Overview: Unlocking the Power of Weekly Price Action

Expert Forex traders swear by the Complete Forex Weekly Range indicator as a power tool for identifying significant price levels and making informed trading decisions. Let’s dive into the world of weekly ranges and learn how this indicator can transform your trading journey!

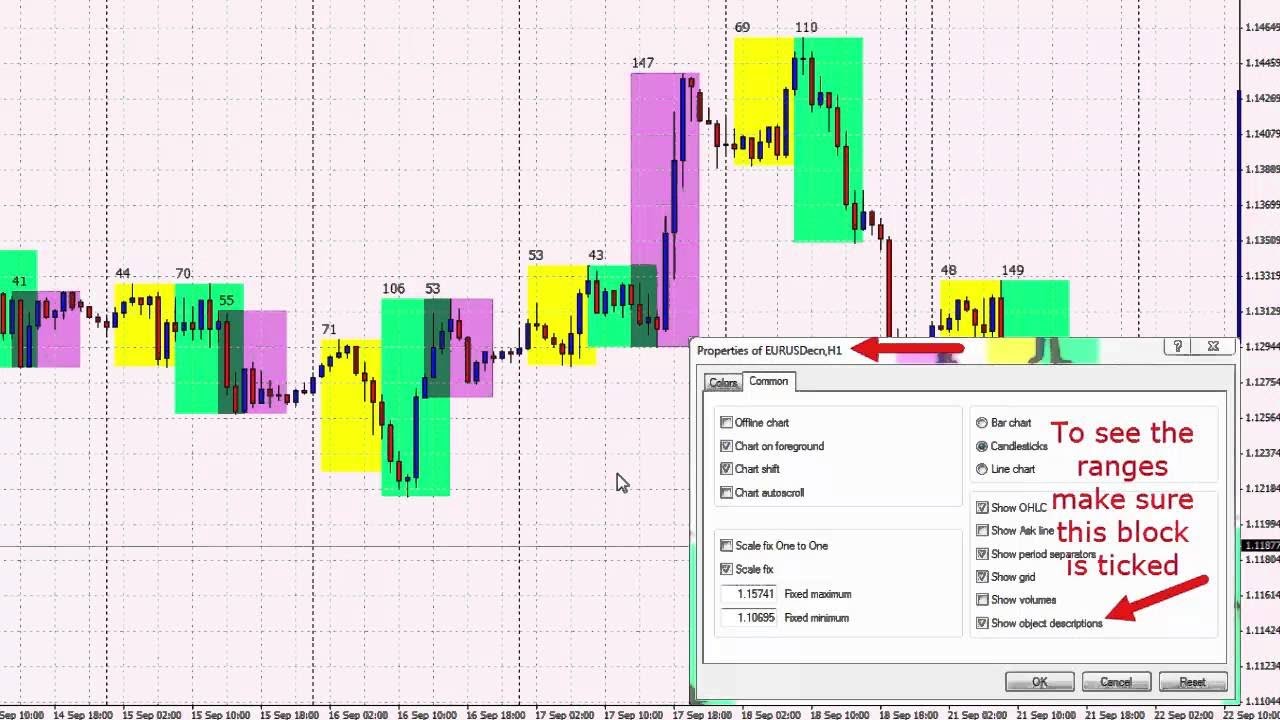

Image: www.youtube.com

Understanding the Weekly Range

The weekly range represents the highest and lowest price points reached during a one-week period. It provides traders with a comprehensive view of price action over an extended timeframe, revealing key support and resistance levels that can shape price direction.

Identifying Key Support and Resistance

The Complete Forex Weekly Range indicator visually displays the weekly range as a horizontal bar. The upper and lower boundaries of this bar serve as crucial support and resistance levels. Breakouts above the resistance or below the support level signal potential trend reversals or continuations.

Determining Market Direction

Traders can use the weekly range to assess the overall market sentiment. A narrow range indicates consolidation or indecision, while a wide range signifies heightened volatility and potential for breakout trades. Ascending weekly ranges suggest bullish momentum, whereas descending ranges indicate bearish pressure.

Image: indicatorchart.com

Fine-tuning Entries and Exits

The Complete Forex Weekly Range indicator can fine-tune entry and exit points within a broader trend. Price pullbacks towards the weekly support or resistance levels offer opportunities for low-risk entries. Traders can also set stop-loss orders outside the weekly range for protection against adverse price movements.

Tips and Expert Advice

- Incorporate the weekly range indicator with other technical tools, such as moving averages and momentum indicators, for a more comprehensive analysis.

- Consider the context of the broader market and economic indicators to validate trading signals derived from the weekly range.

- Respect the weekly support and resistance levels, as they often mark reliable price boundaries. If prices breach these levels, anticipate a potential change in market sentiment.

FAQ

Q: When is the best time to trade the weekly range?

A: Weekly ranges are most relevant during trending markets. They provide strong support and resistance levels to trade with or against the trend.

Q: How can I spot false breakouts?

A: Check if the price action has volume support. If the price moves outside the weekly range but lacks momentum or volume, it may be a false breakout.

Q: Can I use the weekly range on all time frames?

A: No, the weekly range is specifically designed for the weekly time frame. Modifying it for other time frames may compromise its significance.

Complete Forex Weekly Range Indicator

Conclusion

Embrace the power of the Complete Forex Weekly Range indicator and gain a competitive edge in your trading. By understanding weekly price action, identifying key support and resistance levels, and timing entries and exits effectively, you’ll be well-equipped to navigate volatile Forex markets with increased confidence and success.

Would you like to explore further insights on the Complete Forex Weekly Range indicator or other aspects of Forex trading? Reach out to us for expert guidance and join a community of traders who are passionate about mastering the art of market analysis and trade execution.