The foreign exchange (forex) market, a bustling hub where currencies are traded, is a complex ecosystem comprising various interconnected components. Understanding these components is crucial for navigating this dynamic market successfully. Embark on an enlightening journey as we delve into the fundamental elements that shape the forex market and empower traders.

Image: medium.com

The Cornerstone: Market Participants

The forex market is a melting pot of participants, each with unique roles and motivations. Central banks, commercial banks, corporations, hedge funds, retail traders, and individual investors converge in this global arena. Understanding the behaviors and interactions of these players is essential for deciphering market dynamics and predicting price movements.

The Currency Pairs: The Dance of Exchange

Forex trading revolves around currency pairs, representing the exchange rate between two currencies. These pairs are categorized as major, minor, or exotic, reflecting their liquidity and trading volume. Understanding the factors influencing currency pairs, such as economic indicators, political events, and market sentiment, is vital for making informed trading decisions.

The Tickle of Spreads: The Cost of Conversion

Spreads, the difference between the bid and ask prices of a currency pair, are an integral part of forex trading. Spreads represent the broker’s commission for facilitating the trade. Choosing brokers with competitive spreads is crucial for maximizing profits and minimizing operating costs.

Image: www.youtube.com

The Liquidity Tide: Fueling the Market Flow

Liquidity, the ease with which a currency pair can be bought or sold, is the lifeblood of the forex market. High-liquidity pairs, such as EUR/USD and GBP/USD, offer tighter spreads and faster execution, making them ideal for scalping strategies. Understanding liquidity levels is critical for managing risk and avoiding slippage, the difference between the expected and actual execution price.

The Pulse of the Market: News, Data, and Analysis

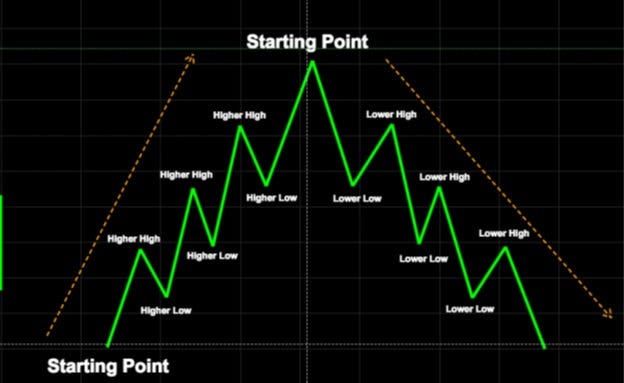

The forex market reacts swiftly to real-time economic news, data releases, and geopolitical events. Economic indicators, such as interest rate decisions, GDP announcements, and inflation figures, can trigger significant market movements. Technical analysis, based on historical price patterns, is another tool traders use to identify trends and predict future price movements.

The Platforms: The Gateway to Market Access

Foreign exchange trading is typically conducted through online trading platforms, also known as forex brokers. These platforms provide a user interface for executing trades, managing accounts, and accessing market data. Choosing a reputable broker with low spreads, fast execution, and advanced trading tools is essential for a successful trading experience.

The Tapestry of Risk Management: Mitigating the Market’s Perils

Risk management is paramount in forex trading. Stop-loss orders and limit orders are indispensable tools for controlling losses and protecting capital. Traders should also establish a comprehensive risk management plan that defines their risk tolerance, trading strategy, and appropriate position sizing.

Different Components Of Forex Market

Conclusion

Grasping the intricacies of the different components of the forex market is a prerequisite for successful trading. From understanding market participants to navigating currency pairs and managing risks, each element contributes to the dynamic tapestry of the forex ecosystem. By mastering these components, traders can navigate the complexities of this global market, seize opportunities, and mitigate potential losses. Embark on your forex journey with confidence, armed with the knowledge and understanding that will guide your path to prosperity.