In the dynamic realm of foreign exchange (forex) trading, spreads play a pivotal role in determining profitability. A forex spread refers to the difference between the bid and ask prices of a currency pair, essentially representing the transaction costs incurred when executing a trade. As a trader, selecting the right spread can significantly impact your overall trading experience and financial outcomes. In this article, we delve into the intricate details of forex spreads and explore whether point-of-sale (POS) systems offer the flexibility to adjust these spreads.

Image: www.urbanforex.com

Navigating the Nuances of Forex Spreads

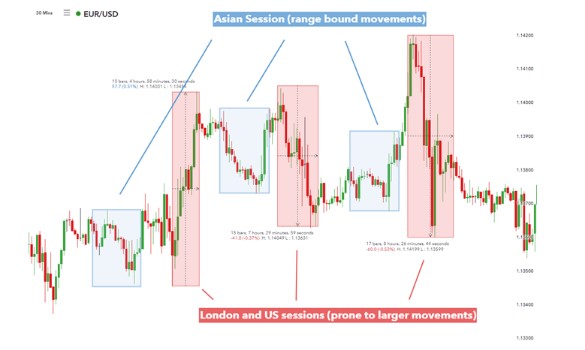

Forex spreads are typically quoted in pips, which represent the smallest price increment for a particular currency pair. The spread is expressed as the difference between the bid and ask prices. For instance, a EUR/USD spread of 1 pip indicates a price difference of 0.0001 between the two currencies. Brokers and market makers determine spreads, and they can vary depending on several factors, including market volatility, liquidity, and the broker’s trading model.

POS Systems and Spread Selection

Point-of-sale (POS) systems are electronic devices primarily employed in retail settings to process transactions. In the forex context, some POS systems do indeed provide the ability to select or customize spreads. However, it’s important to note that not all POS systems offer this feature, and those that do may only allow for a limited range of spread adjustments.

The extent to which you can modify spreads using a POS system varies depending on the specific system and the broker or service provider. Some systems allow traders to choose from a pre-defined range of spreads, while others provide more flexibility by enabling traders to manually set their desired spread. It’s worth emphasizing that even in cases where POS systems offer spread selection, the actual spreads available may still be influenced by market conditions and the broker’s own policies.

Advantages of Spread Selection

The ability to select forex spreads can offer several advantages for traders. Firstly, it allows traders to optimize their trading strategies by selecting spreads that align with their risk tolerance and trading style. For instance, scalpers, who execute numerous trades in a short time frame, may prefer tighter spreads to minimize transaction costs and maximize profitability. Conversely, long-term traders who prioritize stability may opt for wider spreads to reduce volatility and potential losses.

Secondly, spread selection empowers traders to access better pricing. By selecting lower spreads, traders can save on transaction costs and increase their profit margins, especially when trading high-volume positions. Although the difference in spread may seem small, it can accumulate over time and make a significant impact on overall profitability.

Image: www.audacitycapital.co.uk

Expert Advice and Tips

Seasoned forex traders often emphasize the importance of considering several key factors when selecting spreads. Firstly, traders should carefully evaluate the market conditions and liquidity of the currency pair they intend to trade. Volatile markets and illiquid currency pairs typically result in wider spreads, so traders should adjust accordingly to mitigate potential losses.

Secondly, traders should explore various brokers and POS systems to compare the spreads offered. It’s advisable to choose a broker with competitive spreads and a transparent pricing structure to ensure that the transaction costs are reasonable and predictable.

FAQs on Forex Spreads and POS Systems

Q: Can all POS systems be used to select forex spreads?

A: No, not all POS systems offer spread selection. Some systems may only allow for manual order entry with pre-defined spreads, while others may not support forex trading at all.

Q: What are the factors that influence the availability of spread selection in POS systems?

A: The availability of spread selection in POS systems depends on the specific system, the broker or service provider, and the market conditions.

Q: What are the benefits of selecting forex spreads using POS systems?

A: Selecting forex spreads using POS systems offers advantages such as optimizing trading strategies, accessing better pricing, and reducing transaction costs.

Does Pos Let You Select Forex Spread

Conclusion

To answer the overarching question, yes, certain POS systems do let traders select forex spreads. However, the extent of spread selection capabilities varies depending on the system and broker. By understanding the nuances of forex spreads and the role of POS systems, traders can make informed decisions that enhance their trading experience and ultimately contribute to their profitability. If you’re considering incorporating forex trading into your portfolio, we encourage you to explore POS systems that offer spread selection to give yourself an edge in the competitive world of forex trading.