I vividly recall my initial foray into the realm of forex trading. Armed with newfound confidence and an unyielding belief in my trading abilities, I ventured into the simulated world of demo accounts. The experience felt akin to dancing on a trampoline, where every leap yielded a boundless sense of freedom and success. But alas, as I transitioned to live trading, the music abruptly halted, and reality struck me like a thunderbolt.

Image: www.youtube.com

The transition from demo to real forex trading ranks among the most jarring experiences one can encounter. While both share the veneer of trading currency pairs, the underlying dynamics couldn’t be more disparate. Demo accounts provide a comforting illusion of control, shielding traders from the emotional rollercoaster inherent in real-world trading. The absence of financial risk breeds a sense of invincibility, leading to impulsive trades and reckless decision-making.

The Anatomy of a Demo Account: A Playground for Experimentation

Demo accounts serve as a valuable sandbox for aspiring traders to hone their skills and strategies without risking their hard-earned funds. They allow traders to experiment with different trading styles, test new indicators, and familiarize themselves with the intricacies of the forex market. The absence of financial consequences encourages experimentation, enabling traders to develop confidence and a deeper understanding of the markets.

However, demo accounts can also breed unrealistic expectations and a false sense of accomplishment. The lack of real-world pressure can lead to overconfidence and disregard for proper risk management. Traders may develop a perception that they have mastered the markets, only to be confronted with the harsh realities of live trading.

The Unveiling of Wall Street’s Secrets: The Transition to Live Forex

Exiting the sheltered confines of demo accounts and entering the realm of live trading is a transformative experience. The introduction of financial risk adds an entirely new dimension to the trading process, igniting a whirlwind of emotions ranging from exhilaration to anxiety.

Traders who have thrived in the simulated environment of demo accounts often experience a rude awakening when confronted with the psychological challenges of live trading. The fear of losing real money can cloud judgment and lead to impulsive decisions. The emotional rollercoaster of market fluctuations can take a toll on mental fortitude, testing the limits of self-discipline.

Tips for Navigating the Demo-to-Live Transition

To ensure a smoother transition from demo to live trading, traders should consider adopting the following strategies:

- Start Small: Begin live trading with a small account size that you can afford to lose. This will help mitigate the emotional impact of losses and allow you to gain experience with managing real-world risk.

- Stick to Your Strategy: Adhere to the trading plan you developed during your demo account phase. Avoid making impulsive trades based on emotions or market noise.

- Manage Your Emotions: Recognize that emotions are an inherent part of trading and develop strategies to manage them effectively. Practice mindfulness and stress-reduction techniques to maintain a clear head.

- Seek Mentorship: Consult with experienced traders or mentors who can provide guidance and support as you navigate the transition to live trading.

By following these tips, traders can increase their chances of success as they transition from demo to live forex trading.

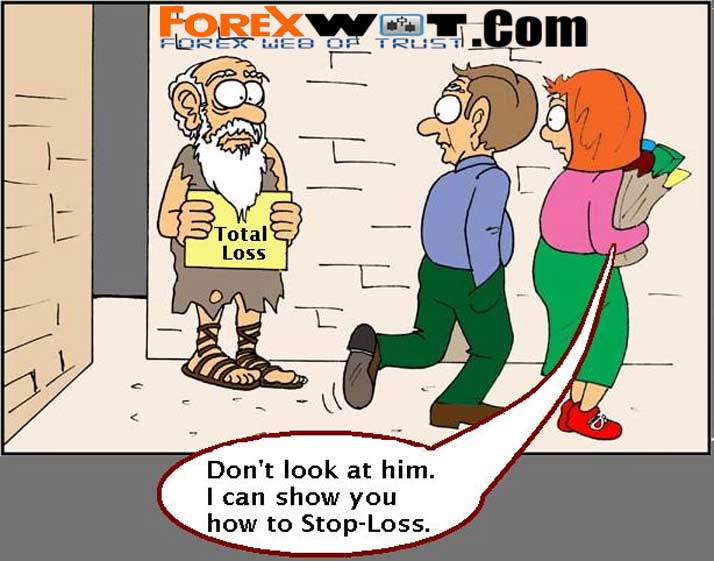

Image: forexwot.com

Frequently Asked Questions (FAQs)

- Q: What is the primary difference between demo and live forex trading?

A: The presence of financial risk distinguishes live trading from demo accounts. - Q: Why is the transition from demo to live trading challenging?

A: The introduction of financial risk adds psychological pressure, which can lead to emotional decision-making and overconfidence. - Q: How can I prepare for the transition to live trading?

A: Practice risk management, develop a trading plan, and seek guidance from experienced traders. - Q: What are some common mistakes made during the demo-to-live transition?

A: Overconfidence, neglecting risk management, and impulsive trading are common pitfalls. - Q: How long does it take to become a successful live trader?

A: The time required varies depending on individual factors, but consistency, dedication, and continuous learning are essential.

Demo Vs Real Forex Funny

Conclusion: Unveiling the Forex Maze

The journey from demo to live forex trading is an arduous but rewarding one. By embracing the challenges and adopting a grounded approach, traders can navigate the transition successfully. The lessons learned in the demo account phase will serve as a compass, guiding them through the complexities of live trading.

Dear reader, has this article sparked your curiosity about the fascinating world of forex trading? Are you ready to venture beyond the realm of paper profits and confront the exhilarating challenges of live trading? Join me on this exciting odyssey, where risk becomes an ally, and the markets reveal their hidden secrets.