Introduction:

Image: www.cmcmarkets.com

In the vast and ever-evolving world of financial markets, navigating the treacherous waters of trading can be daunting. Among the myriad of investment instruments available, spot forex and CFDs (Contracts for Difference) stand out as two popular options. Understanding their fundamental differences empowers traders to make informed decisions that could shape their financial destiny.

Understanding Spot Forex

Spot forex, also known as FX spot or spot currency trading, involves the direct exchange of foreign currencies with settlement completed within two business days. This dynamic marketplace serves as the global hub for currency exchange, facilitating international trade, investment, and speculation. Spot forex offers traders access to real-time market conditions, allowing them to capitalize on fluctuations in currency values.

Exploring CFDs

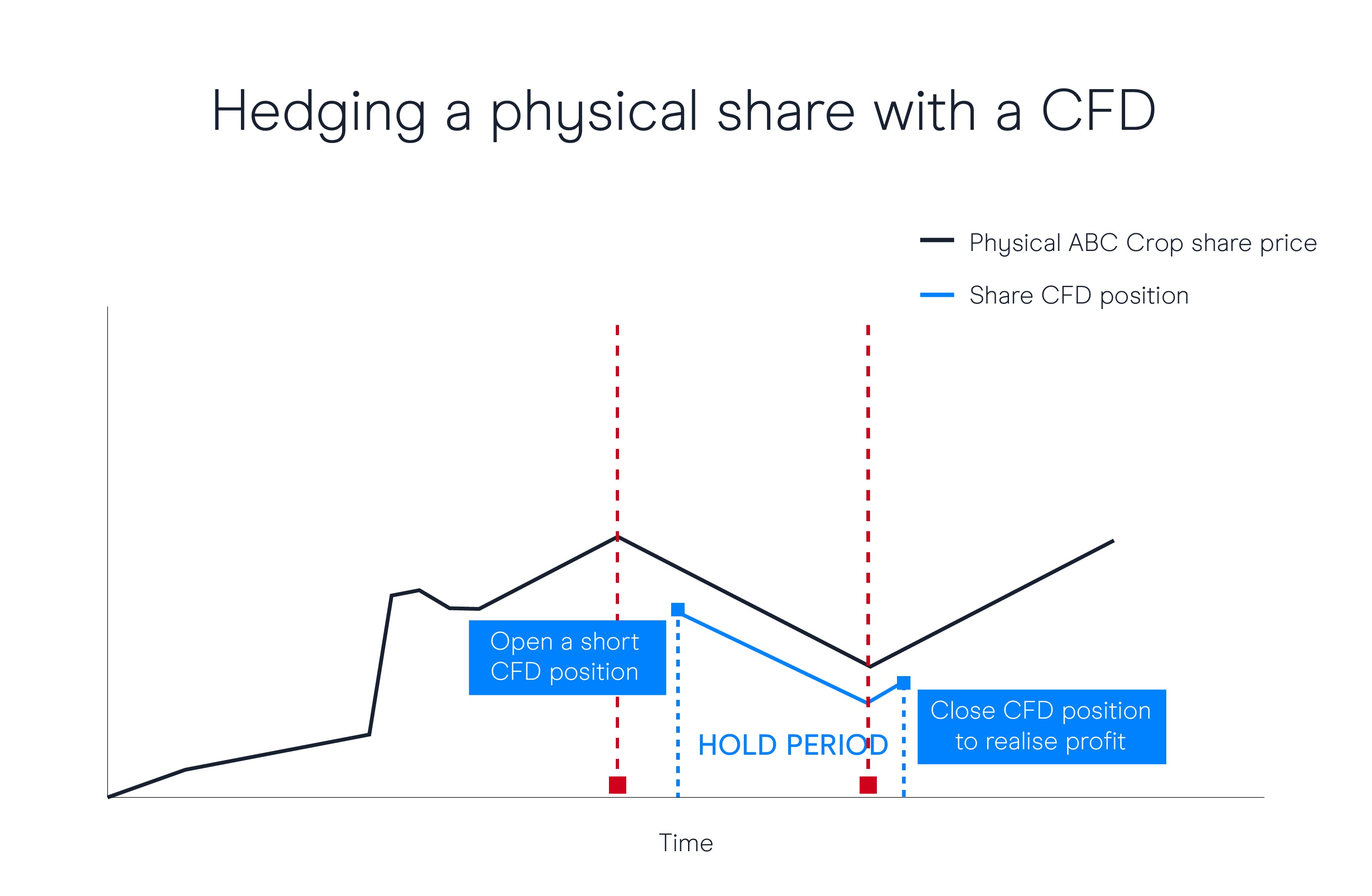

CFDs, on the other hand, are financial contracts representing the difference in price between the opening and closing positions of an underlying asset. They resemble stock options in their essence, enabling traders to speculate on price movements without directly owning the underlying instrument. CFDs offer leverage, amplifying gains and losses, making them a potentially lucrative yet risky trading tool.

Striking Differences: Spot Forex vs. CFDs

-

Underlying Asset: Spot forex deals with the exchange of currencies, while CFDs encompass a broader range of underlying assets, including stocks, indices, commodities, and currencies.

-

Settlement Duration: Spot forex transactions typically settle within two business days, whereas CFDs involve ongoing contracts that can be held indefinitely.

-

Ownership: Spot forex traders acquire actual ownership of the currencies they exchange, while CFD traders merely speculate on price movements without owning the underlying assets.

-

Leverage: CFDs offer leverage, allowing traders to trade with borrowed capital and magnify their potential gains or losses. Spot forex transactions usually do not involve leverage.

-

Trading Venue: Spot forex is traded on decentralized interbank markets, while CFDs are traded on regulated exchanges or over-the-counter platforms.

Choosing the Right Path: Spot Forex vs. CFDs

The choice between spot forex and CFDs hinges on an individual’s trading objectives, risk tolerance, and financial circumstances. Spot forex suits those interested in direct currency trading with limited leverage and a desire for actual ownership. CFDs cater to traders seeking leveraged positions, speculation on various assets, and the flexibility of ongoing contracts.

Unveiling Hidden Advantages

Spot Forex Advantages:

- Real-time market access and execution

- Direct ownership of foreign currencies

- Potentially lower transaction costs

- Reduced counterparty risk

CFDs Advantages:

- Access to a wider universe of tradable assets

- Leverage for both speculative gains and hedging strategies

- Contract flexibility with no preset expiry date

- Possibility of short-selling

Embracing Informed Decisions: The Path to Trading Wisdom

Understanding the differences between spot forex and CFDs empowers traders to make well-informed decisions aligned with their unique goals and risk appetite. By carefully navigating the complexities of these investment instruments, savvy traders can unlock the potential for financial success, traversing the markets with confidence and foresight.

Image: priceactionltd.com

Difference Between Spot Forex And Cfd