Imagine yourself planning your dream vacation to a faraway land. As you pack your bags, a nagging question crosses your mind: do I need a forex card to manage my expenses abroad? Understanding the complexities of international currency exchange can be overwhelming, and choosing the right payment option is crucial.

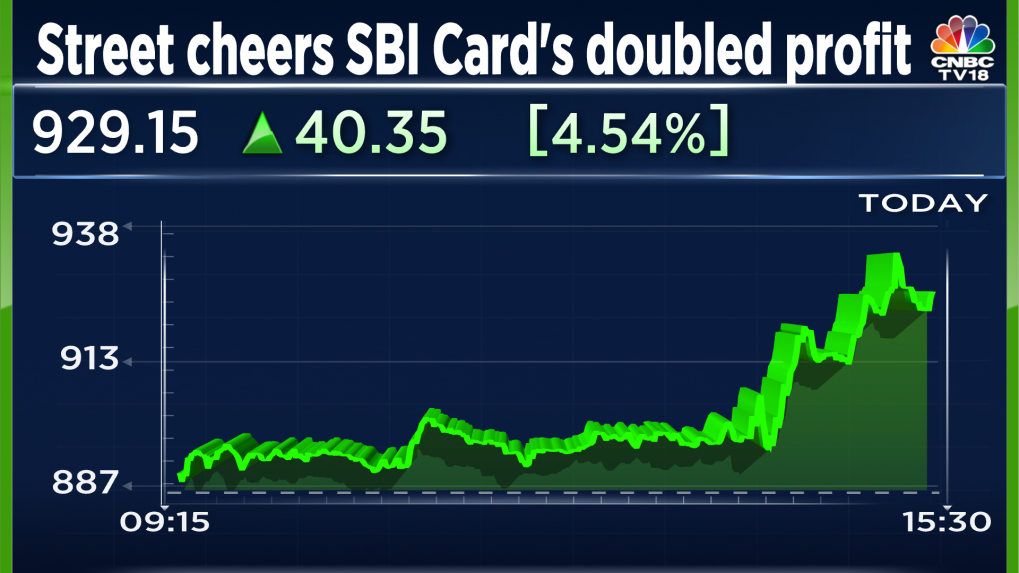

Image: www.cnbctv18.com

Enter SBI, one of India’s leading banking giants. With its vast network and financial expertise, does SBI offer forex cards to ease your travel worries? Let’s delve into the world of forex cards and unearth the answers.

**What is a Forex Card?**

A forex card, also known as a travel card, is a prepaid or reloadable card linked to a specific foreign currency. It allows you to carry funds electronically, eliminating the hassle of exchanging physical currency.

Forex cards offer several advantages over traditional methods, such as increased security, reduced exchange rate fluctuations, and convenience.

**Does SBI Issue Forex Cards?**

Yes, SBI issues forex cards to its customers. SBI offers a range of forex cards, including the SBI Multi-Currency Forex Card and the SBI Travel Card. These cards are available in multiple currencies, allowing you to choose the one most convenient for your travel destination.

SBI forex cards are loaded with foreign currency at the prevailing exchange rate, providing you with a lock-in rate for your transactions. This feature helps you avoid the uncertainties associated with fluctuating exchange rates.

**Types of SBI Forex Cards**

- SBI Multi-Currency Forex Card: This card can be loaded with up to 23 foreign currencies and used for transactions in over 200 countries.

- SBI Travel Card: Specifically designed for travelers, this card allows you to load only one foreign currency and can be used in over 150 countries.

Image: www.zeebiz.com

**How to Apply for SBI Forex Card**

Applying for an SBI forex card is a straightforward process:

- Visit your nearest SBI branch.

- Submit the required documents, including your passport, visa, and proof of identity.

- Choose the forex card that best suits your travel needs.

- Load the card with the desired amount in the foreign currency of your choice.

**Benefits of Using SBI Forex Cards**

- Competitive Exchange Rates: SBI offers competitive exchange rates, ensuring you get the best value for your money.

- Security: Forex cards are more secure than carrying cash, reducing the risk of theft or loss.

- Convenience: SBI forex cards are widely accepted at ATMs, POS terminals, and online merchants worldwide.

- 24/7 Support: SBI provides round-the-clock customer support to assist you with any queries or issues.

Does Sbi Issue Forex Cards

**FAQ on SBI Forex Cards**

- How long does it take to get an SBI forex card?

Ans: Typically, it takes 3-5 working days to receive your SBI forex card. - Can I use my SBI forex card in ATMs?

Ans: Yes, you can withdraw local currency from ATMs using your SBI forex card. - Is there a limit on the amount I can withdraw from my SBI forex card?

Ans: The daily withdrawal limit varies depending on the card type and your bank limit. - What are the charges associated with SBI forex cards?

Ans: SBI charges a minimal issuance fee and currency exchange fee. Please refer to the SBI website for specific details.

Embark on your next international adventure with peace of mind. SBI forex cards offer a safe, convenient, and cost-effective way to manage your finances abroad. Explore the world without currency worries and enjoy the freedom of flexible spending with SBI’s trusted forex card solutions.

Are you ready to upgrade your travel experience with SBI’s forex cards? Visit your nearest SBI branch today or log on to the official SBI website for more information.