Introduction

Image: www.pdfprof.com

For the intrepid explorer navigating the tumultuous seas of forex trading, leveraging is an indispensable tool that can amplify both your profits and losses. It’s akin to a double-edged sword, a force that can both propel you to financial success or cast you into the depths of despair. In this article, we embark on an enthralling journey to unveil the commonly used leverage sizes in forex, unraveling their nuances and empowering you with the knowledge to harness their potency with precision.

Understanding Leverage

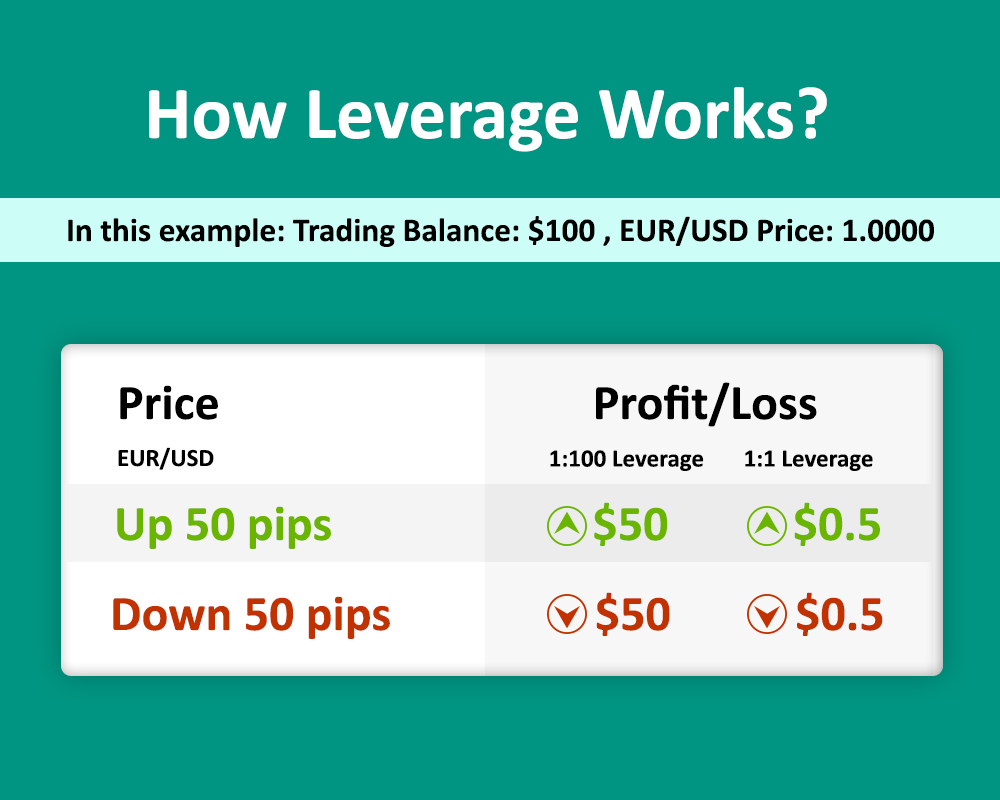

Leverage is a financial mechanism that allows traders to control a larger position size than their account balance would ordinarily permit. It magnifies your potential returns but simultaneously amplifies your potential losses. This is because any profit or loss is calculated on the entire position size, not just the amount invested.

Commonly Used Leverage Sizes

In the realm of forex trading, the most prevalent leverage sizes range from 10:1 to 1000:1.

-

10:1 leverage: With this relatively conservative leverage, for every $1,000 in your account, you can control a position worth $10,000.

-

50:1 leverage: This intermediate leverage allows you to control a $50,000 position with a $1,000 account balance.

-

100:1 leverage: This more aggressive leverage grants you the ability to control a $100,000 position with a mere $1,000 investment.

-

500:1 leverage: Reserved for experienced traders with a high tolerance for risk, this extreme leverage enables you to control a whopping $500,000 position with a $1,000 account.

-

1000:1 leverage: This stratospheric leverage, while rare, allows you to control a staggering $1,000,000 position with a $1,000 investment.

Choosing the Right Leverage

The optimal leverage size depends on several factors, including your risk appetite, trading strategy, and account balance. It is imperative to meticulously consider your individual circumstances before selecting a leverage ratio.

-

Risk Tolerance: If you’re risk-averse, opt for a lower leverage size to minimize potential losses.

-

Trading Strategy: Scalpers and day traders typically employ higher leverage to maximize short-term profits.

-

Account Balance: The higher your account balance, the more conservative you can afford to be with leverage.

Expert Insights

Renowned forex trader George Soros aptly encapsulates the essence of leverage in trading: “Leverage, properly used, is not speculation but rather investment enhanced.” However, he also cautions, “Too much leverage can turn a sound investment into speculation.”

Another industry veteran, Peter Brandt, emphasizes the criticality of disciplined risk management in leveraged trading: “The key to success in leveraged trading is not the amount of leverage you use, but how you manage your risk.”

Conclusion

The judicious use of leverage can elevate your forex trading endeavors. It’s a potent tool that can magnify your profits, but it’s also a double-edged sword that can inflict significant losses if not handled with prudence. By comprehending the different leverage sizes available and tailoring your choice to your specific needs, you can unlock the full potential of this financial instrument while mitigating associated risks. May the winds of fortune guide your trading voyage!

Image: fcsapi.com

Commonly Used Leverage Size In Forex