In the ever-expanding world of global finance, understanding the nuances between debit cards and forex cards has become increasingly important. Whether you’re a seasoned traveler or an occasional adventurer, choosing the right card can make a world of difference in your financial journey.

Image: www.logoskill.com

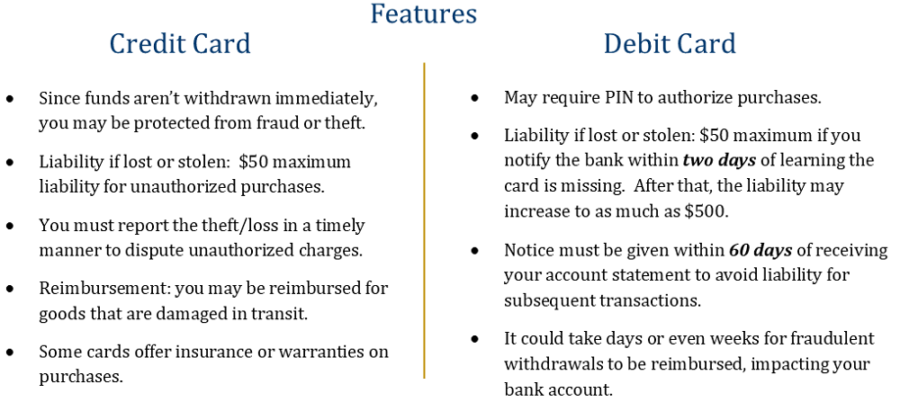

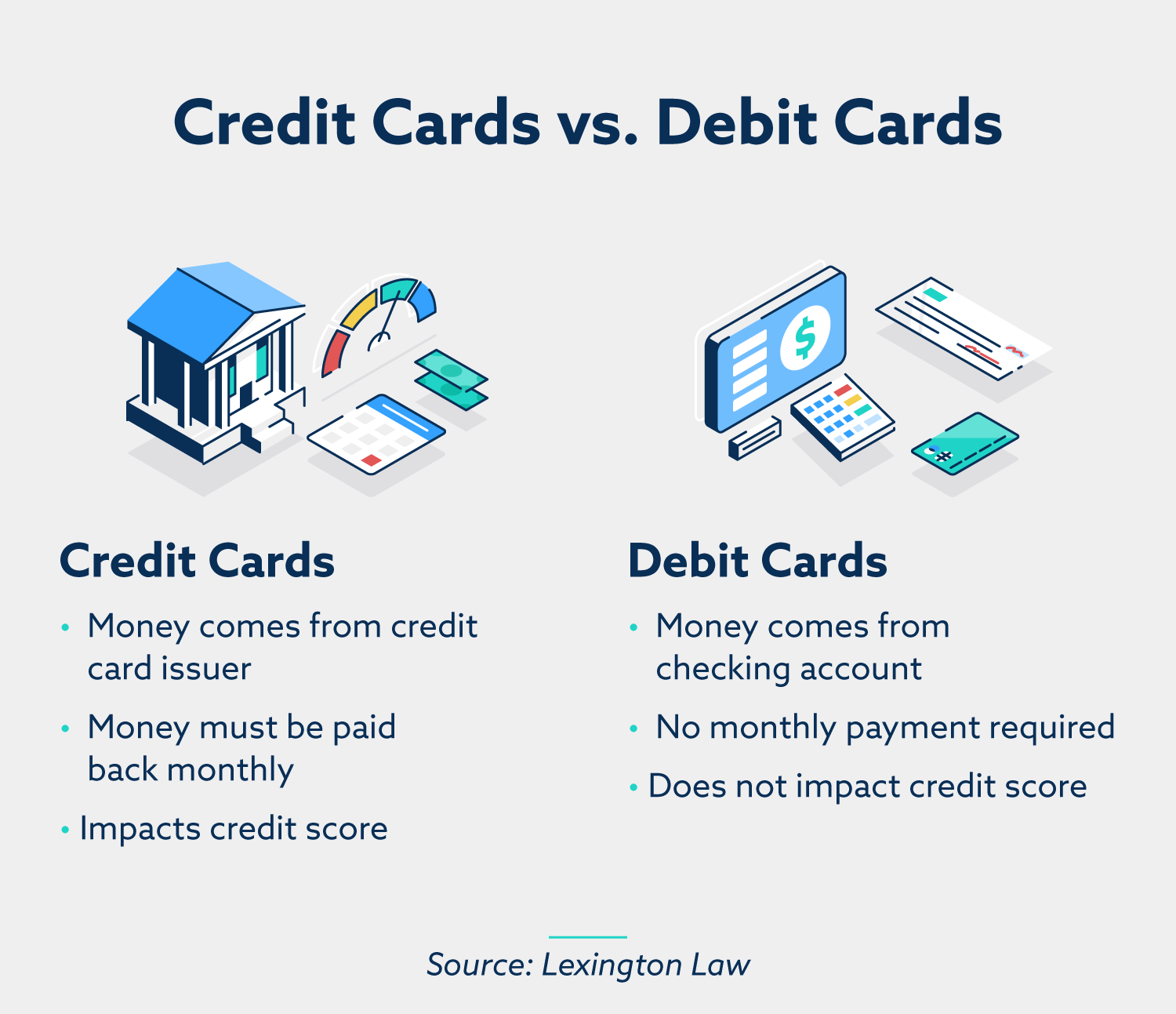

Debit Cards: The Everyday Essential

Debit cards are linked directly to your bank account and provide convenient access to your funds. They are widely accepted at retail stores, restaurants, and online platforms, making them an ideal choice for everyday purchases. However, when it comes to international transactions, debit cards can come with hefty foreign transaction fees and poor exchange rates.

Key Advantages:

- Widely accepted

- Direct access to funds

- Convenient for everyday purchases

Drawbacks:

- Foreign transaction fees

- Poor exchange rates

- May require a PIN for international transactions

Image: www.lexingtonlaw.com

Forex Cards: The International Powerhouse

Forex cards, also known as prepaid travel cards, are specifically designed for international travel. They allow you to load multiple currencies onto a single card, offering flexibility and cost savings when making purchases or withdrawing cash abroad. Forex cards typically offer competitive exchange rates and eliminate foreign transaction fees, providing significant savings compared to debit cards.

Key Advantages:

- Competitive exchange rates

- No foreign transaction fees

- Load multiple currencies

- Wide acceptance in foreign countries

- Can be used for online purchases and ATM withdrawals

Drawbacks:

- May have a loading fee

- Some cards have daily or monthly withdrawal limits

- May not be accepted by all merchants

Choosing the Right Card for Your Needs

The choice between a debit card and a forex card depends on your individual travel habits. If you travel frequently and make international payments, a forex card can provide significant savings and convenience. However, if you primarily use your card domestically, a debit card may suffice. It’s worth noting that some banks offer travel-specific debit cards with reduced foreign transaction fees.

Tips and Expert Advice:

- Always compare exchange rates and fees before choosing a card.

- Consider your expected spending amount and currency needs.

- Activate your card before traveling and inform your bank of your travel plans.

- Carry a backup payment method, such as another card or cash.

- Monitor your transactions regularly to avoid unauthorized charges.

Frequently Asked Questions

- Q: Can I use a debit card to withdraw cash abroad?

A: Yes, but you may face foreign transaction fees and a lower exchange rate. - Q: What is the difference between a prepaid forex card and a postpaid forex card?

A: Prepaid forex cards require you to load funds before use, while postpaid cards function like a credit card and allow you to pay later. - Q: How do I get a forex card?

A: Forex cards can be obtained from banks, currency exchange services, or online providers.

Diff Between Debit Card And Forex Card

Conclusion: Embark on Your Global Adventures with Confidence

Understanding the differences between debit cards and forex cards empowers you to make informed financial decisions while traveling. By choosing the right card for your needs, you can save money, enjoy peace of mind, and enhance your overall travel experience. So, whether you’re planning a quick getaway or an extended adventure, make sure you equip yourself with the right payment solution to navigate the world with ease. Are you ready to embark on your next global adventure with confidence?