Step into the intriguing realm of foreign exchange (forex), where the value of one currency dances against another in a perpetual symphony of gain and loss. Currency rates quoted in forex represent the fundamental heartbeat of international trade, determining the price of commodities, shaping economic landscapes, and impacting our daily lives in myriad ways. In this comprehensive guide, we embark on a journey to explore the complexities of currency exchange rates, empowering you with the knowledge and insights to navigate this ever-evolving marketplace.

Image: www.exchangerates.org.uk

What Are Currency Exchange Rates?

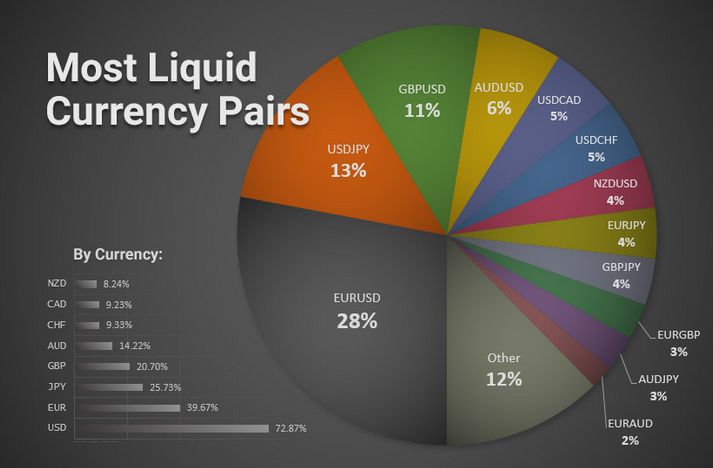

Currency exchange rates establish the relative value of two different currencies. At any given moment, a currency pair will have two rates associated with it: the bid rate and the ask rate. The bid rate is the price at which a financial institution is willing to buy the base currency in exchange for the quote currency, while the ask rate is the price at which it will sell the base currency.

The bid-ask spread, the difference between the bid rate and the ask rate, represents the institution’s profit margin on each transaction. The spread varies depending on factors such as market liquidity, order size, and currency volatility.

Factors Influencing Currency Exchange Rates

A complex interplay of fundamental and technical factors shapes the rollercoaster ride of exchange rates. Central bank policies, economic growth, inflation, interest rates, political stability, and supply and demand all play a significant role.

Central banks have a powerful influence on exchange rates through monetary policy decisions. By raising or lowering interest rates, they can make their currency more or less attractive to investors. Economic growth reflects a country’s productivity and overall financial health, which can impact the demand for its currency.

Inflation, the rate at which prices increase, affects currency values as investors seek to hold assets in currencies with low inflation rates. Interest rates are another key factor, as higher rates make a currency more desirable for carry trade, where investors borrow in low-interest currencies to invest in high-interest ones.

Political stability and news events can also trigger rapid shifts in exchange rates. Uncertainty and negative news can prompt investors to sell a country’s currency, while positive news can boost its value. Finally, supply and demand also shape rates, as a surge in demand for a particular currency can lead to its appreciation against others.

Real-World Applications of Currency Exchange Rates

Currency exchange rates influence countless aspects of our lives beyond the trading floors of forex markets. They shape the prices of imported and exported goods, playing a crucial role in international trade. Tourists face fluctuating currency rates while planning their travels, and businesses adjust their prices based on exchange rate movements to remain competitive in the global marketplace.

Investors seek opportunities to profit from currency movements through various investment vehicles such as spot forex, currency futures, and exchange-traded funds (ETFs). By understanding exchange rates, investors can make informed decisions to maximize returns and manage risk.

Image: www.leaprate.com

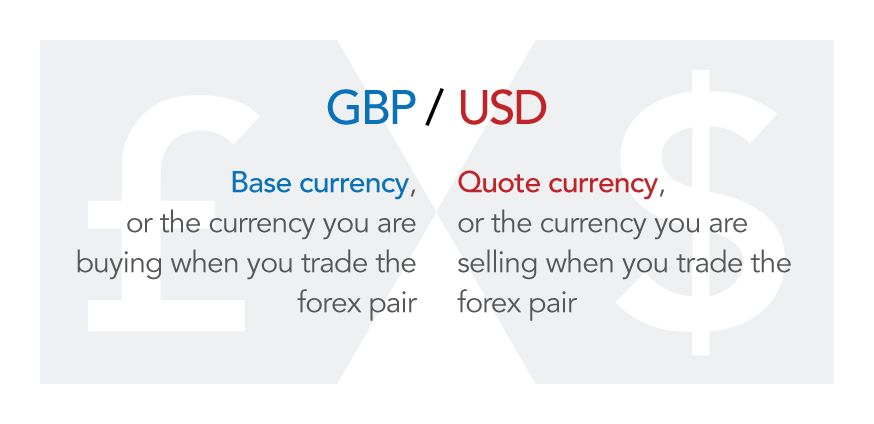

Understanding Currency Quotes

To navigate the forex market, it’s essential to understand how currency pairs are quoted. Most commonly, currency pairs are quoted in the format of “base currency/quote currency,” where the base currency is the one being bought or sold, and the quote currency is the one used as a reference.

For instance, the currency quote “EUR/USD 1.1550” indicates that 1 euro is equivalent to 1.1550 US dollars at the asking rate. Conversely, the bid rate for this quote would be slightly lower, representing the amount of US dollars a financial institution is willing to pay for 1 euro.

Trends and Developments in Forex Markets

The forex market is constantly evolving, with new trends and developments emerging all the time. Technological advancements have played a significant role in making forex trading more accessible and efficient, leading to increased participation by retail traders.

The rise of algorithmic trading, where computer algorithms automate trading decisions based on predefined parameters, has also impacted forex dynamics. Additionally, the introduction of digital currencies and the broader adoption of cryptocurrencies have added a new dimension to the foreign exchange landscape.

The advent of fintech and mobile trading platforms has further broadened the access to forex markets, making it possible to tradecurrencies anytime, anywhere. As technology continues to shape the industry, we can expect to see further innovations and trends that will impact currency exchange rates in the years to come.

Currency Rates Quoted In Forex

Conclusion

Currency exchange rates quoted in forex are a gateway to understanding the interconnectedness of global economies. By grasping the intricacies of currency pairs, factors influencing rates, and practical applications, individuals can make informed decisions and navigate the dynamic world of foreign exchange. Whether you’re a seasoned trader, an investor, a business owner, or simply curious about the forces that shape our financial landscape, this comprehensive guide provides you with the tools to unlock the secrets of currency rates and harness their power.