Trading currencies can be a lucrative venture, but it’s essential to understand the nuances of different markets. Two popular choices are the foreign exchange (forex) and National Stock Exchange of India (NSE) currency markets. While both offer opportunities, they differ significantly in key aspects.

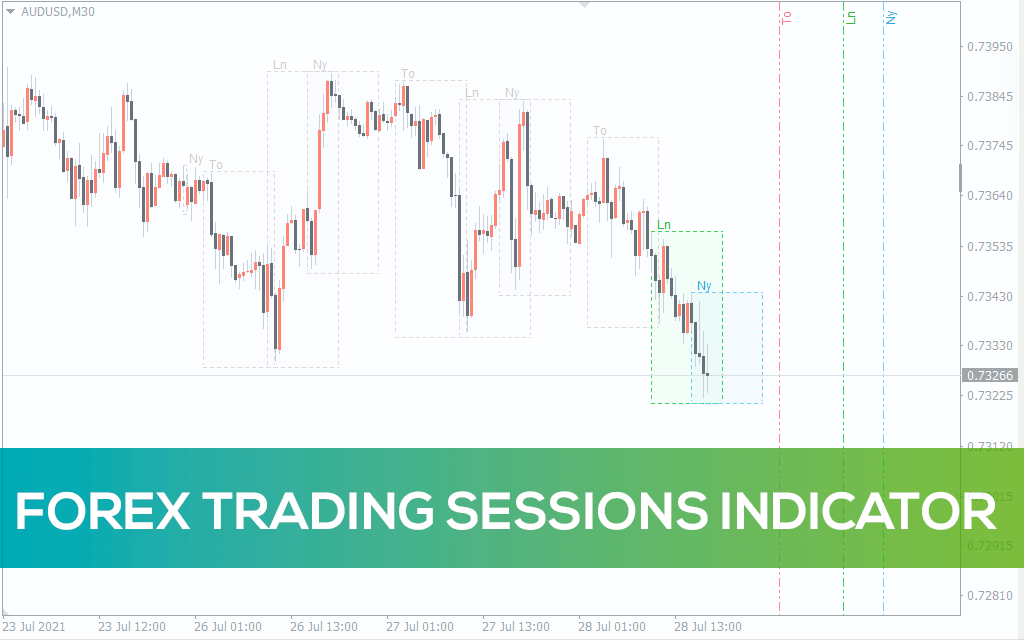

Image: indicatorspot.com

In this article, we’ll delve into the differences between forex and NSE currency trading, exploring their definitions, market structures, trading instruments, and advantages and challenges. Whether you’re a seasoned trader or just starting, this guide will equip you with the knowledge to make informed decisions.

Forex: The Global Currency Market

Forex is the largest and most liquid financial market worldwide, with a daily trading volume exceeding $6 trillion. It’s a decentralized market where currencies are traded directly between participants, including banks, institutional investors, and individual traders.

The forex market operates 24/7, offering traders continuous access to currency trading. It provides a wide range of currency pairs, from major (e.g., EUR/USD) to exotic (e.g., USD/ZMW).

NSE Currency Trading: India’s Domestic Exchange

The NSE currency segment is a domestic exchange in India where participants trade currency futures and options contracts. It’s regulated by the Securities and Exchange Board of India (SEBI) and offers Indian rupee pairs such as USD/INR and EUR/INR.

The NSE currency segment follows specific trading hours and trading rules. It provides opportunities for hedging against currency risks and speculating on exchange rate movements.

Key Differences and Considerations

Image: bestmt4ea.com

1. Market Structure and Liquidity:

- Forex: Decentralized and highly liquid with immense global participation.

- NSE: Centralized and less liquid, focusing on the Indian currency market.

2. Trading Instruments:

- Forex: Spot currencies, forwards, options, and swaps.

- NSE: Currency futures and options contracts.

3. Currency Pairs:

- Forex: Wide range of currency pairs, including major, minor, and exotic.

- NSE: Limited to Indian rupee pairs.

4. Regulation:

- Forex: Regulated by various authorities worldwide.

- NSE: Regulated by the Securities and Exchange Board of India (SEBI).

5. Advantages and Challenges:

- Forex: High liquidity, global access, and 24/7 trading, but high risk due to volatility.

- NSE: Hedging opportunities, regulated environment, and lower risk than forex, but lower liquidity and limited currency pairs.

Tips and Expert Advice

1. Understand Market Dynamics:

Study different currency pairs, their relationships, and the factors that influence their prices. Research economic data, geopolitical events, and market sentiment to make informed decisions.

2. Manage Risk Effectively:

Utilize stop-loss orders, limit orders, and position sizing strategies to manage risk. Ensure that you don’t invest more than you can afford to lose.

Frequently Asked Questions

1. Which market is suitable for beginners?

NSE currency trading offers lower risk and simpler instruments, making it more beginner-friendly.

2. What trading platform should I use?

Choose a reputable broker that offers a user-friendly platform with advanced trading tools and educational resources.

Difference Between Forex And Nse Currency Trading

Conclusion

The choice between forex and NSE currency trading depends on your risk tolerance, trading goals, and preferred instruments. Forex offers global exposure and high liquidity, while NSE provides hedging opportunities within the Indian market. By understanding the differences and considering your preferences, you can make an informed decision and maximize your trading success.

Are you ready to explore the thrilling world of currency trading? Let us know your thoughts and questions in the comments below.