Traveling Abroad: Stay Prepared with Forex Receipts

When traveling outside the country, it’s essential to be prepared with necessary travel documents and financial tools like foreign exchange (forex). While it may not be a legal requirement, keeping receipts for your forex transactions is highly recommended to ensure a smooth and hassle-free travel experience.

Image: www.forex.academy

Importance of Forex Receipts

Carrying forex receipts serves various purposes during your travels:

- Proof of Authorized Exchange: Forex receipts provide tangible evidence that you legally exchanged currency within authorized channels, which may be required by customs officials or financial institutions at the destination country.

- Discrepancy Resolution: In case of any discrepancies or disputes related to your forex transactions, receipts act as official documentation supporting your claims.

- Travel Expense Record: If you’re claiming travel expenses for business or tax purposes, receipts serve as valid proof of your expenses abroad.

- Convenience for Future Transactions: When you return to India, receipts allow you to reconvert your unused foreign currency, making future trips more convenient.

Essential Information on Forex Receipts

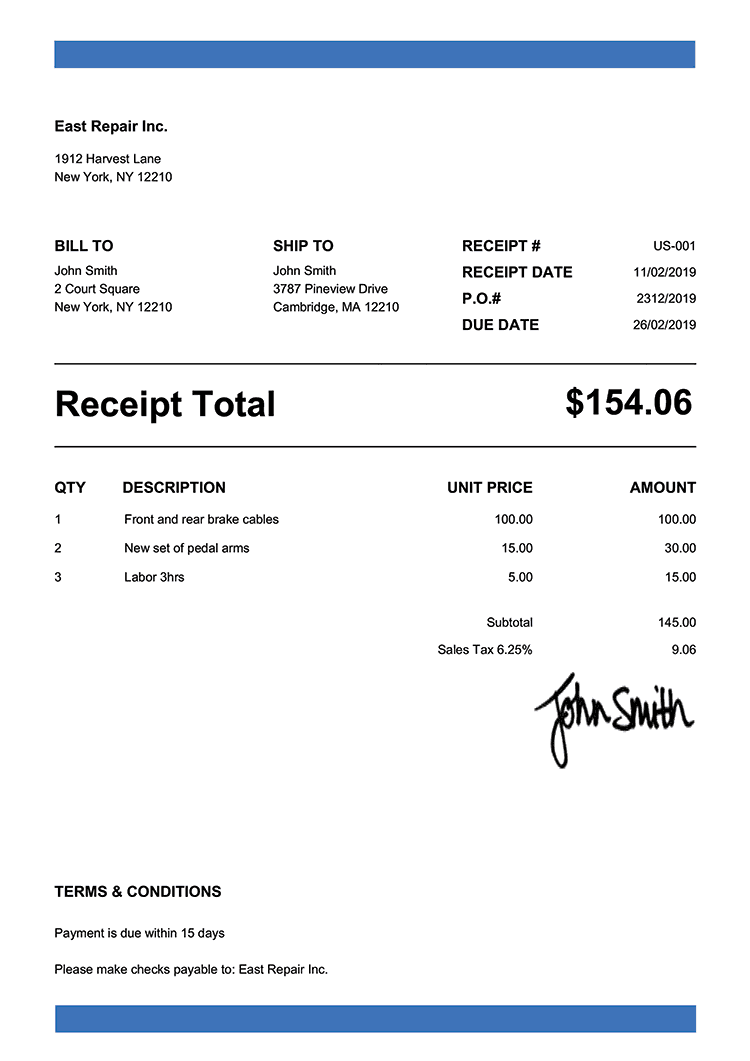

Every forex receipt includes vital information, ensuring transparency and proof of the transaction:

- Transaction Date and Time: This specifies when the currency exchange occurred.

- Currency Exchanged: This indicates the specific currencies exchanged, such as Indian Rupees and US Dollars.

- Amount Exchanged: Both the amount in Indian Rupees and the foreign currency are mentioned.

- Exchange Rate: The applied exchange rate is clearly stated on the receipt.

- Authorized Dealer Information: Details about the authorized foreign exchange dealer, including their name and license number, are provided.

Latest Trends and Developments in Forex Regulations

With the growing global economy, forex regulations continue to evolve to combat illegal financial activities like money laundering and tax evasion. One recent trend is the implementation of stricter documentation requirements for forex transactions. To comply, individuals should diligently preserve receipts for any currency exchanges.

Image: mazwelove.weebly.com

Expert Advice for Forex Travelers

- Keep Physical Copies: Digital receipts are convenient, but maintain physical copies as backup in case of any technical issues abroad.

- Obtain Receipts for All Transactions: Even for small amounts, always ask for a receipt to ensure a comprehensive record of your forex expenses.

- Check Exchange Rates Regularly: Stay informed about currency fluctuations and compare rates offered by different authorized dealers to make informed decisions.

- Declare Large Amounts: If you’re carrying significant amounts of foreign currency, declare it at customs upon arrival in the destination country to avoid penalties.

Frequently Asked Questions about Forex Receipts

Q: Are forex receipts mandatory when traveling abroad?

A: No, but strongly recommended for proof of legal exchange, discrepancy resolution, and expense tracking.

Q: What information should a forex receipt include?

A: Transaction date, currencies exchanged, amount exchanged, exchange rate, and authorized dealer details.

Q: How long should I keep forex receipts?

A: As a general guideline, it’s advisable to keep them for at least a year or as required by your country’s tax regulations.

Do You Need Reciept For Forex Out Of India

https://youtube.com/watch?v=pBMMYzzkv1k

Conclusion

While not legally required, keeping receipts for forex transactions is highly recommended for a hassle-free travel experience abroad. Forex receipts provide proof of authorized exchange, facilitate discrepancy resolution, and serve as documentation for expenses and future transactions. By adhering to these guidelines and expert advice, you can ensure a smooth and secure financial journey during your international travels.

Do you have questions or find this article informative? Leave a comment or share your travel experiences requiring forex receipts.