In the realm of international finance, the consequences of failing to realize or repatriate foreign exchange (forex) proceeds can be dire and far-reaching. Forex proceeds refer to earnings generated from exports, investments, or other cross-border transactions that are denominated in a currency other than the domestic currency.

Image: titanfx.com

Realizing forex proceeds involves converting them into the domestic currency at an authorized dealer or designated bank. Repatriation, on the other hand, refers to the process of transferring these proceeds back to the home country. Both actions are subject to strict regulations and timelines, and failure to comply can result in severe penalties.

Economic Implications

Unrepatriated forex proceeds can have significant macroeconomic consequences. By depriving the domestic economy of much-needed foreign currency, this failure can lead to:

- Depreciation of the local currency, making imports more expensive

- Reduced foreign direct investment (FDI), as investors become wary of potential difficulties in repatriating profits

- Foreign exchange shortages, making it difficult for businesses to engage in international trade

- Weakened balance of payments position, affecting a country’s creditworthiness

Legal and Financial Penalties

In many countries, failing to realize or repatriate forex proceeds is a violation of the law. Companies and individuals found guilty of this offense may face:

- Hefty fines

- Imprisonment

- Seizure of assets

Moreover, banks may refuse to provide credit or financing to individuals or businesses with a history of non-compliance. This can severely impact their ability to operate effectively.

Damaged Reputation

Failure to comply with forex regulations can tarnish a company’s reputation and damage the trust of stakeholders. This can result in:

- Loss of clients and partners

- Difficulty obtaining business loans and other financial assistance

- Exclusion from international trade networks

Image: www.coganpower.com

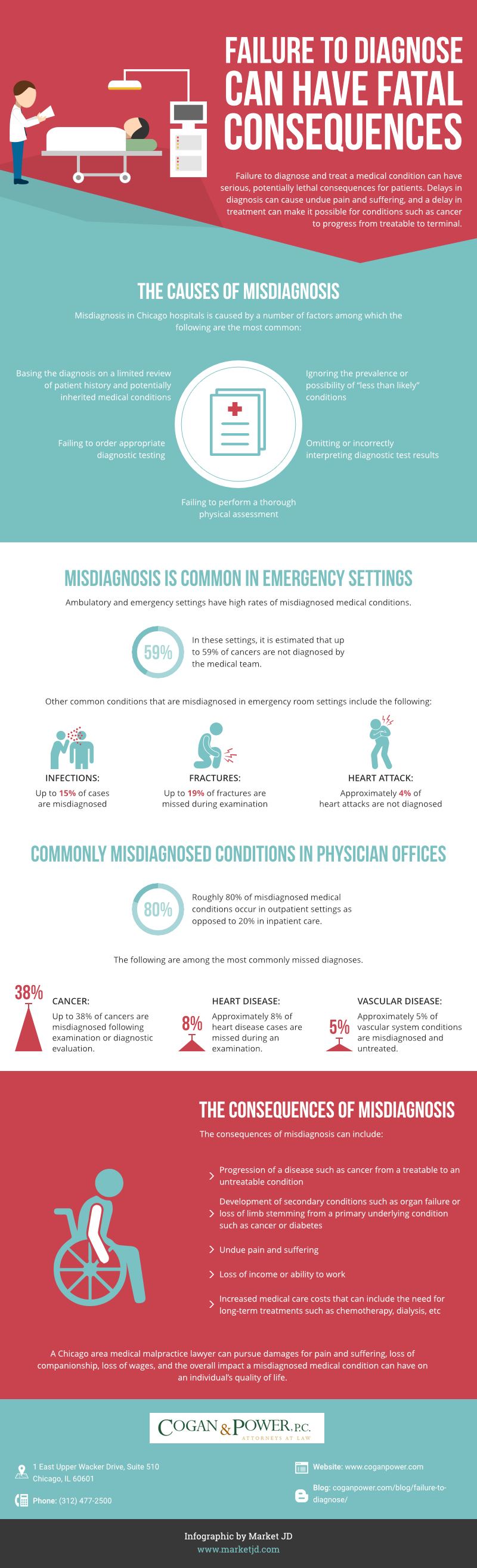

Consequences Of Failure In Realising Or Repatriating Forex Proceeds

How to Avoid the Consequences

To avoid the severe consequences associated with failing to realize or repatriate forex proceeds, it is crucial to adhere to the following guidelines:

- Understand and comply with all applicable laws and regulations

- Keep accurate records of all forex transactions

- Work with authorized dealers or designated banks for converting and repatriating forex proceeds

- Seek professional advice from legal, financial, or accounting experts as needed

Realizing and repatriating forex proceeds responsibly is not only a legal obligation but also a sound financial practice. By adhering to these guidelines, businesses and individuals can safeguard their economic interests and protect their reputation.

Remember, the consequences of non-compliance can be severe. Failure to act responsibly in realizing and repatriating forex proceeds can lead to financial losses, legal problems, and reputational damage. By staying informed and complying with the regulations, you can ensure the smooth operation of your business and protect your financial wellbeing.