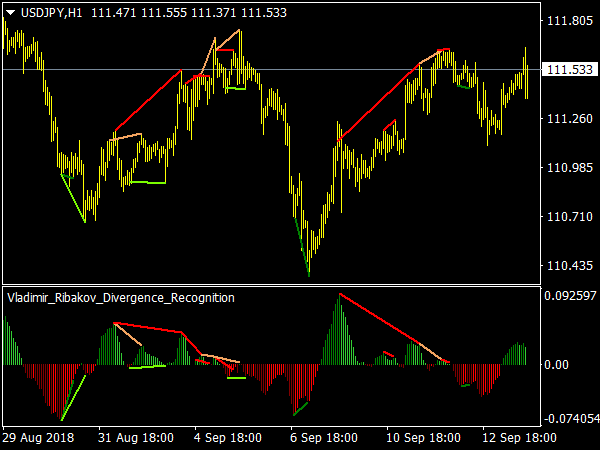

The RSI Divergence indicator compares the RSI value with the price action of a security. A divergence occurs when the RSI moves in the opposite direction of the price action. This divergence can often signal a potential reversal in the market trend.

Types of RSI Divergence

There are two main types of RSI divergence:

-

Regular Divergence: Occurs when the RSI creates a lower high while the price action creates a higher high (bearish divergence) or when the RSI creates a higher low while the price action creates a lower low (bullish divergence).

-

Hidden Divergence: Similar to regular divergence, but the RSI does not create a new extreme, making it more subtle and potentially less reliable.

Importance of RSI Divergence

RSI Divergence is a powerful tool that can provide valuable insights into market trends and potential trading opportunities. Identifying divergence can help you:

- Predict potential trend reversals

- Time your entries and exits with greater precision

- Identify overbought and oversold conditions

- Increase your trading accuracy

How to Use the Indicator

The MT4 Forex RSI Divergence Indicator is easy to use. Once you have installed the indicator on your trading platform, you can add it to your chart. It will plot the RSI values and identify divergence with highlighted areas.

Tips for Using RSI Divergence

- Use divergence as a confirmatory signal in conjunction with other technical analysis methods.

- Consider the overall market context and other indicators to avoid false signals.

- Be aware of convergence, which occurs when the RSI and price action move in the same direction, potentially neutralizing a divergence signal.

- Do not trade based solely on RSI divergence; confirm your decisions with other factors and risk management strategies.

Conclusion

The MT4 Forex RSI Divergence Indicator is a powerful tool that can enhance your trading strategy. By identifying and interpreting RSI divergence, you can gain valuable insights into market trends and improve your trading accuracy. Remember, technical analysis is not an exact science, and multiple factors should be considered before making trading decisions.

Image: www.aiophotoz.com

Download Free Mt4 Forex Rsi Divergence Indicator