Introduction

Image: dombeetchim.ru

In the ever-evolving world of forex trading, Cyprus has emerged as a formidable hub, attracting companies worldwide with its alluring tax incentives. The island nation boasts a robust regulatory framework, a highly skilled workforce, and a favorable geopolitical location, making it a prime destination for forex operations. However, navigating the intricacies of Cyprus tax laws can be a daunting task. This meticulous guide delves into the intricate tapestry of Cyprus tax rates specifically tailored for forex companies, illuminating the path towards informed decisions and efficient tax planning.

Cyprus Tax Regime: An Overview

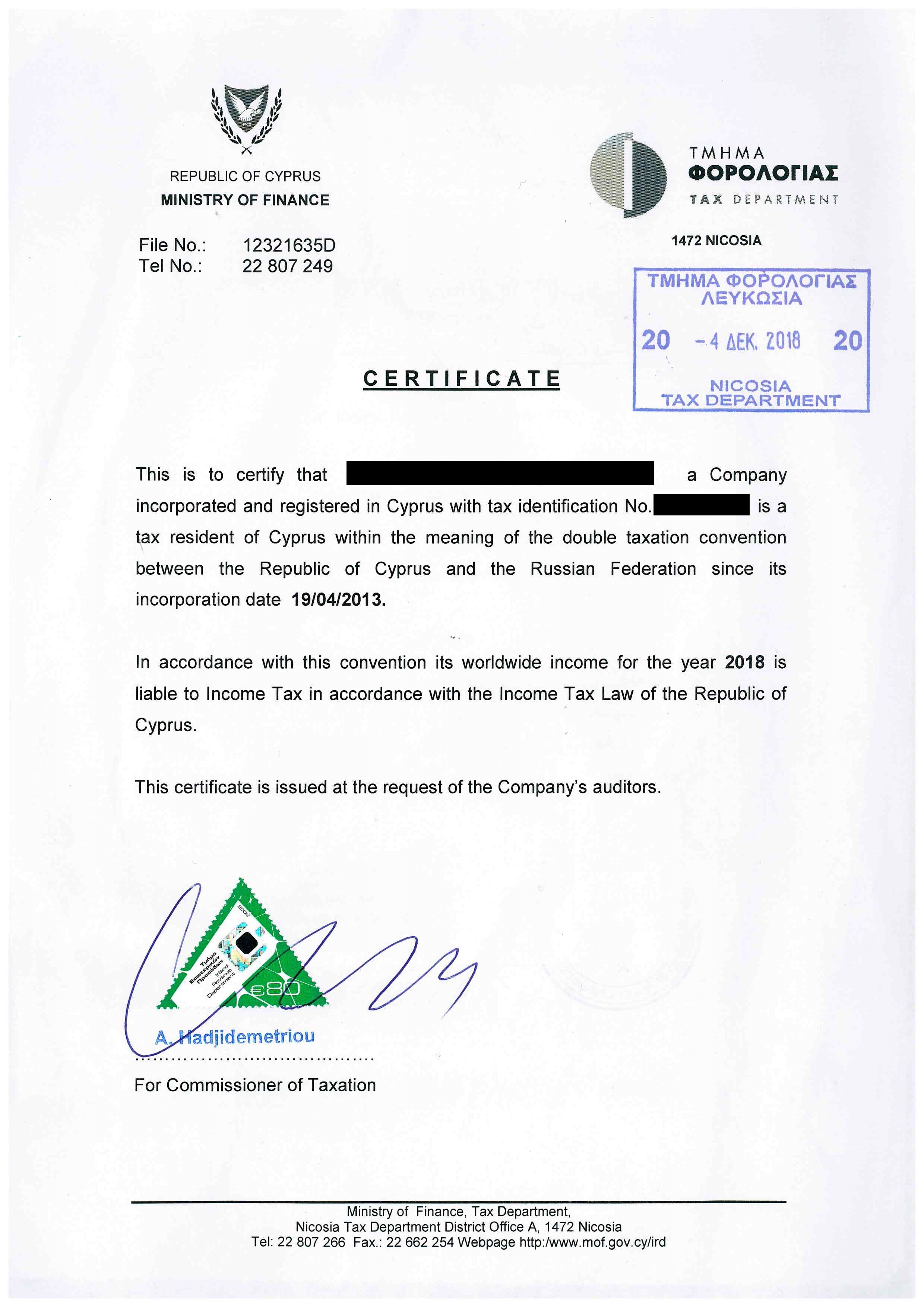

Cyprus offers a corporate tax rate of 12.5%, one of the lowest in the European Union. This favorable rate extends to forex companies, enabling them to minimize their tax burden and enhance profitability. Moreover, Cyprus has implemented a series of tax incentives specifically designed to bolster the forex industry. These incentives include tax exemptions on dividend income and capital gains, further reducing the tax liability of forex companies. Additionally, Cyprus has signed comprehensive double taxation treaties with over 65 countries, ensuring that forex companies avoid double taxation on their overseas earnings.

Understanding the Cyprus Tax Rates for Forex Companies

To fully harness the benefits of the Cyprus tax system, forex companies must meticulously analyze the tax rates applicable to their operations. The following sections provide a detailed breakdown of the relevant tax rates:

- Income Tax: 12.5%

Forex companies are subject to a flat corporate income tax rate of 12.5%. This tax is levied on the net income generated by forex trading activities, taking into account deductions for expenses related to the business. The low tax rate is a significant advantage for forex companies, allowing them to retain a larger portion of their earnings for reinvestment and expansion.

- Dividend Tax: 0%

Cyprus exempts dividend income from taxation, both at the corporate and individual level. This means that forex companies can repatriate their profits without incurring any additional tax burden. The absence of dividend tax facilitates capital repatriation and enables forex companies to reward their shareholders without tax penalties.

- Capital Gains Tax: 0%

Capital gains arising from the disposal of shares in forex companies are exempt from taxation in Cyprus. This exemption provides additional tax savings to forex companies engaging in equity investments. By avoiding capital gains tax, forex companies can maximize their returns and enhance their overall profitability.

- Withholding Tax: Lower Rates

Cyprus has negotiated reduced withholding tax rates on dividends, interest, and royalties with over 50 countries. These reduced rates significantly mitigate the tax liabilities of forex companies operating internationally. For instance, the withholding tax rate on dividends is typically reduced to 5% or 10%, and the withholding tax rate on interest income is often set at 0%.

Expert Insights and Actionable Tips

Navigating the complexities of Cyprus tax laws requires professional expertise and a thorough understanding of the applicable regulations. Seek guidance from experienced tax advisors who can provide personalized advice tailored to your specific circumstances. Additionally, consider the following actionable tips to optimize your tax planning:

-

**Utilize Tax Exemptions: Capitalize on the numerous tax exemptions available to forex companies, including dividend and capital gains exemptions.

-

**Leverage Double Taxation Treaties: Explore the benefits of double taxation treaties to minimize tax exposure on overseas earnings.

-

**Maintain Proper Documentation: Ensure meticulous record-keeping to substantiate expenses, income, and other tax-related transactions.

-

**Plan for the Long Term: Develop a comprehensive tax strategy aligned with your business objectives, considering both current and future tax implications.

-

**Embrace Transparency: Adhere strictly to all tax regulations and disclosure requirements to build credibility and avoid potential tax penalties.

Conclusion

Cyprus offers a captivating tax landscape for forex companies, featuring a low corporate tax rate, numerous tax exemptions, and reduced withholding taxes. By comprehending the intricacies of the Cyprus tax system, forex companies can optimize their tax planning, minimize their tax burden, and maximize their profitability. Remember to seek professional guidance, implement the actionable tips outlined above

Image: hoxtoncapital.com

Cyprus Tax Rates For Forex Company