Prepare yourself for an exhilarating educational journey as we delve into the realm of foreign exchange trading, commonly known as forex. Forex, the world’s largest financial market, offers countless opportunities for both novice and seasoned traders alike. But navigating this complex world can be daunting without a solid understanding of the different trading strategies at your disposal. In this comprehensive guide, we will unveil the intricacies of each strategy, empowering you to make informed decisions and maximize your trading potential.

Image: www.forex.academy

A Brief Overview of the Forex Market

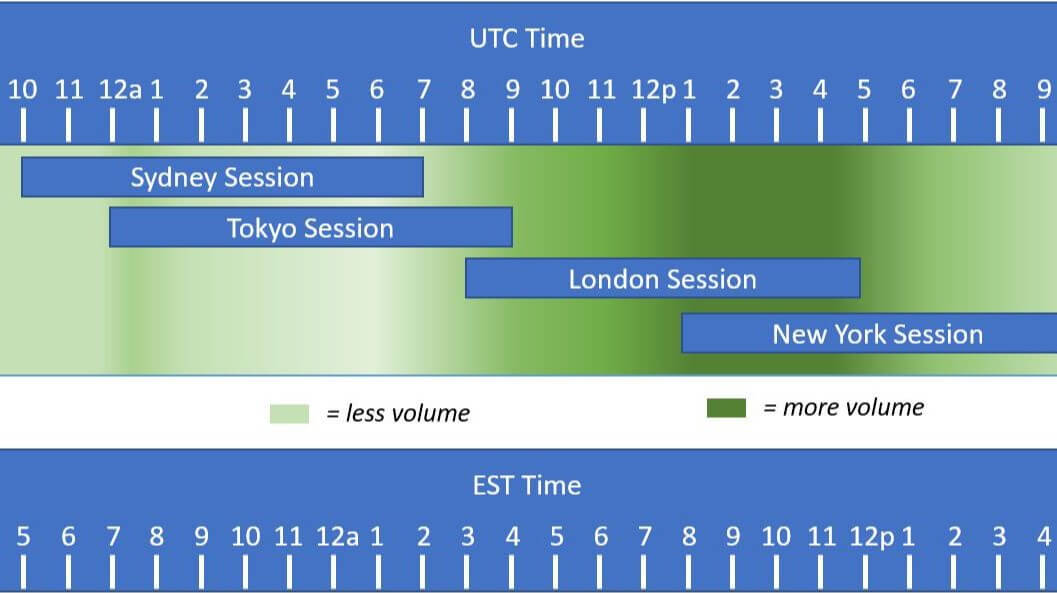

Forex trading involves the buying and selling of currency pairs, with the exchange rates fluctuating constantly due to a myriad of economic, political, and geopolitical factors. Unlike stock exchanges with fixed trading hours, the forex market operates 24 hours a day, offering traders unparalleled flexibility. However, it’s crucial to approach this market with caution, as the potential for both profits and losses is substantial.

Different Trading Strategies for Forex Market

Navigating the forex market requires a carefully crafted strategy that aligns with your risk tolerance, investment goals, and market conditions. Various trading strategies have evolved over time, each offering unique advantages and drawbacks. Let’s explore some of the most popular approaches:

1. Scalping

Scalping is a rapid-fire trading style that involves making numerous small profits within a short timeframe, often within minutes or even seconds. Scalpers capitalize on tiny price movements by entering and exiting positions quickly, aiming for small but consistent gains. This strategy requires lightning-fast execution, discipline, and the ability to manage emotions in a fast-paced environment.

Image: www.pinterest.com

2. Day Trading

Day trading is another short-term trading approach where positions are opened and closed within the same trading day. Day traders attempt to profit from intraday price fluctuations, relying on technical analysis to identify potential trading opportunities. They typically hold positions for a few hours or less, aiming to capture short-term profits before market conditions change.

3. Swing Trading

Swing trading combines elements of short-term and long-term trading. Swing traders hold positions for several days or weeks, seeking to profit from broader market trends. They analyze price charts to identify potential swings, aiming to buy low and sell high or vice versa. Swing trading requires patience, technical analysis skills, and the ability to tolerate fluctuations.

4. Position Trading

Position trading is a long-term trading approach where positions are held for months or even years. Position traders aim to capture major market trends, relying on fundamental analysis to identify undervalued or overvalued currencies. They typically incorporate economic data, political events, and long-term trends into their decision-making process. This strategy requires a strong understanding of the market, a high level of patience, and the ability to withstand market fluctuations over extended periods.

5. News Trading

News trading involves trading on the back of important economic events or political announcements that could significantly impact currency exchange rates. News traders analyze scheduled economic data releases, central bank announcements, and other news events to anticipate market reactions and position themselves accordingly. This strategy requires up-to-date information, rapid decision-making skills, and the ability to quickly interpret the market response to news events.

6. Algorithmic Trading

Algorithmic trading, also known as automated trading, involves using computer programs to execute trades based on predefined algorithms. These algorithms analyze market data, identify trading opportunities, and automatically execute trades without human intervention. Algorithmic trading allows for precise execution, backtesting of strategies, and the ability to trade around the clock. However, it requires programming skills and a deep understanding of how algorithms work in different market conditions.

Choosing the Right Strategy for You

Selecting the appropriate trading strategy is pivotal to your success in the forex market. Consider your risk tolerance, time availability, financial resources, and personality. If you prefer a high-paced environment with quick profits, scalping or day trading may be suitable. For those seeking long-term gains and are comfortable with holding positions for extended periods, position trading could be a better fit. Swing trading offers a balance between short-term and long-term approaches, while news trading requires a strong understanding of economic events. Algorithmic trading can be advantageous for those seeking automation and precision, but it requires programming knowledge and ongoing maintenance.

Different Ways Of Trading Forex Market

Conclusion

The forex market offers a vast array of trading opportunities, but navigating its complexities requires a well-defined strategy. Understanding the different trading styles available empowers you to tailor your approach to your unique goals and risk tolerance. Remember, trading forex involves both risks and rewards, and it’s crucial to approach the market with knowledge, discipline, and a strategic mindset.