Corporations, governments, and individuals rely heavily on sound financial treasury and forex management to navigate the complex financial landscape. From managing risk to optimizing cash flow, these practices form the backbone of financial stability and growth.

Image: ulurn.in

Unlocking the Benefits of CS Financial Treasury and Forex Management

Effective financial treasury management empowers organizations to gain control over their financial resources, make informed decisions, and enhance profitability. It involves optimizing cash flow, managing liquidity, and minimizing financial risks. Forex management, on the other hand, focuses on managing foreign exchange risks and capitalizing on currency fluctuations.

CS financial treasury and forex management practices empower businesses and institutions to:

- Reduce financial risk: Proactively identify and mitigate financial threats to safeguard assets and ensure financial stability.

- Optimize cash flow: Efficiently manage cash inflows and outflows to ensure adequate liquidity, reduce borrowing costs, and maximize investment opportunities.

- Minimize costs: Identify cost-saving measures, negotiate favorable terms with banks and other financial institutions, and minimize transaction fees.

- Maximize returns: Capitalize on investment opportunities, manage currency risks, and enhance returns on financial assets.

- Achieve financial stability: Develop a solid financial foundation, ensuring the long-term financial health and sustainability of the organization.

Understanding the Core Concepts

CS financial treasury management encompasses a wide range of activities, including:

- Cash management: Optimizing cash flow, managing liquidity, and ensuring access to funds when needed.

- Risk management: Identifying, assessing, and mitigating financial risks, such as credit risk, market risk, and liquidity risk.

- Financial forecasting and planning: Developing financial plans, budgets, and forecasts to guide financial decision-making.

- Investment management: Allocating funds to maximize returns while managing risk.

Forex management involves:

- Currency risk management: Mitigating the risks associated with currency fluctuations.

- Foreign exchange trading: Facilitating currency exchanges at competitive rates.

- Hedging: Using financial instruments to reduce exposure to foreign exchange risks.

- Speculation: Capitalizing on currency fluctuations for profit.

Image: www.yumpu.com

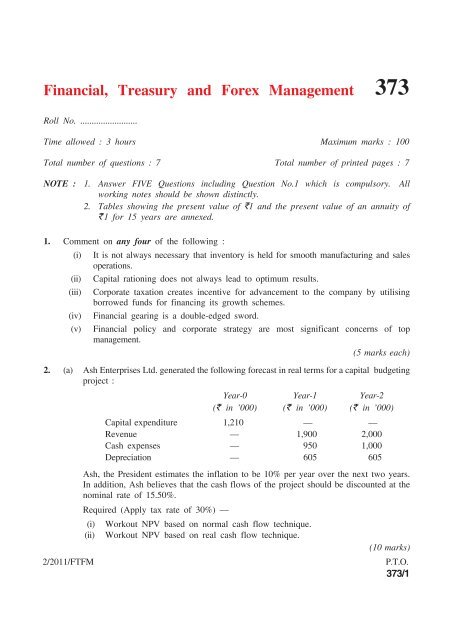

Cs Financial Treasury And Forex Management

Navigating the Global Financial Landscape

In today’s interconnected global economy, managing financial treasury and foreign exchange risks has become more critical than ever. Cross-border transactions, currency fluctuations, and international business ventures pose challenges that cannot be ignored. CS financial treasury and forex management strategies equip organizations with the tools and knowledge they need to navigate these challenges and thrive in the global financial arena.

By embracing best practices, organizations can optimize their financial operations, reduce risks, capitalize on opportunities, and achieve sustained financial success.