Emerge as a Forex Master: Harness the Power of the Deep MACD Strategy

Delve into the realm of forex trading and ascend to new heights of financial decision-making. Our journey today centers around the Deep Moving Average Convergence Divergence (Deep MACD) strategy—a potent tool that will transform your trading experience. This comprehensive guide will equip you with the knowledge, insights, and actionable tips to unlock the world of forex trading with confidence and finesse.

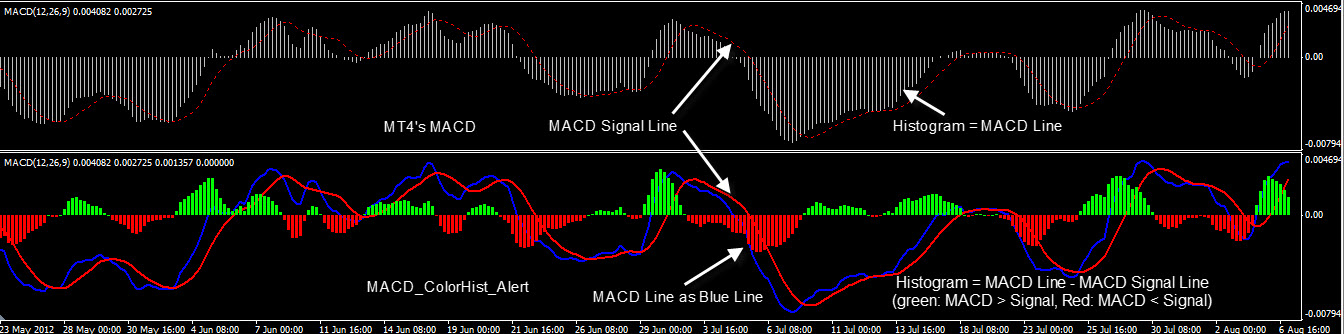

Image: www.forexstrategiesresources.com

Unveiling the Deep MACD Strategy: A Path to Forex Prowess

The Deep MACD strategy is an advanced technical analysis tool that empowers traders like you to identify potential trading opportunities with remarkable accuracy. By leveraging multiple moving averages, this strategy harnesses the power of trend identification, momentum assessment, and divergence recognition—all crucial elements for successful forex trades.

A Deeper Dive into the Deep MACD

Foundation of the Deep MACD: The Deep MACD strategy rests upon three primary moving averages: a 50-day EMA (Exponential Moving Average), a 100-day EMA, and a 200-day EMA. These moving averages decipher the short-term, medium-term, and long-term price trends, respectively.

Interpreting the Deep MACD: Understanding the interplay between these moving averages is paramount. When the 50-day EMA crosses above or below the 100-day EMA, it signals a potential trend reversal. A further confirmation occurs when the 100-day EMA breaches the 200-day EMA.

Trading with the Deep MACD: Mastering the Deep MACD strategy goes beyond theoretical knowledge. Learn how to implement this technique in your trades with practical guidance and real-world examples.

A Glimpse into Expert Insights: Navigating Forex with Seasoned Guides

Seasoned forex traders share invaluable wisdom to sharpen your trading acumen. These insights will guide you in implementing the Deep MACD strategy with precision and maximizing your returns.

Expert Tip 1: When the Deep MACD line crosses above the zero line, it suggests bullish momentum. Conversely, a cross below zero signifies bearish market sentiment.

Expert Tip 2: Divergences between the Deep MACD histogram and price action provide valuable trading signals. A bullish divergence, where prices drop but the Deep MACD histogram rises, indicates a potential reversal. A bearish divergence hints at an impending downswing.

Image: www.cashbackforex.com

The Path to Mastery: Empowering Your Forex Endeavors

The Deep MACD strategy is a powerful tool, yet its true value lies in your ability to leverage it. Embrace the insights within this article, apply them diligently, and transform your forex trading into a profitable pursuit.

Practice and Refinement: Forex mastery is a journey of continuous learning and refinement. Implement the Deep MACD strategy in your trades, observe the outcomes, and fine-tune your approach over time.

Discipline and Patience: Success in forex trading hinges upon discipline and patience. Resist impulsive decisions; instead, let the Deep MACD strategy guide your trades with objectivity and confidence.

Continuous Education: The financial markets are ever-evolving. Stay abreast of the latest trends and developments in forex trading to remain competitive and informed.

Deep Macd Strategy Forex Pdf

Embark on a New Chapter in Forex Trading: Confidence, Success, and Empowerment

With the Deep MACD strategy as your guide, you possess the knowledge and tools to navigate the world of forex trading with confidence and skill. Unlock hidden opportunities, maximize your earnings, and embark on a journey of financial success. Remember, the path to mastery is paved with dedication, continuous learning, and the unwavering belief in your abilities.