The Fundamentals of Forex Trading

Before diving into the dynamics of demand and supply, it’s essential to grasp the foundational concepts of the foreign exchange (forex) market. The forex market is an over-the-counter global market where currencies are traded in pairs. This vast marketplace operates 24/5, facilitating the exchange of currencies between businesses, governments, and individuals worldwide.

Image: forexswingprofit.com

Each currency pair represents the value of one currency relative to another. For instance, the EUR/USD currency pair measures the value of the euro against the U.S. dollar. Forex traders speculate on the changes in these currency pairs’ values to profit from their fluctuations.

Supply and Demand in Forex

The Impact of Fundamentals and Technicals

The forex market is driven by the interplay of supply and demand, which determine the price of currency pairs. Supply and demand are influenced by various fundamental and technical factors, including economic data, political events, market sentiment, and price action patterns.

Fundamentals are economic and geopolitical events that have a significant impact on a currency’s value. These include Gross Domestic Product (GDP) data, interest rate decisions, and political stability. Technicals, on the other hand, focus on the historical price action of a currency pair. Traders use charts and technical indicators to identify trends and potential trading opportunities.

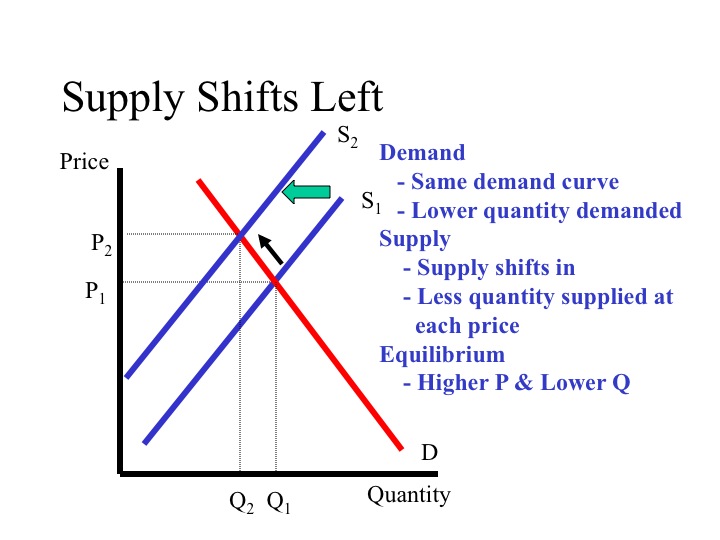

Equilibrium and Imbalances

When the forces of supply and demand are balanced, the currency pair trades at its equilibrium price. In this state, there are an equal number of buyers and sellers, and the price remains relatively stable. However, when supply exceeds demand (oversupply), the price falls as sellers are eager to unload their holdings. Conversely, if demand outstrips supply (oversupply), the price rises as buyers compete to acquire the desired currency.

These imbalances create trading opportunities as traders anticipate market movements. If demand is expected to exceed supply, a trader may buy the currency pair in the expectation that its value will appreciate. Alternatively, if supply is expected to exceed demand, a trader may sell the currency pair to capture the expected decline in its value.

Image: www.bank2home.com

The Relationship with Liquidity

Liquidity plays a crucial role in the dynamics of supply and demand. In a highly liquid market with numerous participants, it’s easier for traders to execute buy and sell orders at the desired price. High liquidity ensures smooth price discovery and reduces the risk of large price gaps. On the other hand, illiquid markets can experience significant price fluctuations due to limited participation and order imbalances.

Tips for Navigating Supply and Demand in Forex

Consider Fundamentals and Technicals

To succeed in forex trading, it’s imperative to analyze both fundamental and technical factors that influence supply and demand. Fundamental analysis provides insights into macroeconomic events and their potential impact on currency values. Meanwhile, technical analysis allows traders to identify trends, support, and resistance levels based on historical price action.

Monitor Liquidity

Liquidity is a crucial factor in ensuring the execution of trades at desired prices. Traders should monitor market depth and trading volume to assess liquidity levels. Markets with higher liquidity provide better trading conditions and reduce the risk of slippage.

Use Market Sentiment Indicators

Sentiment indicators can provide valuable insights into the current mood of the market. By analyzing market sentiment, traders can gauge whether buyers or sellers are dominant and potentially predict future price movements. Common sentiment indicators include the Relative Strength Index (RSI) and the Commitment of Traders (COT) report.

FAQs on Demand and Supply in Forex

Q: What is the equilibrium price?

A: Equilibrium price is the price at which the forces of supply and demand are balanced.

Q: What causes an imbalance in supply and demand?

A: Imbalances occur when the number of buyers exceeds the number of sellers (oversupply) or vice versa (oversupply).

Q: How does liquidity impact supply and demand?

A: Liquidity facilitates the execution of trades and affects the volatility of currency pairs.

Demand And Supply In Forex Market

Conclusion

Understanding demand and supply dynamics is fundamental to successful forex trading. By analyzing fundamental and technical factors, traders can identify imbalances in supply and demand and anticipate market movements. Incorporating these principles into a trading strategy, traders can enhance their decision-making process and improve their chances of profitability.