Picture this: you’re a seasoned forex trader, navigating the tumultuous waters of the market with unwavering determination. Armed with a potent weapon, you possess the ability to see into the future, anticipating market movements with uncanny precision. No, this isn’t some supernatural ability reserved for the chosen few. It’s the transformative power of Depth of Market (DOM) data in forex.

Image: s3.amazonaws.com

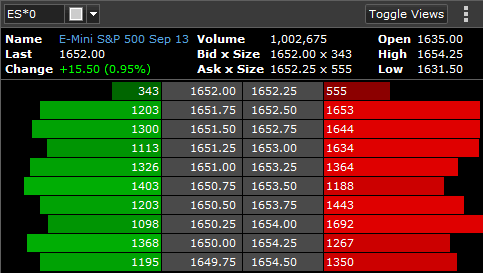

DOM data, the unsung hero of forex trading, provides a detailed snapshot of the orders waiting to be executed at various price levels. This real-time market intelligence allows you to gauge market sentiment, pinpoint potential price reversal points, and make informed trading decisions with an unparalleled level of confidence.

DOM Data: Your Window into the Market’s Mind

DOM data breaks down the seemingly chaotic forex market into a structured and comprehensible hierarchy. It reveals the invisible forces driving market movements by showing you the number of buy and sell orders at each price level. This invaluable information unveils the market’s true intentions, giving you an edge in predicting future price action.

For instance, a concentrated cluster of buy orders above the current market price signals that there’s a strong demand for the currency at that level. This surge in buying pressure indicates a potential price uptrend. Conversely, a spike in sell orders below the current market price suggests a wave of selling pressure, hinting at a potential price downtrend.

Unveiling the Secrets of Order Dynamics

The beauty of DOM data lies in its ability to illuminate the dynamics between buyers and sellers. It’s like having a window into their clandestine negotiations. By analyzing the changes in the number and size of orders at each price level, you can decipher the intentions and strategies of other market participants.

A sudden influx of large buy orders can signify institutional or professional traders entering the market, potentially pushing prices higher. Conversely, a steady stream of smaller sell orders might indicate retail traders exiting their positions, exerting downward pressure on prices. Interpreting these subtle shifts can provide valuable insights into the market’s direction.

Harnessing the Power of DOM Data

Equipping yourself with DOM data is like unlocking a secret superpower in the forex realm. It empowers you to:

- Identify potential trading opportunities with greater accuracy and confidence.

- Finetune your entry and exit points for optimal profitability.

- Predict market reversals before they occur.

- Gauge market sentiment and volatility levels in real-time.

- Analyze trader behavior and market dynamics to refine your trading strategies.

Image: fxopen.com

Depth Of Market Data In Forex

Conclusion:

In the competitive arena of forex trading, Depth of Market data is your indispensable ally. It’s the crystal ball that allows you to peer into the future, empowering you to stay ahead of the curve and maximize your trading potential. Embrace this potent tool, sharpen your trading skills, and unlock a new level of forex trading mastery.