Unlocking the Enigmatic Code: Metals in Forex Trading Revealed

Image: www.slideshare.net

In the tumultuous world of forex trading, deciphering the ever-changing market dynamics is akin to navigating a labyrinth. Among the myriad of variables that traders must master, the enigmatic code that governs metals trading holds a magnetic allure, promising both opportunities and pitfalls. Fear not, aspiring traders, for this comprehensive guide will unravel the secrets of metals in forex, paving the way for informed and profitable decisions.

Unveiling the Luster of Metals in Forex Trading

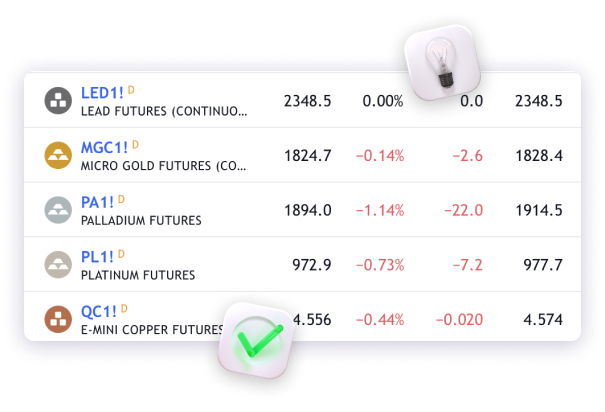

Metals, with their inherent value and volatility, have long captivated traders seeking to harness their market potential. Gold, silver, palladium, and platinum reign supreme, their fluctuations offering a rich tapestry of trading opportunities. The allure of metals lies in their unique characteristics: intrinsic value, stability during market turmoil, and reliable demand as safe-haven assets.

Decoding the Metal Code

To conquer the metals market, it is imperative to decipher the code that drives their movements. Seasoned traders rely on a combination of technical analysis, fundamental analysis, and sentiment analysis to gauge market sentiment and predict price direction. Technical analysis examines historical price charts, identifying patterns and trends that may provide clues to future market behavior. Fundamental analysis delves into real-world factors, such as economic data, political instability, and supply and demand dynamics, that influence metal prices. Sentiment analysis taps into market psychology, measuring the collective sentiment of traders to anticipate market shifts.

Charting the Course: Technical Analysis of Metals

Technical analysts meticulously study price charts, employing a vast array of indicators and tools to uncover trading opportunities. Moving averages, Bollinger Bands, and Fibonacci retracements help identify trends, support and resistance levels, and potential reversal points. By recognizing these patterns, traders can make educated guesses about future price movements and capitalize on market fluctuations.

Navigating the Depths: Fundamental Analysis of Metals

Fundamental analysts immerse themselves in economic reports, political news, and industry developments to decipher the underlying forces that shape metal prices. Economic growth, interest rates, geopolitical events, and supply chain disruptions can all profoundly impact metal markets. By comprehending these fundamental factors, traders can anticipate market shifts and make informed decisions.

Unveiling Hidden Emotions: Sentiment Analysis in Metals Trading

Sentiment analysis, by measuring the collective attitudes and expectations of traders, provides valuable insights into market dynamics. Bullish or bearish sentiment, as revealed by market surveys, news headlines, and social media buzz, can influence price movements. Interpreting market sentiment enables traders to gauge the prevailing market mood and align their trading strategies accordingly.

Expert Insights: Guiding Your Trading Journey

Harnessing the knowledge of experienced traders can significantly enhance your forex trading endeavors. Seek out the wisdom of industry experts through webinars, articles, and trading forums. Their insights, born from years of experience, can illuminate market intricacies and guide your trading decisions towards greater profitability.

Unlocking Success: Essential Tips for Metals Trading

- Mastering the Art of Position Sizing: Determine the appropriate risk exposure for each trade, based on your trading capital and risk tolerance.

- Stop-Loss Discipline: Implement stop-loss orders to mitigate losses in an adverse market environment.

- Leverage Market Volatility: Exploit market fluctuations to maximize potential profits, while managing risk judiciously.

- Thwarting Emotional Trading: Sidestep impulsive trades born from fear or greed. Adhere to your pre-defined trading plan and avoid irrational decisions.

- Continuous Learning: The forex market is a constantly evolving beast. Dedicate yourself to ongoing education and refining your trading strategies.

Conclusion: Embracing the Power of Metals in Forex

By wielding the knowledge and insights shared in this article, you possess the keys to unlocking the enigmatic world of metals trading. Grasp the intricacies of technical, fundamental, and sentiment analysis. Seek guidance from industry veterans. Adhere to sound trading principles. Embark on this exhilarating journey with confidence, embracing the allure of precious metals in the ever-shifting forex market. Every trade, every triumph, and every setback is a valuable lesson in the pursuit of financial triumph in the realm of forex.

Image: www.forexland-fx.com

Code For Metals In Forex Trading