Introduction

The foreign exchange market, or Forex, is a vast global marketplace where currencies are traded. Understanding the market’s range fluctuations is crucial for any trader seeking success. This article delves into the complete forex market range, exploring daily, weekly, and monthly ranges and empowering traders with insights to optimize their strategies.

Image: www.hsb.co.id

The forex market is characterized by remarkable liquidity, trading 24 hours a day, five days a week. However, market behavior exhibits distinct patterns and ranges, each with its unique implications for traders. Grasping these ranges enables traders to identify opportunities, manage risk, and maximize their potential returns.

Daily Range: The Short-Term Market Pulse

The daily range represents the price fluctuation of a currency pair over a single trading day, from market open to close. This range reflects the immediate sentiment and order flow, providing insights into short-term market dynamics. Day traders, who typically open and close positions within a single trading day, closely monitor daily ranges to identify trading opportunities.

Weekly Range: Unveiling Market Trends

The weekly range encompasses price movements over a seven-day period, offering a broader perspective than the daily range. Weekly ranges reveal underlying trends and shifts in market sentiment. Swing traders, who hold positions for several days or weeks, analyze weekly ranges to identify potential trading setups aligned with emerging trends.

Monthly Range: Shaping the Market Landscape

The monthly range captures price movements over a 30-day period, revealing the most significant trends and shifts in market dynamics. Monthly ranges provide insights into overall market direction, enabling long-term investors and position traders to make informed investment decisions. By identifying key support and resistance levels within the monthly range, traders can develop strategies that align with broader market movements.

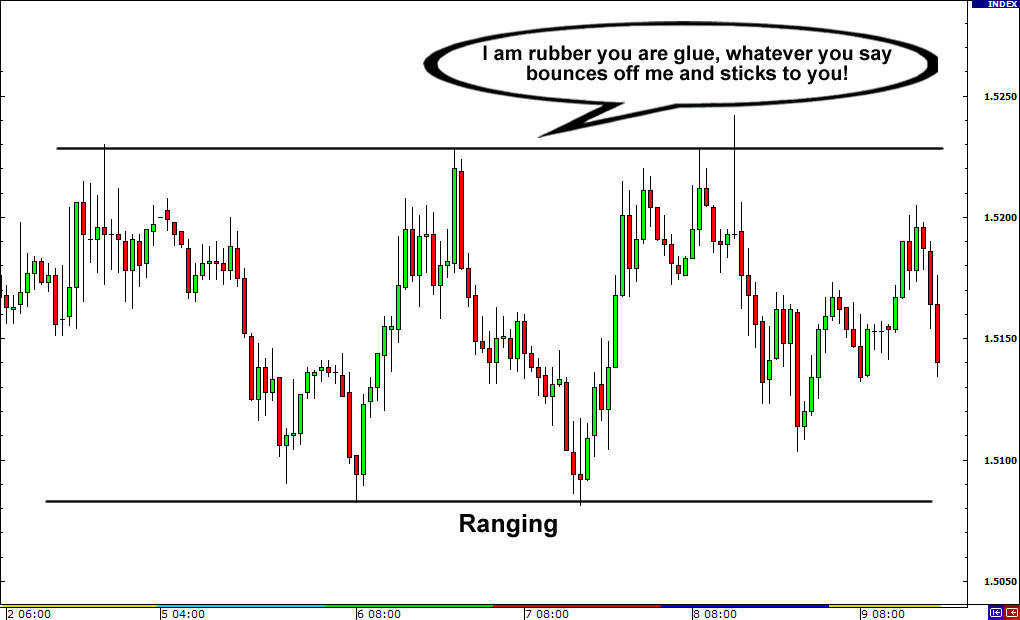

Image: jwfx.blogspot.com

Navigating the Market’s Rhythmic Fluctuations

Understanding the interplay between daily, weekly, and monthly ranges equips traders with a comprehensive market perspective. While daily ranges provide insights into immediate market sentiment, weekly ranges unveil emerging trends, and monthly ranges shape the overall market landscape, analyzing all three ranges holistically is essential for successful trading.

Exploiting Trading Opportunities

Traders can leverage range analysis to identify potential trading setups and maximize their profit potential. By combining range information with technical analysis and fundamental factors, traders can develop trading strategies tailored to different time frames. This multifaceted approach enhances risk management, helps traders stay in sync with market trends, and increases the probability of successful trades.

Complete Forex Market Range Mothnly Range Weekly Range Dialy Range

Conclusion

The forex market’s complete range, encompassing daily, weekly, and monthly fluctuations, offers invaluable insights into market dynamics and trading opportunities. By mastering the art of range analysis, traders can gain a competitive edge, make informed decisions, and navigate the ever-evolving forex landscape with confidence. Embracing the rhythmic dance of the market’s ranges empowers traders to unlock the full potential of the global currency markets.