Have you ever ventured into the exciting world of Forex trading, only to be met with its complexities and intricacies? If so, you’re not alone. But don’t despair! With a deep understanding of fundamental analysis, you can navigate the Forex market with confidence and potentially reap its rewards.

Image: www.tradingpedia.com

This comprehensive course will provide you with the necessary knowledge and skills to master fundamental analysis, empowering you to make informed trading decisions based on a sound understanding of the factors that drive currency values.

Economic Indicators: The Building Blocks of Fundamental Analysis

At the heart of fundamental analysis lies the study of economic indicators. These indicators provide insights into a country’s economic health and performance, which directly influence its currency value. Key economic indicators include:

- Gross Domestic Product (GDP)

- Inflation

- Interest rates

- Employment figures

- Balance of payments

By analyzing these indicators, traders can gauge the strength and direction of an economy and make informed decisions about which currencies to trade.

Political Events and Market Sentiment

Apart from economic indicators, political events and market sentiment also play a significant role in fundamental analysis. Political stability, government policies, and geopolitical tensions can greatly impact currency values. For instance, a change in government or a major political event can lead to shifts in investor confidence and, consequently, currency fluctuations.

Market Sentiment: A Powerful Force

Market sentiment refers to the prevailing attitude of investors towards a particular currency or market. Sentiment can be measured using tools like surveys, sentiment indicators, and social media analysis. By gauging market sentiment, traders can identify potential trading opportunities and make informed decisions based on prevailing market conditions.

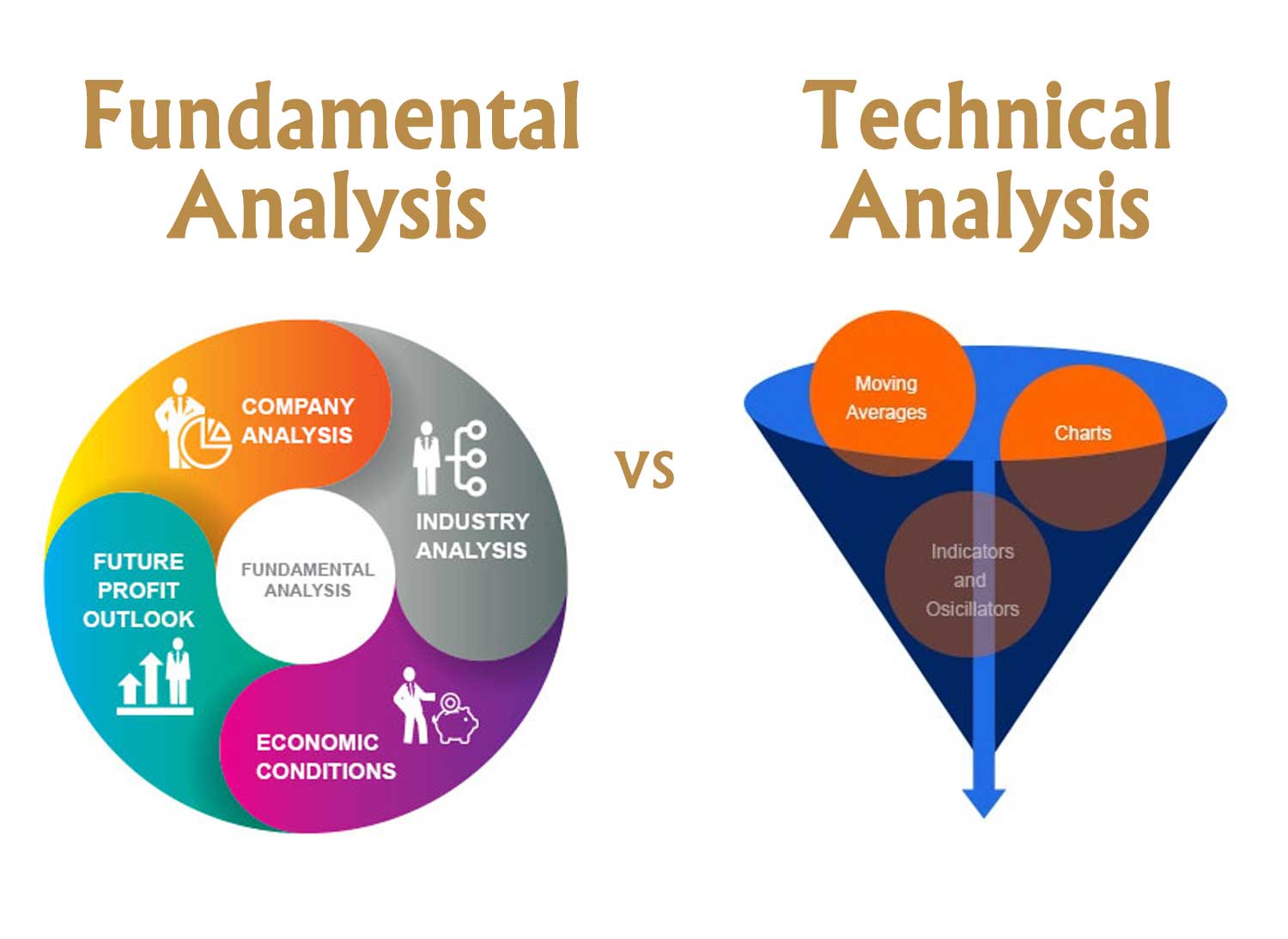

Image: stockphoenix.com

Latest Trends and Developments in Forex Fundamental Analysis

The Forex market is constantly evolving, and so is the field of fundamental analysis. To stay ahead of the curve, it’s essential to keep abreast of the latest trends and developments. One emerging trend is the increasing use of machine learning and artificial intelligence (AI) to enhance the efficiency and accuracy of fundamental analysis.

By utilizing advanced algorithms and data mining techniques, AI can identify patterns and relationships that human analysts might miss. This enables traders to make more informed decisions and potentially outperform the market.

Tips and Expert Advice for Mastering Forex Fundamental Analysis

Mastering Forex fundamental analysis is not a walk in the park, but with dedication and the right guidance, you can achieve it. Here are some tips from seasoned experts:

- Stay informed: Keep an eye on economic news, political events, and market sentiment through reliable sources.

- Use a variety of indicators: Don’t rely solely on a single indicator. A combination of different indicators provides a more comprehensive view.

- Compare and contrast currencies: Identify similarities and differences between currency pairs to make more informed decisions.

By following these tips, you can elevate your Forex fundamental analysis skills and gain an edge in the ever-changing currency market.

FAQs on Forex Fundamental Analysis

Q: What are the benefits of fundamental analysis?

A: Fundamental analysis provides a deep understanding of the underlying forces that drive currency values, enabling traders to make informed decisions and potentially increase their profits.

Q: How much time does it take to master fundamental analysis?

A: Mastering fundamental analysis requires consistent effort and dedication. The time it takes varies depending on your learning style and the resources available to you.

Q: Can I learn fundamental analysis on my own?

A: While self-learning is possible, it’s recommended to seek guidance from experienced traders or enroll in courses to ensure a comprehensive understanding of the subject matter.

Complete Forex Fundamental Analysis Course

Conclusion

Forex fundamental analysis is an indispensable tool for anyone serious about succeeding in the currency market. By understanding the economic, political, and sentimental factors that influence currency values, you can make informed trading decisions and potentially maximize your returns.

Embark on this comprehensive fundamental analysis course today and unlock the secrets to becoming a savvy Forex trader. The journey may not be easy, but with unwavering determination and the right knowledge, you can master this art and achieve financial success in the Forex market.

Are you ready to dive into the world of Forex fundamental analysis and conquer the currency market? Let the journey begin!