In the dynamic world of forex trading, understanding the interbank market is crucial for both novice and experienced traders alike. The interbank market represents the core of foreign exchange transactions, where banks and other financial institutions trade currencies directly with each other.

Image: www.rightqinfotech.com

Let’s delve into the intricacies of the interbank market and its significance in forex trading.

**What is the Interbank Market?**

The interbank market, also known as the wholesale forex market, is a decentralized network of banks and other financial institutions that facilitates the exchange of foreign currencies in large volumes. Transactions within the interbank market occur electronically, enabling seamless and efficient currency conversions for global businesses, central banks, and institutional investors.

**Why is the Interbank Market Important?**

The interbank market plays a pivotal role in setting currency exchange rates. The prices quoted in the interbank market reflect the real-time supply and demand for currencies, providing an accurate barometer of market sentiment. These rates serve as the foundation for the retail forex market, influencing the prices available to individual traders.

**Participants in the Interbank Market**

The interbank market is primarily dominated by large banks and financial institutions with a substantial presence in international trade. Key participants include:

- Primary Dealers: These are banks that deal directly with central banks, playing a crucial role in the implementation of monetary policy.

- Currency Brokers: They act as intermediaries between banks and institutional clients, facilitating currency exchanges and providing liquidity.

- Investment Banks: They participate in interbank trading to manage their portfolios, hedge risks, and provide services to their clients.

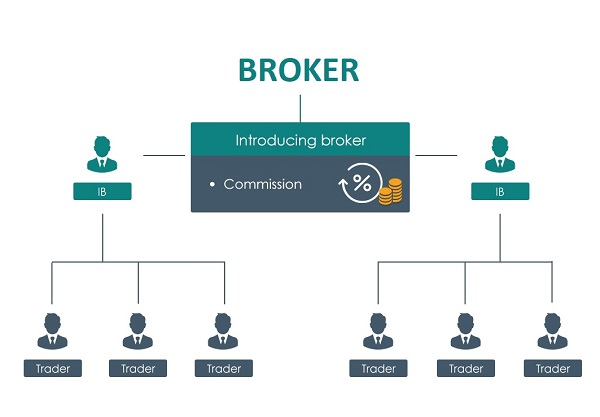

Image: tsqkq.vn

**Benefits of Trading on the Interbank Market**

For institutional traders and large corporations, accessing the interbank market offers significant advantages:

- Tighter Spreads: The interbank market boasts extremely narrow bid-ask spreads, resulting in reduced trading costs.

- Exceptional Liquidity: The high volume of transactions ensures deep liquidity, allowing for rapid execution of large orders.

- Transparency: Market participants benefit from price transparency, as interbank rates are widely disseminated.

- Reduced Risk: The decentralized nature of the interbank market mitigates the risk of counterparty default.

**Tips and Expert Advice for Interbank Trading**

To maximize the benefits of interbank trading, it’s essential to follow the guidance of experienced market veterans:

- Establish Strong Relationships with Banks: Building relationships with reputable banks is crucial for gaining access to the interbank market and securing favorable trading terms.

- Monitor Market News and Events: Staying abreast of economic data, geopolitical events, and market news is vital for making informed trading decisions.

- Use Technology Effectively: Utilize advanced trading platforms and tools to optimize order execution and manage risk effectively.

**Common FAQs on the Interbank Market**

Q: Who has direct access to the interbank market?

A: Only large financial institutions, such as banks and investment banks, have direct access.

Q: How are interbank rates determined?

A: Interbank rates are influenced by supply and demand, economic indicators, and market sentiment.

Q: What is the difference between interbank and retail forex markets?

A: The interbank market deals with large currency transactions between financial institutions, while the retail forex market caters to individual traders.

Defination Of Ib In Forex

**Conclusion**

The interbank market lies at the heart of forex trading, facilitating the exchange of currencies between global financial institutions. Understanding its structure, participants, and benefits can empower traders with the knowledge and strategies necessary for success. By adhering to expert advice and harnessing the power of technology, traders can navigate the interbank market effectively and optimize their trading endeavors.

Are you intrigued by the world of interbank forex trading? Share your thoughts and questions in the comments below!