Managing foreign exchange reserves is crucial for any nation. These reserves serve as a financial safety net, ensuring a steady flow of international payments and providing a vital cushion during economic uncertainties. India’s forex reserves have been steadily accumulating, strengthening its resilience and stability in the global market.

Image: gogoheh.web.fc2.com

To delve into this topic, we’ll dissect the composition of India’s forex reserves, shedding light on their significance and implications. Let’s dive in!

Exploring the Components: Breaking Down India’s Forex Reserve Puzzle

India’s forex reserves are a diverse portfolio consisting of a range of assets, each playing a specific role in the country’s financial preparedness. Understanding these components is essential for appreciating their collective impact.

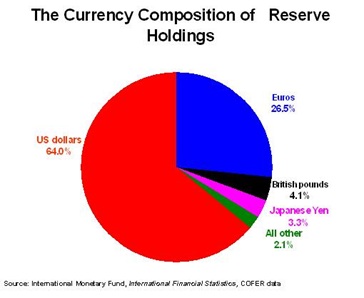

- US Dollars: The reserve currency of the world, US dollars account for the majority of India’s forex stash.

- Gold: Often considered a safe haven asset, gold acts as a stable store of value, hedging against currency fluctuations.

- Special Drawing Rights (SDRs): An international reserve asset created by the IMF, SDRs are akin to a weighted basket of several world currencies.

- Euros: The currency of the European Union, euros diversify India’s reserve base, mitigating single-currency risks.

- GBP Sterling: The currency of the United Kingdom, GBP Sterling offers another layer of diversification, reducing exposure to currency volatility.

- Government Securities: Indian government securities, such as treasury bills and bonds, diversify the reserve portfolio while offering returns on investments.

- Loans to International Monetary Fund: India’s lending to the IMF provides a buffer against global financial crises.

Evolution of Forex Reserves: A Historical Journey

India’s forex reserves have seen a remarkable transformation over the years, mirroring the country’s economic growth and global integration.

- Pre-1991: Limited reserves due to import-substitution policies and a fixed exchange rate regime.

- 1991-2007: Post-liberalization era witnessed a sharp surge in reserves fueled by foreign direct investment, remittances, and IT exports.

- 2008-Present: Reserve accumulation continued, albeit at a slower pace, amid global economic uncertainties and rising imports.

Benefits and Significance: Understanding the Impact

Maintaining a robust forex reserve portfolio offers numerous advantages:

- Import Cover: Reserves ensure sufficient foreign exchange to pay for essential imports, stabilizing the economy during external shocks.

- Currency Stability: Ample reserves cushion against sudden currency depreciations, protecting the domestic economy from global turbulence.

- Economic Cushion: Forex reserves provide a buffer during economic downturns, enabling the government to finance deficits and maintain essential services.

- International Credibility: Substantial reserves enhance India’s credibility in international markets, boosting investor confidence and facilitating foreign trade.

- Contingency Fund: Reserves serve as a contingency fund for unforeseen crises, ensuring financial preparedness for geopolitical events or natural calamities.

Image: allaboutforexs.blogspot.com

Tips and Expert Advice: Managing a Healthy Forex Reserve Portfolio

Maintaining a healthy forex reserve balance requires strategic management and expert guidance:

- Diversify the Portfolio: Spread investments across different assets to mitigate risks associated with currency fluctuations and market volatility.

- Monitor Global Economic Conditions: Continuously monitor geopolitics, global economic trends, and interest rate changes to anticipate potential impacts on reserves.

- Cooperate with International Organizations: Engage with the IMF and World Bank to leverage international support during financial crises.

- Promote Foreign Exchange Stability: Implement measures to attract foreign direct investment, encourage exports, and reduce non-essential imports.

- Build a Strong Domestic Economy: Focus on domestic economic growth, fiscal discipline, and export competitiveness to reduce reliance on external borrowing.

FAQs: Your Questions Answered

- What is the optimal level of forex reserves? There is no fixed benchmark; it depends on a country’s specific economic conditions and external vulnerabilities.

- How are forex reserves managed by central banks? Central banks employ various tools, including market interventions, asset allocation, and monetary policy, to maintain desired reserve levels.

- Why do countries accumulate forex reserves? To protect against global economic shocks, stabilize currencies, and enhance international credibility.

- How do forex reserves impact monetary policy? High forex reserves provide central banks with flexibility in setting interest rates and managing inflation.

- What are the challenges in managing forex reserves? Global economic uncertainties, currency fluctuations, and geopolitical risks can pose challenges for reserve managers.

Composition Of Indias Forex Reserves

Conclusion: Call to Action

Understanding the composition, significance, and management strategies of India’s forex reserves is crucial for comprehending India’s economic stability and global standing. Embracing the insights provided in this article will empower you to make informed decisions and