Navigating the Labyrinth of Currency Exchanges for Savvy Travelers and Businesses

Forex, the foreign exchange market, plays a pivotal role in international trade and finance. With India’s ever-evolving economy and burgeoning global connections, a growing number of businesses and individuals seek reliable and cost-effective forex services. Amidst the myriad of forex dealers, navigating the complexities of the market can be daunting. This comprehensive guide unravels the secrets to obtaining the cheapest forex rates in India, empowering you to make informed decisions and maximize your currency exchange value.

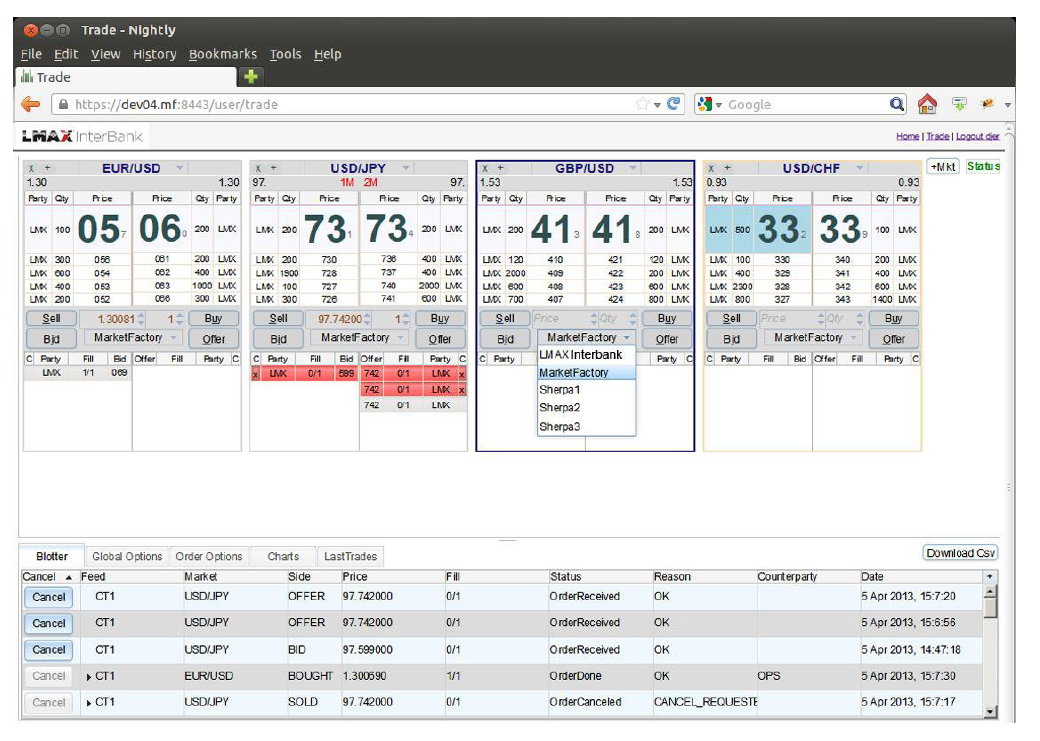

Image: camupay.web.fc2.com

Understanding Forex Rates and Factors that Influence Them

Forex rates, or exchange rates, determine the relative values of different currencies at any given time. These rates are constantly fluctuating due to a multitude of economic and geopolitical factors. Key determiners include interest rates, inflation, economic stability, political events, and supply and demand dynamics. By comprehending these factors, you can stay abreast of market movements and anticipate potential changes.

Interest Rates

Central banks set interest rates to influence borrowing and lending within an economy. Higher interest rates typically attract foreign investment, strengthening the currency’s value. Conversely, low interest rates can lead to currency depreciation.

Inflation

Inflation, a sustained increase in prices, erodes the purchasing power of a currency. High inflation rates tend to weaken a currency, while low inflation maintains or strengthens its value.

Image: sambadenglish.com

Economic Stability

Countries with strong economic growth, stable political systems, and low debt levels typically have higher-valued currencies. Conversely, economic turmoil or uncertainty can trigger currency depreciation.

Political Events

Geopolitical events, such as elections, referendums, or diplomatic tensions, can significantly impact currency values. Positive events often lead to currency appreciation, while adverse events can cause depreciation.

Supply and Demand

Forex rates are also influenced by supply and demand for different currencies. When the demand for a particular currency exceeds its supply, its value tends to rise. Conversely, when supply outstrips demand, the currency’s value may decrease.

Identifying the Cheapest Forex Rates: A Strategic Approach

Armed with an understanding of the factors that affect forex rates, individuals and businesses can proactively seek the most favorable exchange rates. Here are some proven strategies:

Compare Multiple Forex Dealers

Avoid settling for the first exchange rate you encounter. Diligently compare quotes from various forex dealers to ensure you’re getting the best deal. Utilize online comparison platforms or contact multiple providers directly.

Negotiate and Haggle

Don’t hesitate to negotiate with forex dealers, especially for large transactions. Politely request a better rate and be prepared to provide evidence of competitive quotes you’ve received from other providers.

Consider Online Forex Providers

Online forex brokers and platforms often offer more competitive rates than traditional banks or exchange counters due to lower overheads and operational costs. Research reputable online providers and compare their rates before committing.

Look for Hidden Fees and Charges

Beware of hidden fees or charges in addition to the quoted exchange rate. Read the terms and conditions carefully and inquire about any additional costs, such as transaction fees, spreads, or commission charges.

Monitor Market Trends

Stay informed about global economic news and currency market trends. By tracking exchange rate fluctuations, you can anticipate favorable exchange rate scenarios and time your transactions accordingly.

Secure Your Foreign Exchange Transactions: Choosing a Reputable Provider

Once you’ve identified the cheapest forex rates, it’s equally important to choose a reliable and reputable provider. Here are key considerations:

Regulation and Licensing

Ensure the forex dealer is appropriately regulated and licensed by a recognized financial authority, such as the Reserve Bank of India (RBI) or other competent authorities. This guarantees adherence to industry best practices and protects your interests.

Reputation and Track Record

Research the provider’s reputation in the market. Read online reviews, consult industry experts, and gauge client testimonials to assess their reliability and track record of providing favorable exchange rates.

Customer Support

Choose a forex provider with responsive and knowledgeable customer support to address your queries and concerns promptly and efficiently. Availability of multiple support channels, including phone, email, and live chat, is a valuable asset.

Security Measures

Verify that the provider employs robust security measures, such as SSL encryption and anti-fraud protocols, to safeguard your sensitive financial information and transactions.

Transparency and Clarity

Transparency is paramount in forex dealings. Choose providers who clearly disclose their exchange rates, fees, and trading conditions, leaving no room for hidden costs or surprises.

Cheapest Forex Rates In India

Conclusion

Navigating the complexities of forex exchange can be empowering and lucrative with the right knowledge and strategy. By understanding the factors that influence forex rates, comparing quotes from multiple dealers, and selecting a reputable provider, you can secure the cheapest forex rates in India and maximize the value of your currency exchange transactions. Whether you’re an avid traveler, a business owner, or an individual managing global finances, stay informed, negotiate wisely, and seize the most favorable opportunities in the dynamic world of forex.