Introduction

As a seasoned forex trader, I’ve witnessed the ever-evolving composition of world forex reserves firsthand. The dominance of the US dollar has long faded, and central banks around the globe are now diversifying their portfolios to minimize risk and capitalize on potential opportunities. This article will delve into the intricate details of this fascinating shift, exploring the reasons behind it and its implications for global financial markets.

The Rise of Multi-Currency Reserves

The shift towards multi-currency reserves has been driven by several factors, including:

- Diminishing US Dollar Dominance: The US dollar’s share of forex reserves has declined from a peak of 70% in 2000 to around 59% in 2022. This decline is partly due to the Federal Reserve’s expansionary monetary policies, which have devalued the currency against its peers.

- Diversifying Risks: Central banks are seeking to reduce their exposure to a single currency by diversifying their reserves across different denominations. This diversification helps them mitigate the risks associated with currency fluctuations and geopolitical uncertainties.

- Taking Advantage of Yield: Low interest rates in developed economies have prompted central banks to explore currencies with higher yields, such as the Australian dollar and the Chinese yuan. This pursuit of yield has further fueled the trend towards multi-currency reserves.

The Currency Composition of World Forex Reserves

The currency composition of world forex reserves has become increasingly diverse in recent years. While the US dollar remains the most commonly held currency, its dominance has diminished and other currencies, such as the euro, the Chinese yuan, and the Japanese yen, have gained prominence.

- Euro: The euro has been the second most widely held currency in world forex reserves since its inception in 1999. Its stability and its status as the currency of the European Union, the world’s largest economic bloc, have contributed to its appeal.

- Chinese Yuan: The Chinese yuan has seen a rapid rise in its share of world forex reserves, from a mere 1% in 2016 to over 7% in 2022. This increase is largely due to China’s growing economic power and its efforts to internationalize the yuan.

- Japanese Yen: The Japanese yen has been a safe haven currency for decades, and it continues to play a significant role in world forex reserves. Its low interest rates, combined with the stability of the Japanese economy, have made it attractive to central banks.

Benefits and Challenges of Multi-Currency Reserves

The diversification of forex reserves offers several benefits to central banks:

– Risk Reduction: By spreading their reserves across multiple currencies, central banks can reduce their exposure to a single currency’s fluctuations and mitigate overall risk.

– Higher Potential Returns: Multi-currency reserves provide the potential for higher returns compared to holding a single currency. By investing in currencies with higher interest rates, central banks can boost their yield without taking on excessive risk.

– Increased Financial Autonomy: Multi-currency reserves give central banks greater independence in managing their monetary policies. They are less constrained by the decisions of a single currency issuer, such as the Federal Reserve.

However, there are also some challenges associated with multi-currency reserves:

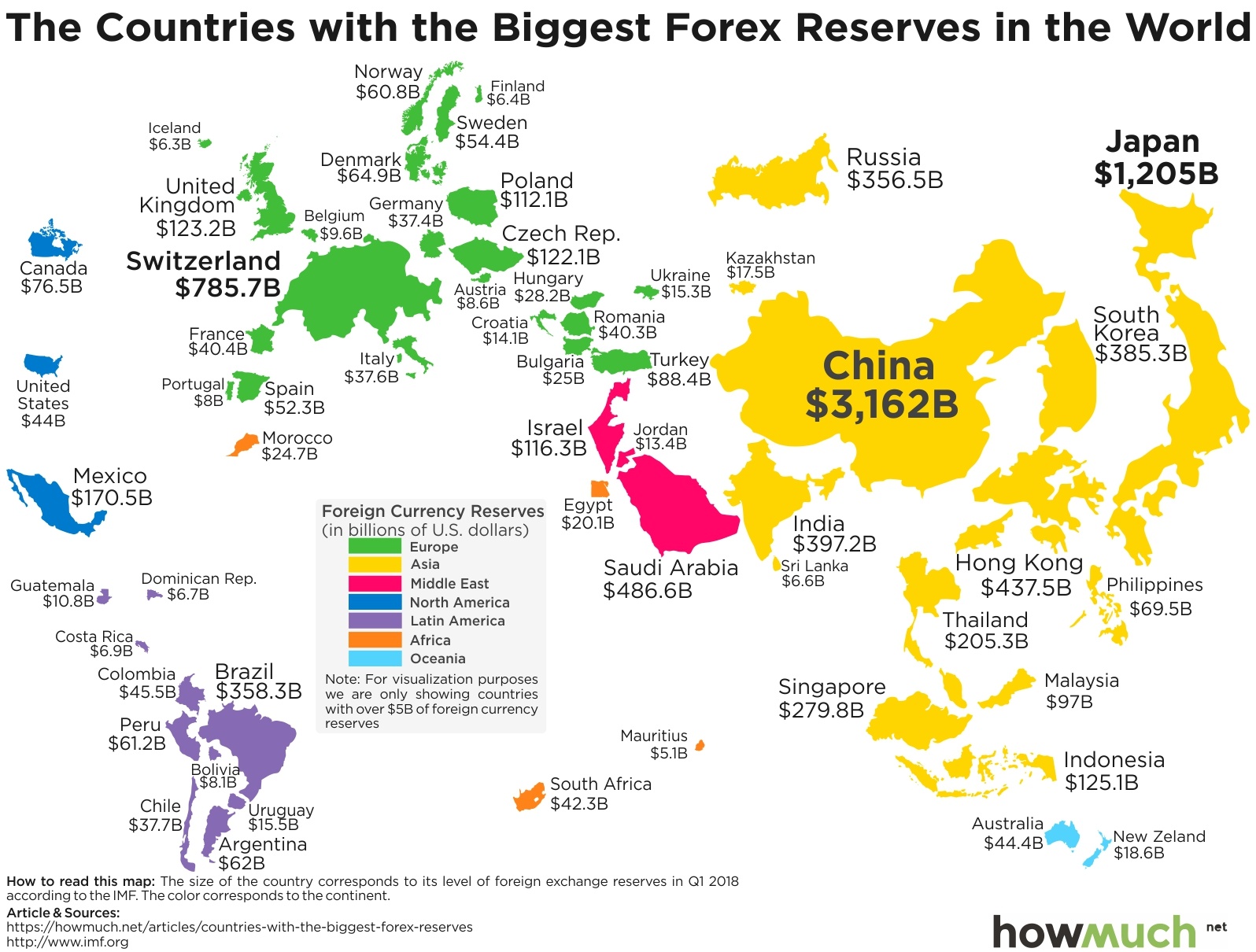

Image: howmuch.net

- Currency Exchange Costs: Diversifying forex reserves involves converting currencies, which can incur transaction costs and potentially erode returns.

- Currency Volatility: Multi-currency reserves expose central banks to the volatility of multiple currencies. Managing fluctuations in exchange rates can be complex and time-consuming.

- Reserve Management Complexity: Managing a multi-currency reserve requires specialized skills and in-depth knowledge of currency markets. This can be a significant challenge for smaller central banks with limited resources.

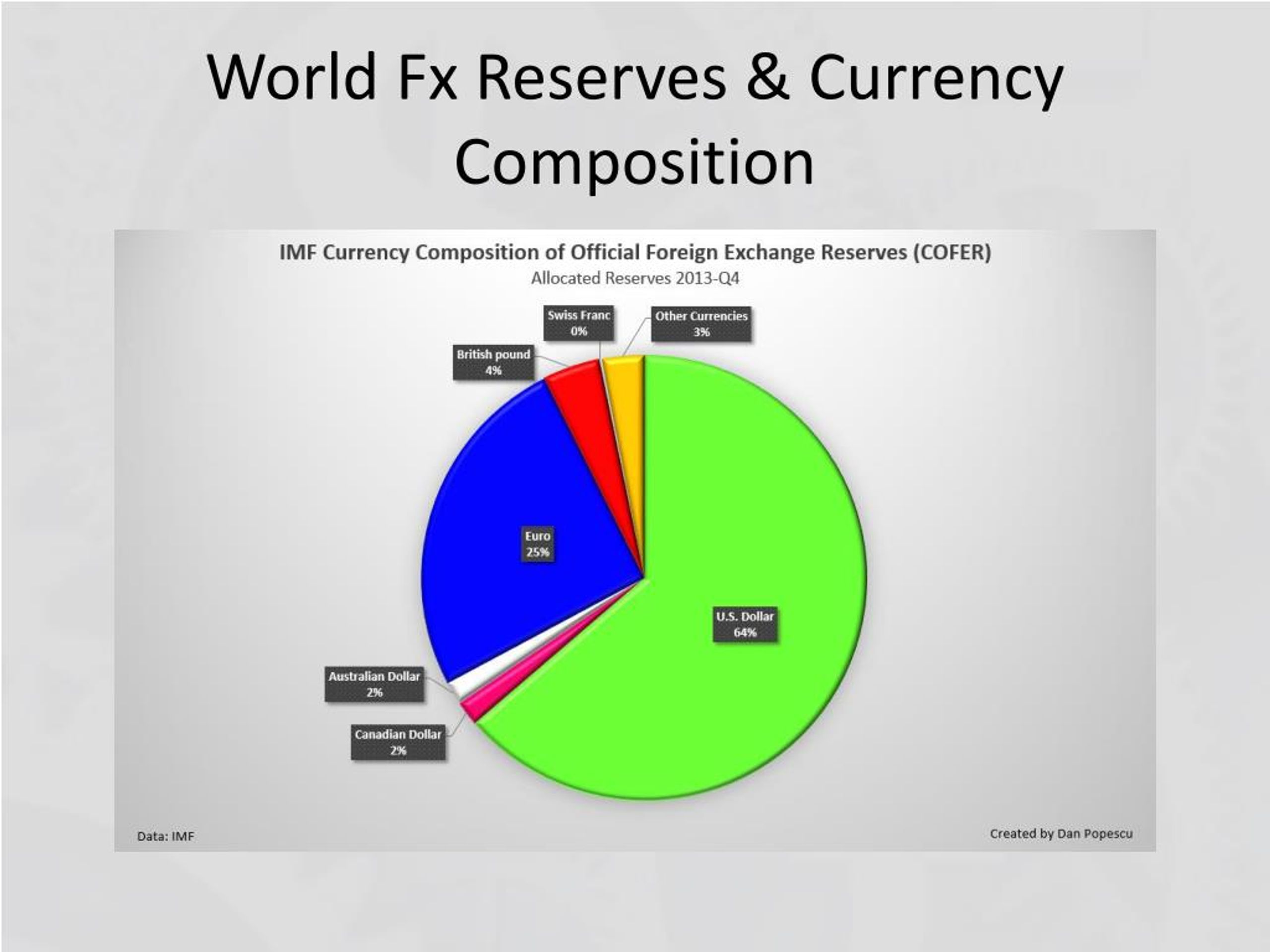

Image: www.slideserve.com

Currency Composition Of World Forex Reserves

Conclusion

The world’s central banks are embracing a multi-currency approach to foreign exchange reserves, seeking to reduce risks, boost returns, and enhance financial autonomy. As the currency composition of reserves continues to evolve, we can expect to see a more balanced and diversified global financial system. Are you interested in learning more about the topic of forex reserves and the implications for the global economy?