As a seasoned Forex trader, I’ve witnessed firsthand the transformative power of technical analysis in navigating the volatile currency markets. Its ability to decipher price patterns, forecast market movements, and make informed trading decisions has been instrumental in my success. But before delving into the intricacies of technical analysis, let’s delve into its very essence.

Image: www.youtube.com

**Definition and Significance of Forex Technical Analysis**

Forex technical analysis is the methodical examination of historical price data to identify trends, patterns, and potential support and resistance levels. By studying charts and identifying these patterns, traders aim to predict future market movements and make sound investment decisions. The underlying principle of technical analysis lies in the belief that market history tends to repeat itself, allowing traders to leverage past behaviors to decipher future trends.

In the context of Forex trading, technical analysis empowers traders with a systematic approach to analyze market fluctuations. It helps them decipher the complexities of currency movements, identify potential trading opportunities, and manage risk effectively. Whether you’re a seasoned trader or a novice in the Forex market, understanding technical analysis is crucial for navigating the ever-changing currency landscape.

**Exploring the Mechanics of Technical Analysis**

The toolbox of technical analysis encompasses a vast array of tools and techniques, each serving a specific purpose in market analysis. From moving averages that identify long-term trends to oscillators that measure market momentum, these tools enable traders to gain insights into market behavior. Candlestick charts, with their distinct patterns, provide visual representations of price movements, aiding in the identification of market trends and reversals.

Additionally, technical indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) provide valuable insights into market overbought and oversold conditions, helping traders gauge market sentiment and make informed decisions. The skillful application of these tools empowers traders to turn complex market data into actionable trading strategies.

**The Latest Trends and Developments in Forex Technical Analysis**

The realm of Forex technical analysis is in constant evolution, with new tools and techniques emerging to cater to the ever-changing market dynamics. One notable development is the integration of artificial intelligence (AI) and machine learning in technical analysis platforms. These cutting-edge technologies enhance the analysis process, providing traders with real-time market insights and automated trading capabilities.

Moreover, the rise of mobile trading platforms has made technical analysis accessible to traders on the go. Traders can now monitor market movements, apply technical indicators, and execute trades from the convenience of their smartphones or tablets. These advancements empower traders to stay informed and make decisive moves even when away from their workstations.

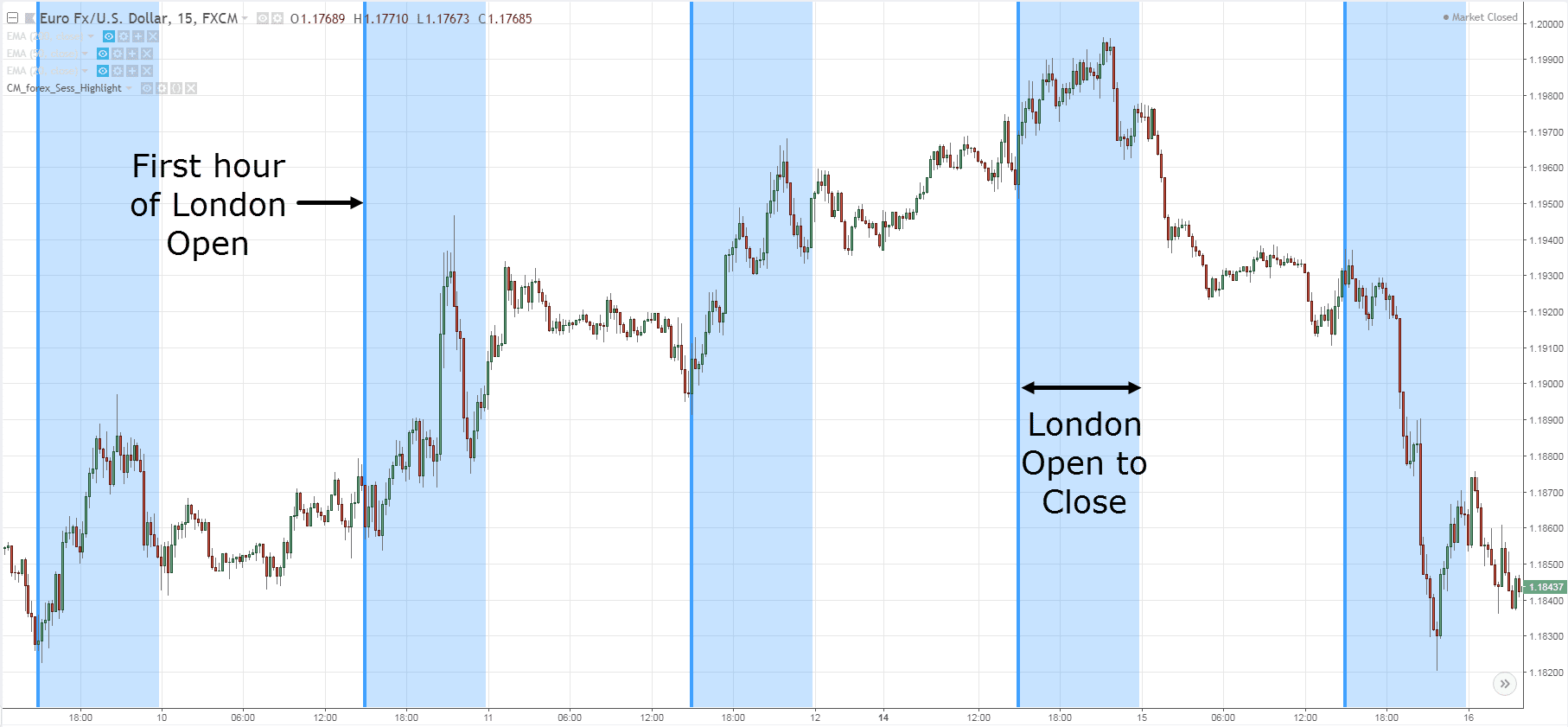

Image: www.tradingwithrayner.com

**Expert Tips and Advice for Effective Forex Technical Analysis**

To effectively harness the power of technical analysis, it’s imperative to follow some fundamental principles:

- Comprehend the Basics: Master the fundamentals of technical analysis, including candlestick patterns, moving averages, and technical indicators.

- Choose Appropriate Time Frames: Select the time frames that align with your trading style and risk tolerance.

- Combine Multiple Indicators: Use a combination of technical indicators to confirm signals and enhance analysis accuracy.

- Monitor Market News: Stay abreast of economic events and market news that may impact currency movements.

- Practice Discipline: Follow your trading plan diligently and avoid making impulsive decisions based on emotions.

**Understanding Common FAQs on Forex Technical Analysis**

Q: How accurate is forex technical analysis?

A: Technical analysis is not an exact predictor of market movements. However, it offers valuable insights and helps traders make informed decisions.

Q: Can technical analysis be used in other financial markets?

A: Yes, technical analysis is applicable to other financial markets, such as stocks, bonds, and commodities.

Q: Is technical analysis sufficient for successful forex trading?

A: No, technical analysis is just one component of a comprehensive trading strategy. It should be combined with fundamental analysis and risk management techniques.

Does Forex Technical Analysis Work

https://youtube.com/watch?v=L6Igs5d-cbs

**Conclusion: Empowering Traders with Technical Insights**

Forex technical analysis is a powerful tool that can greatly enhance the decision-making process for traders. By understanding market patterns and trends, traders can make informed trading decisions and navigate the intricacies of the Forex market. However, it’s crucial to remember that market conditions can change rapidly, so flexibility and adaptability are key. Are you intrigued by the potential of Forex technical analysis?