Image: www.chegg.com

A Tale of Two Traders

John, an eager currency trader, had recently secured a promising trade opportunity. As the market opened, he swiftly executed his plan, buying a hefty amount of Japanese Yen with hopes of a profitable margin. Across the trading screen, his counterpart, Mary, had placed an opposing order, selling an equal quantity of Yen. In a matter of milliseconds, their transactions interlocked, setting in motion a series of obligations that would culminate at a pivotal moment – the settlement date.

The Clock Starts Ticking

The settlement date, often referred to as “T+2” in the world of forex, marks the day when traders fulfill their financial commitments. It is a non-negotiable deadline for both parties involved in a currency exchange to transfer the agreed-upon currency amounts, akin to a rendezvous where obligations are settled. For John, this meant delivering the Japanese Yen he had purchased, while Mary would transfer the corresponding amount in her designated currency.

A Dance of Time Zones and Intermediaries

The journey from trade execution to settlement date is a meticulously orchestrated dance involving multiple actors. Following the initial trade, the transactions are routed through clearinghouses, financial institutions that serve as intermediaries, guaranteeing the swift and secure execution of trades. These clearinghouses then initiate the funds transfer process based on the agreed-upon settlement date.

Navigating the Settlement Timelines

Understanding the settlement timeline is crucial for traders, as it impacts their risk management strategies and liquidity preferences. In most cases, T+2 applies to spot forex transactions, where settlement occurs two business days after the trade date. However, certain currency pairs may operate with different settlement timelines, requiring traders to be cognizant of these variations.

Factors Influencing Settlement Dates

Multiple factors can influence settlement dates, including the location of the counterparties, the currencies involved, and any applicable holidays. Delays may arise due to weekends, public holidays, or differences in time zones. Thus, traders must consider these factors when planning their trades and preparing for settlement day.

Consequences of Missed Settlement Dates

Failing to settle obligations on time can have significant consequences for traders. Late settlements can trigger penalty charges or margin calls, putting their accounts and trading privileges at risk. Moreover, it can disrupt market stability and create imbalances within the forex ecosystem.

Ensuring Timely Settlements

Traders can play a vital role in ensuring timely settlements by being well-versed in settlement timelines and promptly providing necessary funds. Accurate documentation and efficient communication with clearinghouses are also essential. By adhering to these best practices, traders can reduce the likelihood of settlement delays and maintain their credibility within the market.

Conclusion

Settlement dates in forex serve as the culmination point of every trade, a moment when obligations are fulfilled, and financial commitments are realized. By understanding the intricate workings of settlement dates, traders can navigate the complexities of currency exchange with confidence, mitigating risks and ensuring a seamless flow of funds. Whether you’re an experienced trader or embarking on your forex journey, may this guide serve as your beacon, empowering you to forge successful and timely settlements in the ever-evolving world of currency exchange.

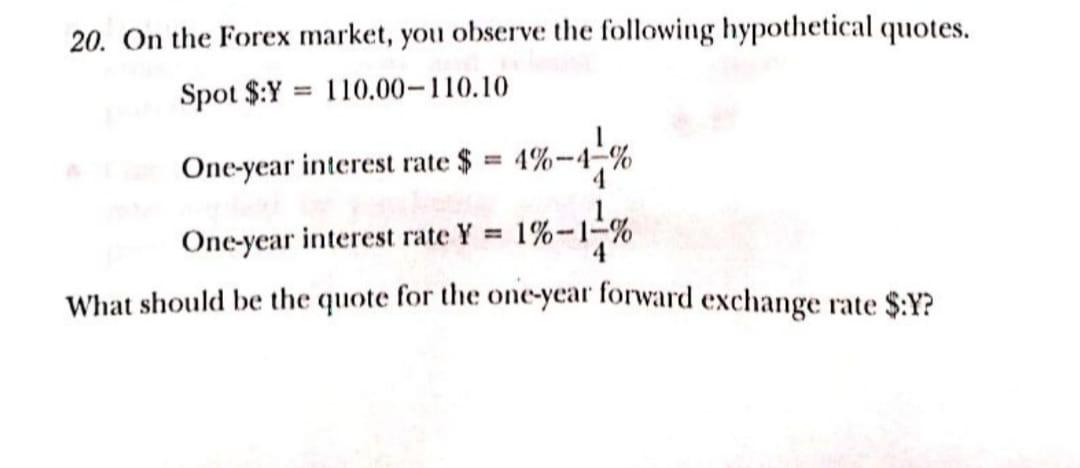

Image: www.chegg.com

Date Whgere Counterarties Settle Their Obligation In Forex