In the turbulent waters of forex trading, recognizing chart patterns can be an invaluable tool to navigate the ebb and flow of currency fluctuations. Among the most reliable patterns are double tops and double bottoms, which provide crucial insights into potential price reversals, offering opportunities for savvy traders.

Image: www.forex.academy

Double Tops: A Precursor to Bearish Trends

A double top pattern emerges when a security’s price reaches a high point, falls back, and then ascends to approximately the same high point again before dropping below a supporting level. This configuration signals a potential trend reversal, with the second high typically acting as a resistance zone.

Traders often interpret double tops as a bearish indication, expecting the price to continue its downward trajectory. By recognizing this pattern, investors can potentially position themselves to capitalize on the impending decline, shorting the currency pair in anticipation of further price depreciation.

Double Bottoms: Signaling Bullish Momentum

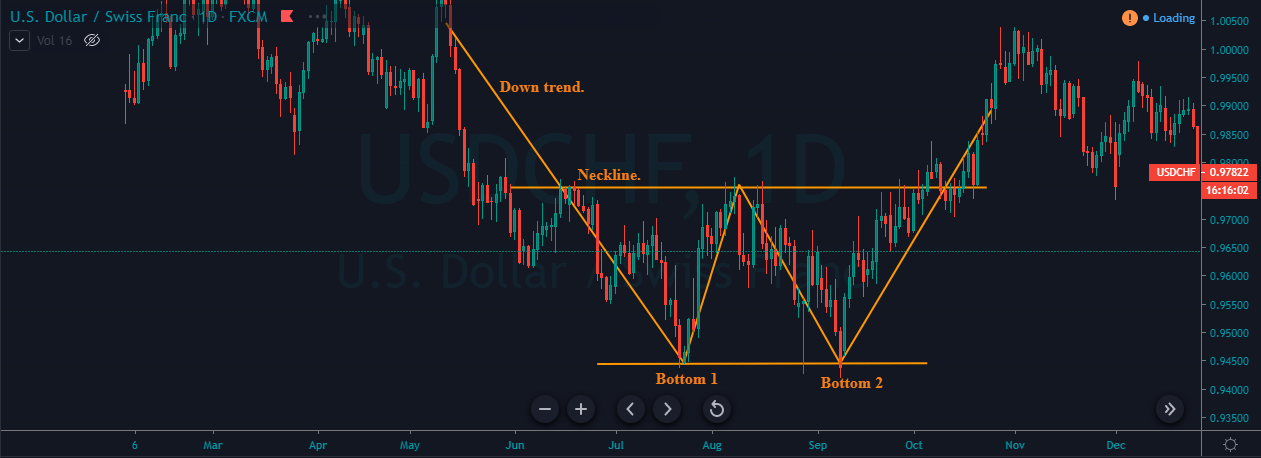

In contrast to double tops, double bottoms signify a potential trend reversal from bearish to bullish conditions. The pattern forms when a security’s price falls to a low point, rebounds, and then drops to around the same low point again before rising above a resistance level.

The second low represents a support zone, and the subsequent price increase suggests a shift in market sentiment towards optimism. Traders might take advantage of this pattern by going long on the currency pair, anticipating further price appreciation.

Tips from an Experienced Trader

- Confirm with Volume: High trading volume during a pattern formation confirms the validity of the signal.

- Monitor Breakouts: Focus on breakouts beyond support or resistance levels for clear trend reversals.

- Utilize Indicators: Technical indicators, such as moving averages or stochastic oscillators, can aid in pattern recognition.

- Avoid False Breakouts: Wait for a sustained move beyond key levels to eliminate false signals.

- Manage Risk: Always implement proper risk management techniques, including stop-loss orders, to minimize potential losses.

Image: dailypriceaction.com

Frequently Asked Questions

Q: What is the difference between a double top and a triple top?

A: While double tops involve two distinct highs, triple tops have three consecutive highs before a price reversal.

Q: Can double bottom patterns fail?

A: Yes, any chart pattern can fail due to unexpected market events, false signals, or changes in underlying factors.

Q: How long do double tops and double bottoms typically last?

A: The duration of these patterns varies depending on the security and market conditions, but they typically range from a few days to several weeks.

Double Top And Double Bottom Forex Chart Patterns

https://youtube.com/watch?v=luyF_enPa5U

Conclusion

Grasping the significance of double tops and double bottom patterns empowers forex traders with a formidable tool to identify potential price reversals. By understanding these formations, investors can make informed decisions, plan their trades with precision, and enhance their chances of navigating market fluctuations with greater success.

Are you interested in further exploring the dynamics of chart patterns and expanding your trading knowledge? If so, I highly recommend continuing your exploration into this valuable topic.