In the world of global finance, Forex (Foreign Exchange) transactions often involve the exchange of cheques. Depositing these cheques into your local bank account can be a daunting task, but it’s crucial for accessing funds from international sources. This article will provide you with a comprehensive guide on how to deposit a Forex cheque in State Bank of India (SBI), ensuring a seamless and efficient process.

Image: www.sexiezpicz.com

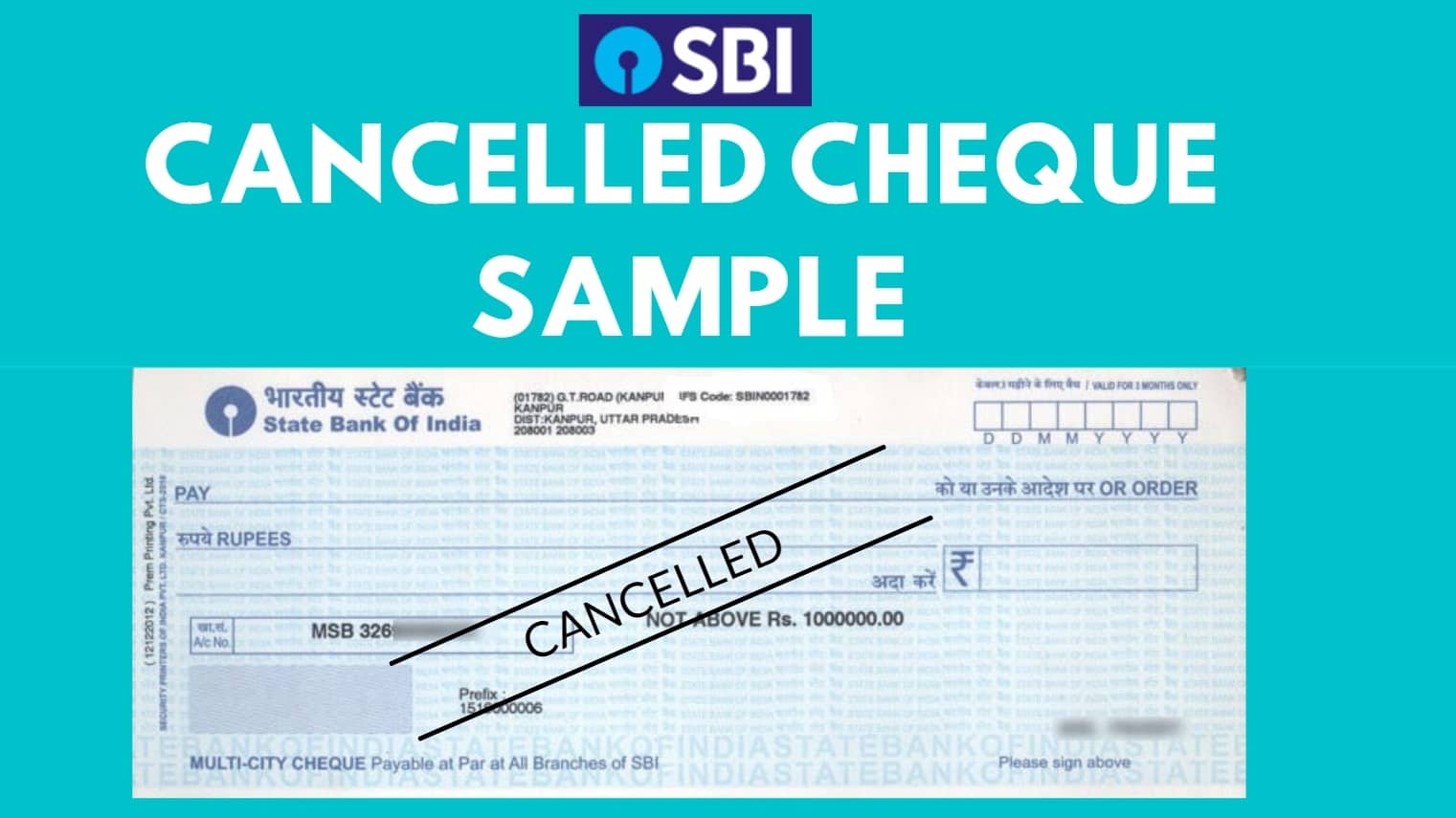

Understanding Forex Cheques

A Forex cheque is a payment instrument drawn on a foreign bank and denominated in a currency other than the local currency. These cheques are commonly encountered in international trade and business transactions where payments are made from overseas sources. The key difference between a Forex cheque and a regular cheque is that the funds are held in a foreign bank account and require conversion into the local currency before being deposited into your domestic account.

Depositing a Forex Cheque in SBI

To deposit a Forex cheque in SBI, follow these steps:

- Visit Your Branch: Visit your nearest SBI branch that offers Forex services.

- Submit the Cheque and Documents: Present the Forex cheque along with the following documents:

- A covering letter specifying the cheque details, purpose of the transaction, and your account details.

- A copy of your identity proof (e.g., Aadhaar card, passport).

- Fill Out Deposit Forms: You will need to complete the necessary deposit forms provided by the bank.

- Verification and Processing: Bank officials will verify the cheque’s authenticity, currency conversion rates, and applicable charges. The processing time can vary depending on the cheque’s origin and currency.

- Crediting Your Account: Once the verification and processing are complete, the equivalent amount in Indian rupees will be credited to your designated SBI account.

Key Considerations

Before depositing a Forex cheque, keep these key considerations in mind:

- Acceptance Currencies: SBI accepts Forex cheques denominated in various foreign currencies, including USD, GBP, EUR, and JPY.

- Charges: SBI levies service charges for Forex cheque processing, which can vary based on the cheque amount and currency.

- Processing Time: The processing time can range from a few hours to several working days, depending on factors such as cheque clearance, interbank communication, and currency conversion time.

- Validity: Forex cheques have a limited validity period. Deposit the cheque within the validity period to avoid potential issues.

Image: www.paisabazaar.com

Depositing A Forex Cheque Sbi

Benefits of Depositing Forex Cheques in SBI

Depositing a Forex cheque in SBI offers several benefits:

- Convenience: Depositing Forex cheques within the country simplifies the process and eliminates the need for overseas transactions.

- Transparency: SBI provides clear and transparent exchange rates, ensuring fair value for your funds.

- Reliable Service: SBI’s Forex services are backed by its established reputation and extensive network of banking professionals.

- Access to Global Funds: Depositing Forex cheques allows you to access funds from international sources seamlessly.

By following these steps and considering the key factors discussed, you can efficiently deposit Forex cheques in SBI and leverage the benefits of global financial transactions.