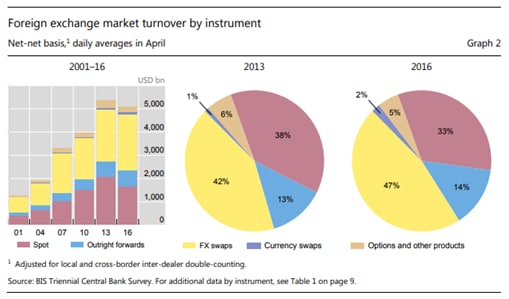

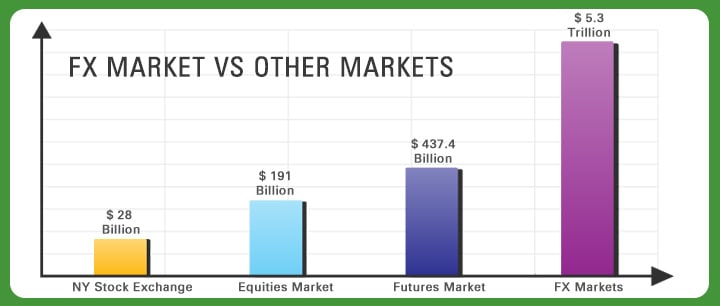

The foreign exchange market, also known as forex, is an awe-inspiring financial arena where currencies of nations are traded 24 hours a day, five days a week. The daily turnover in this colossal marketplace is mind-boggling, routinely exceeding a staggering $6 trillion. This immense volume renders the forex market the world’s largest and most liquid financial market, dwarfing other markets like stocks and bonds.

Image: forexbestscalpingindicator.blogspot.com

The daily turnover in the forex market is not merely a number; it’s a symphony of economic forces colliding. It reflects the myriad transactions undertaken by a diverse cast of market participants, including central banks, commercial banks, institutional investors, hedge funds, and retail traders. Each of these players contributes to the ceaseless ebb and flow of currencies, shaping the intricate tapestry of the forex market.

Demystifying Forex Market Mechanics

The forex market operates on a decentralized platform, devoid of a central exchange. Instead, it’s an electronic network connecting countless market participants worldwide. This structure fosters efficiency and accessibility, enabling traders to execute transactions with lightning speed.

In the forex market, currencies are traded in pairs, with one currency quoted against another. For instance, the EUR/USD currency pair represents the exchange rate between the euro and the US dollar. Traders endeavor to profit from fluctuations in these exchange rates by buying currencies they anticipate will appreciate and selling those expected to depreciate.

Unveiling the Currency Trading Spectrum

The array of currencies traded in the forex market is vast, with the US dollar reigning supreme as the world’s reserve currency. Other major currencies include the euro, the Japanese yen, the British pound, and the Swiss franc. However, a plethora of other currencies, representing diverse economies, are also actively traded.

Currency trading encompasses a broad spectrum, ranging from short-term scalping to long-term investing. Scalpers seek to capitalize on fleeting market inefficiencies, while long-term investors adopt a more measured approach, often holding positions for weeks or even months. The choice of trading style hinges on individual risk tolerance and market outlook.

A Crucible of Economic Influence

The daily turnover in the forex market is a barometer of global economic health. Changes in currency values mirror underlying economic fundamentals, such as interest rate differentials, inflation levels, and political stability. Central banks wield considerable influence by adjusting monetary policies, which can trigger significant currency movements.

Economic events, geopolitical developments, and even natural disasters can ripple through the forex market, causing sudden shifts in currency prices. Traders must remain abreast of these events and their potential impact on the market to make informed trading decisions.

Image: www.netpicks.com

Harnessing Technology in Forex Trading

Technological advancements have revolutionized forex trading, making it more accessible and efficient. Online trading platforms provide a user-friendly interface, real-time data, and sophisticated charting tools, empowering traders to make informed decisions.

Algorithmic trading, utilizing sophisticated software, has also gained traction. These algorithms monitor the market relentlessly, executing trades based on predefined criteria. While automation offers advantages, it’s crucial to understand the underlying principles and exercise caution.

Daily Turnover In Forex Market

Prudence in Forex Trading

While the forex market offers immense opportunities, it is equally important to exercise caution. Forex trading is not a zero-sum game; for every winner, there is a loser. It’s imperative to trade within one’s means and manage risk effectively.

Aspiring traders should approach forex with an education-first mindset. Thoroughly understanding market dynamics, risk management strategies, and trading psychology is key to navigating this complex realm.

The daily turnover in the forex market is a testament to its immense scale and global reach. It’s a captivating arena where economic forces interplay, creating opportunities and risks for market participants. By comprehending the intricacies of the forex market, traders can harness its potential while adhering to prudent risk management principles.