In the bustling realm of forex trading, where currencies dance to the rhythm of global events and economic fluctuations, astute traders seek the Holy Grail of consistent profitability. Amidst the myriad technical indicators and complex analysis techniques, one treasure that has stood the test of time is the power of currency correlation.

Image: forexwot.com

Correlation, the measure of co-movement between currency pairs, is a beacon of light for traders, revealing hidden opportunities and guiding them towards a profitable path. By harnessing the correlation between different currencies, traders can diversify their portfolios, optimize risk management, and potentially increase their trading edge.

The Symphony of Correlation: Understanding Its Significance

Correlation is a quantifiable measure of the degree to which two currency pairs move in tandem. A positive correlation indicates a direct relationship, where an increase in the value of one currency pair is likely to lead to an increase in the other. Conversely, a negative correlation indicates an inverse relationship, where an increase in one currency pair’s value is mirrored by a decline in the other’s value.

Understanding the correlation between different currency pairs is pivotal for traders seeking a balanced and resilient portfolio. By diversifying their positions across correlated pairs, traders can mitigate risk by spreading the impact of market movements over multiple investments. Moreover, correlation can assist in identifying potential trading opportunities, as it can reveal the likelihood of similar price movements in related currency pairs.

Leveraging Correlation for Profitable Trades

The correlation between currency pairs offers invaluable insights for crafting profitable trading strategies. Here are some of the key ways traders can exploit correlation to their advantage:

1. Scalping: Correlation can be an invaluable asset for scalpers, who profit from small and rapid price movements. By identifying highly correlated currency pairs, scalpers can simultaneously trade both pairs, maximizing profit potential while minimizing risk.

2. Hedging: Correlation plays a crucial role in hedging strategies, where traders aim to reduce risk by holding opposing positions in correlated pairs. If one currency pair in the correlation experiences a loss, the gains from the other correlated pair can potentially offset the deficit.

3. Carry Trading: Correlation is also essential in carry trading, a strategy that entails borrowing currencies with low-interest rates and investing them in currencies with higher interest rates. By selecting highly correlated currency pairs, carry traders can reduce the risk of unfavorable exchange rate fluctuations.

Delving into Correlation Analysis: Tools and Techniques

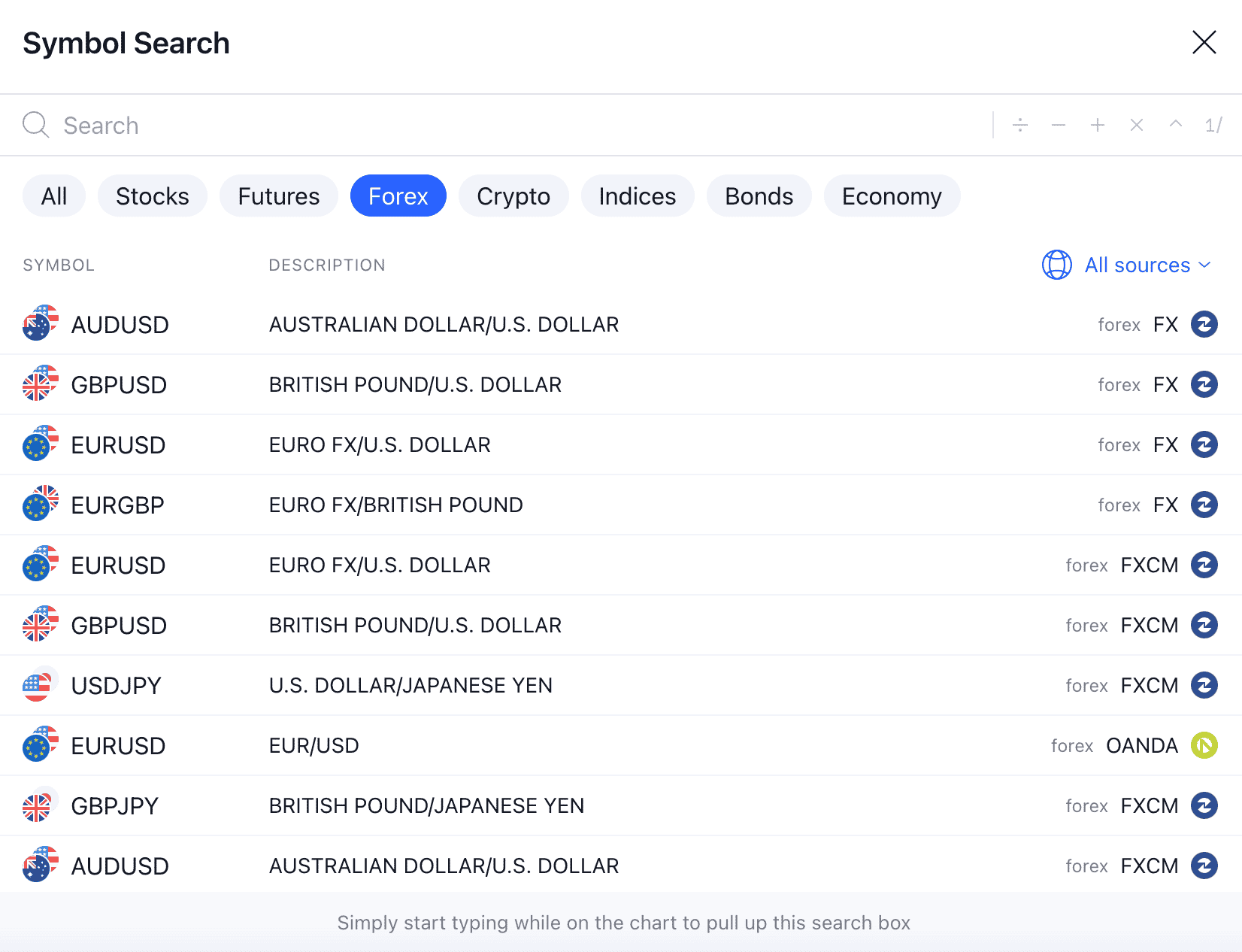

To harness the power of correlation in forex trading, a thorough understanding of its analysis is paramount. Here are some of the key tools and techniques used to analyze correlation:

1. Correlation Coefficient: The correlation coefficient is a statistical measure that quantifies the strength and direction of correlation between two variables, ranging from -1 to +1. A coefficient close to +1 indicates a strong positive correlation, while a coefficient close to -1 indicates a strong negative correlation.

2. Scatter Plots: Scatter plots are graphical representations of the relationship between two variables. They provide a visual representation of the correlation, with data points clustered together indicating a strong correlation and data points scattered randomly indicating a weak or absent correlation.

3. Historical Data: Analyzing historical correlation data can provide insights into the stability and persistence of correlation over time. Traders can use this information to assess the reliability of correlation-based trading strategies.

Image: www.business2community.com

Daily Profitable Strategy Forex Corelation

Conclusion: Mastering the Art of Correlation-Based Trading

Currency correlation is a fundamental aspect of forex trading that can unlock the potential for increased profitability and risk management. By understanding the concept of correlation, its impact on price movements, and the techniques used to analyze it, traders can develop and implement robust trading strategies that leverage the power of correlation. In the ever-evolving market of forex, correlation serves as a beacon of opportunity, guiding traders towards consistent gains and a thriving trading career.