Image: www.quesba.com

In the dynamic world of foreign exchange, the use of derivative instruments has become increasingly prevalent, offering traders and investors a myriad of opportunities to manage risk and enhance returns. This article delves into the depths of the forex derivative market, exploring the various instruments that have recently emerged, shaping the landscape and transforming the way traders interact with currencies.

Derivatives Defined

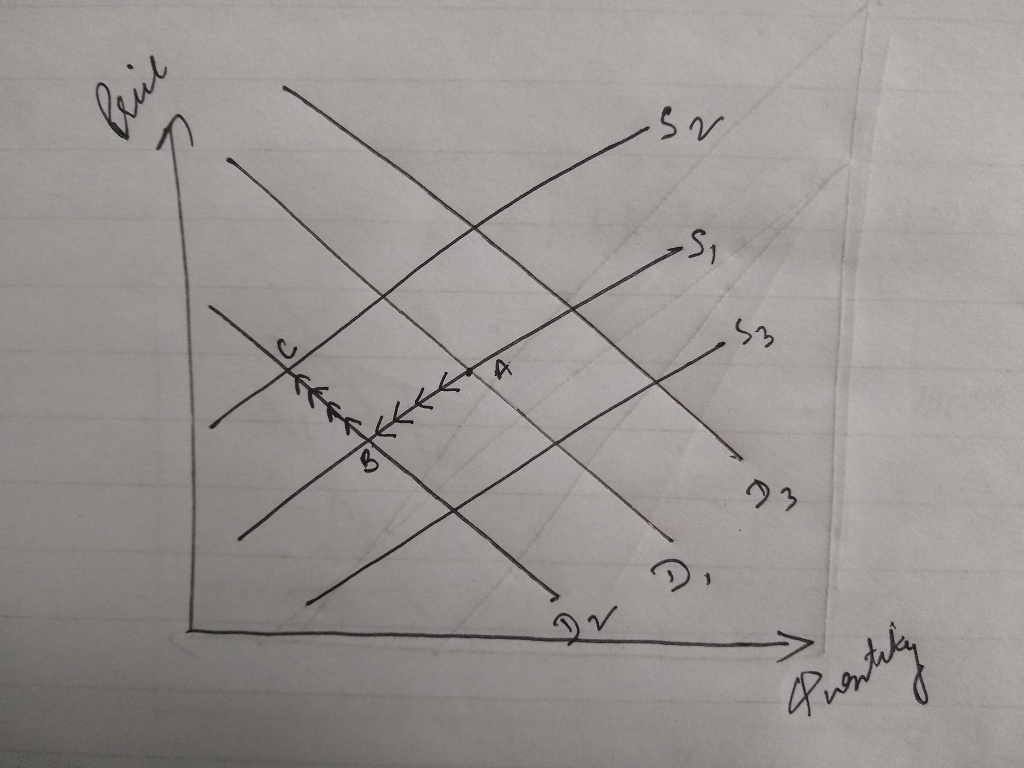

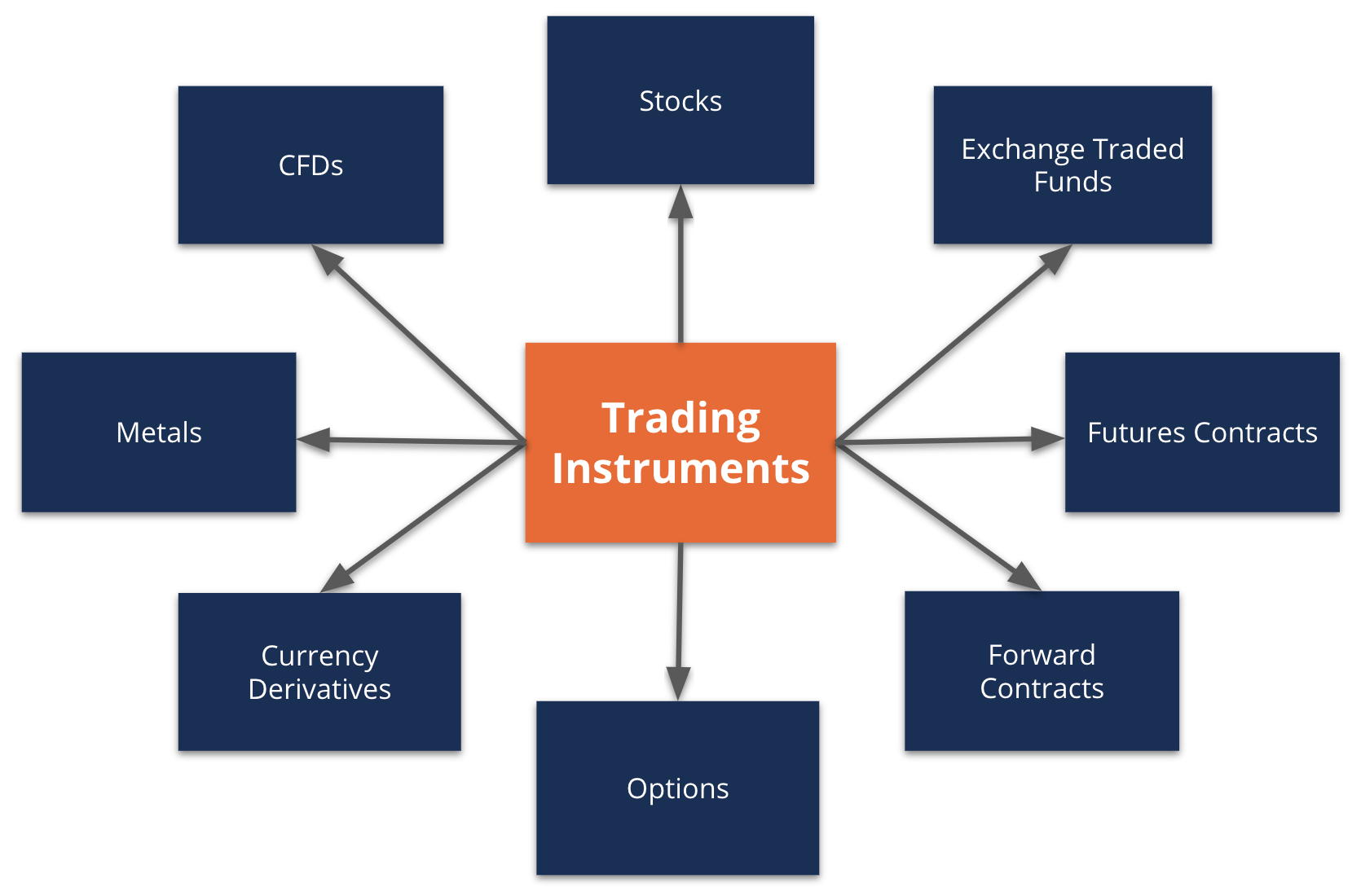

Derivatives are financial contracts that derive their value from an underlying asset, such as a currency pair, index, or commodity. They allow traders to speculate on the future price movements of these assets without taking direct ownership. The diverse range of derivative instruments available in the forex market empowers traders to tailor their strategies to specific risk appetites and investment goals.

Recent Advancements in Forex Derivatives

The forex derivative market has witnessed a surge in innovation, leading to the development of several cutting-edge instruments. These include:

- Currency Options: These provide the holder the right, but not the obligation, to buy or sell a currency pair at a predetermined price.

- Currency Forwards: Similar to options, forwards give traders the obligation to exchange currencies at a set rate on a future date.

- Currency Swaps: These complex instruments involve the exchange of interest payments and principal amounts between two parties, each denominated in different currencies.

- Binary Options: These high-risk, high-reward instruments offer a fixed payout based on whether the underlying asset price meets or exceeds a specified level at a predefined time.

- Cryptocurrency Derivatives: As the cryptocurrency market gains traction, derivatives linked to digital assets have emerged, allowing traders to speculate on their price fluctuations.

Advantages of Forex Derivatives

The use of forex derivatives presents numerous advantages, including:

- Risk Management: Derivatives provide a powerful tool for hedging against currency fluctuations, shielding traders from adverse market movements.

- Enhanced Returns: The leverage offered by certain derivatives enables traders to amplify potential profits, although it also magnifies risks.

- Tailored Strategies: The diversity of derivative instruments allows traders to customize their strategies based on their individual risk tolerance and investment objectives.

- Global Market Access: Derivatives open up access to global currency markets, facilitating the seamless exchange of currencies across borders.

- Transparency and Regulation: Forex derivatives are typically traded on regulated exchanges, ensuring transparency and protecting traders from malicious practices.

Harnessing the Power of Forex Derivatives

To effectively utilize forex derivatives, traders should:

- Understand the Underlying Principles: A thorough understanding of derivatives concepts, such as leverage, risk, and payoff structures, is essential.

- Conduct Thorough Research: Diligent research on the different derivative instruments, their characteristics, and potential risks is paramount.

- Consult an Expert: Seeking guidance from experienced financial professionals or brokers can provide invaluable insights and help mitigate potential pitfalls.

- Manage Risk Prudently: Traders should always assess risks carefully and implement appropriate risk management strategies, such as stop-loss orders.

- Stay Informed: The forex market is constantly evolving; staying abreast of the latest trends and developments is vital for successful trading.

Conclusion

Forex derivatives have revolutionized the foreign exchange market, offering traders a plethora of instruments to manage risk and enhance returns. By understanding the concepts, researching different options, and adopting a prudent approach, traders can unlock the full potential of these powerful financial tools. Ultimately, the mastery of forex derivatives can empower traders to navigate the volatile world of currencies with confidence and profitability.

Image: corporatefinanceinstitute.com

Discuss Various Derivative Instruments Recently Used In Forex Market