Navigating the tumultuous waters of financial markets requires a keen eye and a deep understanding of trading techniques. Chart pattern technical analysis empowers traders with the knowledge to decipher market trends, identify potential opportunities, and make informed trading decisions.

Image: www.forex.academy

Chart patterns, as the name suggests, are recurring formations in price movements that often indicate future price behavior. Identifying and interpreting these patterns is a skill honed through practice and a solid grasp of technical analysis fundamentals. In this guide, we’ll delve into the world of chart patterns, exploring their types, significance, and practical applications in forex and stock trading.

Unveiling the Secrets of Chart Patterns

1. Definition and Significance

A chart pattern is a recurring formation in a price chart that can hint at potential future price movements. These patterns are believed to reflect the collective psychology and behavior of market participants. By recognizing and analyzing chart patterns, traders aim to gain insights into market sentiment and predict future price trends.

2. Types of Chart Patterns

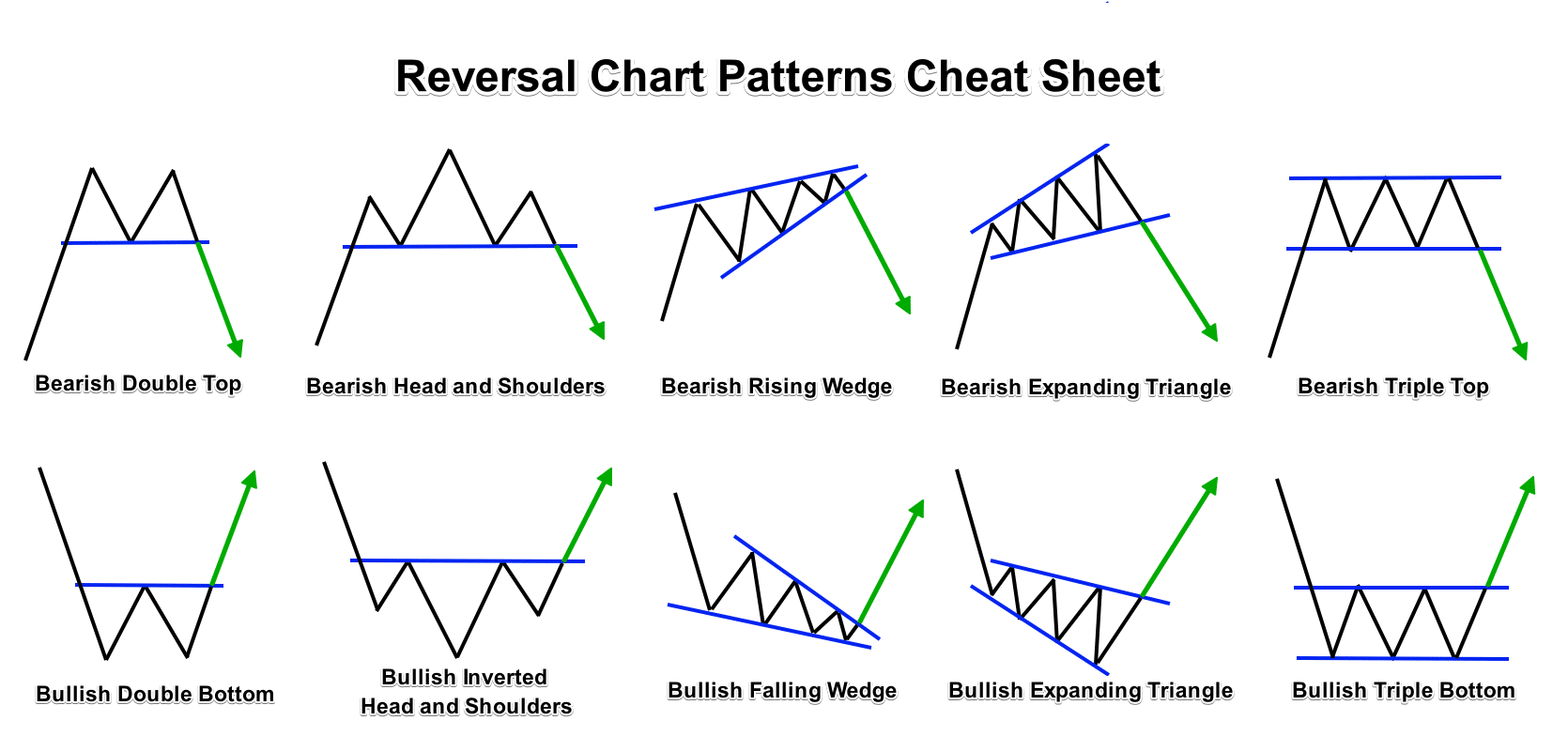

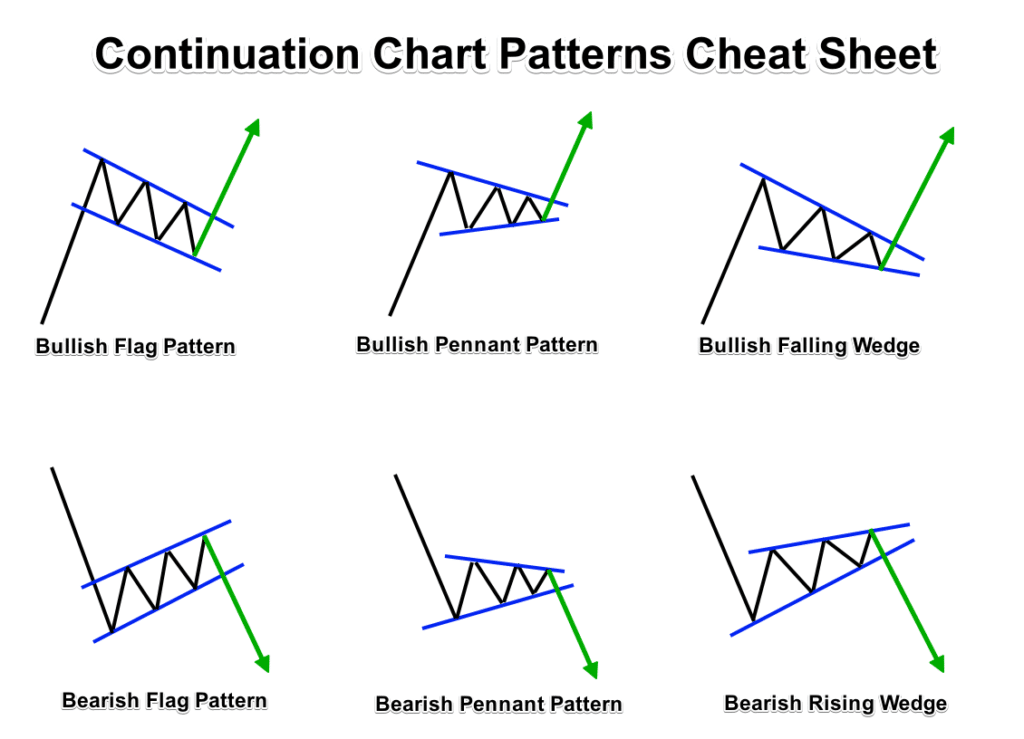

Chart patterns are broadly classified into two main categories:

Each type of chart pattern has its own unique characteristics and implications, which traders must understand to make effective trading decisions.

Image: entryhub.blogspot.com

3. Practical Applications in Forex and Stock Trading

Chart pattern technical analysis plays a pivotal role in both forex and stock trading:

While chart pattern analysis is a valuable tool, it’s crucial to remember that it’s not a foolproof method. Market conditions can change rapidly, and other factors may influence price movements, making it essential to combine chart pattern analysis with other trading techniques for a comprehensive approach.

Tips and Expert Advice for Effective Chart Pattern Analysis

1.Study Price Action: Focus on the price action itself, rather than solely relying on technical indicators. Identify key levels of support and resistance, as well as candlestick patterns and volume indicators, to gain a holistic view of market sentiment.

2.Consider Context: Analyze chart patterns in the context of the overall market trend, economic factors, and news events. This broader perspective can provide valuable insights and help avoid false signals.

3.Combine Multiple Patterns: Combining different types of chart patterns can increase the reliability of trading signals. For instance, a double top pattern followed by a head and shoulders pattern can provide a stronger indication of a potential trend reversal.

4.Use Stop-Loss Orders: Always employ stop-loss orders to manage your risk and protect your profits. Place stop-loss orders below support levels in uptrends and above resistance levels in downtrends.

Frequently Asked Questions (FAQs)

- Q: Is chart pattern technical analysis reliable?

A: Chart pattern analysis can be a valuable tool, but it’s not a foolproof method. Traders should combine chart pattern analysis with other trading techniques for a more comprehensive approach. - Q: Which chart pattern is the most profitable?

A: There is no single most profitable chart pattern. Different patterns perform well in different market conditions. Traders should learn to identify and interpret a variety of patterns to increase their success rate. - Q: How long does it take to become proficient in chart pattern analysis?

A: Proficiency in chart pattern analysis requires practice and dedication. Consistent study, analysis, and practical application can help traders develop their skills over time.

Chart Pattern Technical Analysis For Forex & Stock Trading Udemy

Conclusion

Chart pattern technical analysis is a powerful tool that can enhance your trading skills and increase your chances of success in forex and stock markets. By understanding the different types of chart patterns, their significance, and how to interpret them effectively, you can make informed trading decisions and navigate the financial landscape with greater confidence.

Remember, success in trading requires a comprehensive approach that combines technical analysis with a deep understanding of market dynamics and risk management. Embrace the journey of learning and apply these principles to your trading strategies. Are you ready to embark on this exciting path of trading mastery?