Introduction: Navigating the Maze of Forex Card Fees

Embarking on international adventures has become increasingly accessible with the convenience of forex cards. These cards, offered by renowned banks like SBI, seamlessly convert your home currency into foreign currencies, ensuring hassle-free global transactions. However, concealed within the allure of effortless currency conversions lurks a labyrinth of charges that might drain your travel budget if left unchecked. This comprehensive guide will delve into the charges associated with SBI forex cards, empowering you to make informed financial decisions and maximize your travel experience.

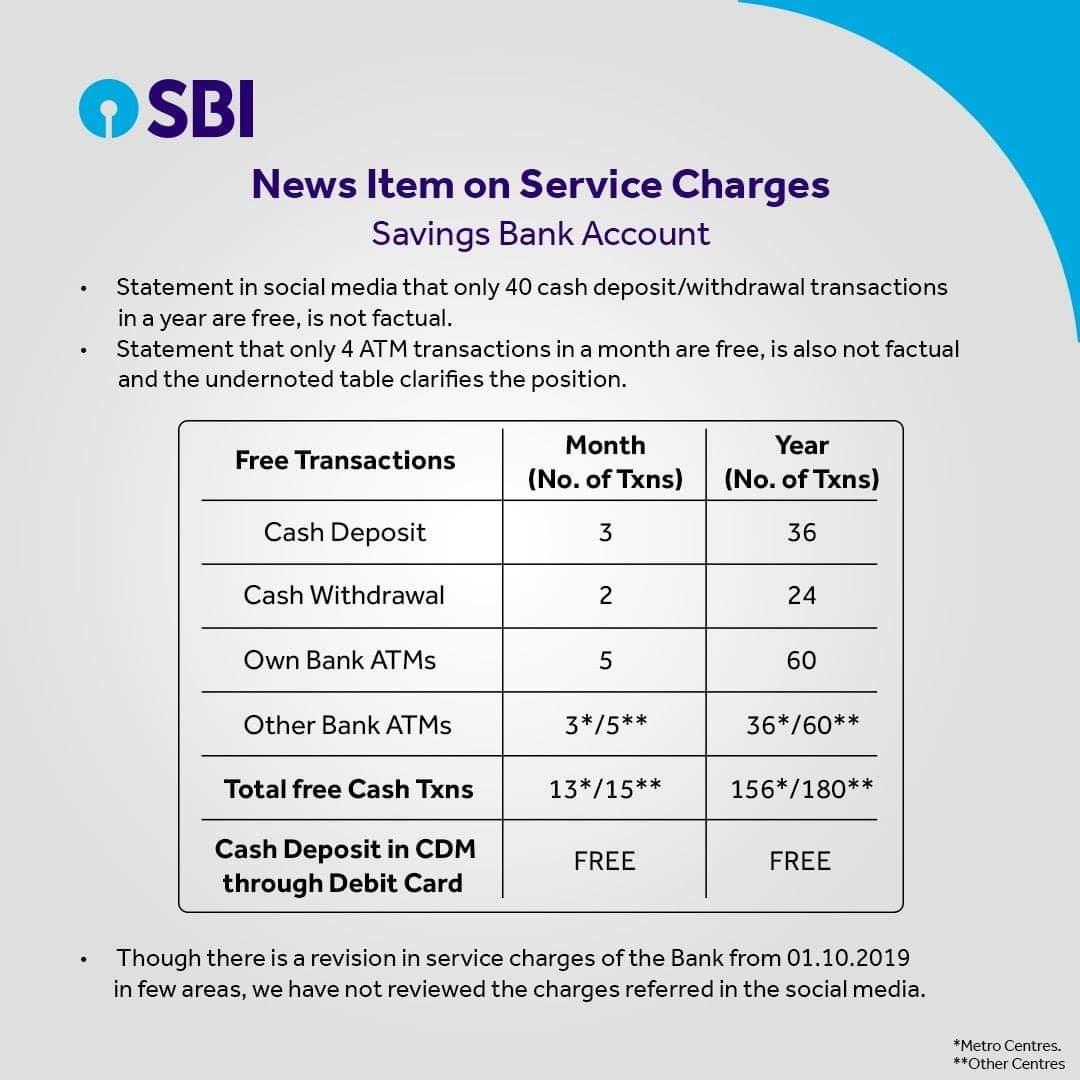

Image: potools.blogspot.com

Demystifying Forex Card Charges: A Comprehensive Breakdown

Understanding the various charges levied on SBI forex cards is paramount to managing your travel expenses effectively. These charges can be broadly categorized as:

1. Issuance Fee:

As the initial step towards owning an SBI forex card, you will encounter an issuance fee. This fee covers the administration and processing costs incurred in providing you with the card.

2. Loading Fee:

Every time you add funds to your forex card, you may be subject to a loading fee. This charge compensates the bank for handling and converting your home currency into foreign currencies.

Image: www.youtube.com

3. Transaction Fee:

This fee applies each time you use your forex card to make a purchase or withdraw cash. It typically ranges from 2% to 4% of the transaction amount, varying based on the specific currency and location.

4. Currency Conversion Fee:

Forex cards offer the convenience of converting currencies at the point of transaction. However, this convenience comes with an additional cost in the form of a currency conversion fee. This fee is usually levied as a percentage of the transaction amount, typically ranging from 1% to 3%.

5. ATM Withdrawal Fee:

Accessing local currency through ATMs carries an additional charge known as the ATM withdrawal fee. This fee is imposed by both SBI and the ATM operator.

6. Dormant Account Fee:

If your SBI forex card remains inactive for an extended period, you may be charged a dormant account fee. This fee serves as a periodic maintenance cost for keeping the card active.

Unveiling the Impact of Hidden Charges on Your Travel Budget

While individual charges may appear insignificant, their cumulative impact on your travel budget can be substantial. Consider the following scenario to illustrate this impact:

Assume you load INR 100,000 onto your SBI forex card for a 10-day trip to Thailand. With an assumed transaction fee of 3% and a currency conversion fee of 2%, each transaction of THB 1,000 would incur charges amounting to approximately INR 150 (3% + 2% of THB 1,000 = INR 150). If you make an average of 10 transactions per day, the total charges over 10 days would amount to INR 150 x 10 x 10 = INR 15,000. This hidden cost represents a significant 15% of your original card balance!

Mitigating Charges: Strategies for Cost-Effective Forex Transactions

Minimizing the impact of forex card charges requires a proactive approach. Here are some effective strategies to consider:

1. Compare Issuance and Loading Fees:

Before finalizing a forex card, compare the issuance and loading fees charged by different banks. Opt for the option that offers competitive rates and aligns with your travel plans.

2. Maximize Transactions:

To minimize the impact of transaction fees, consolidate your purchases and withdrawals into larger transactions. This reduces the number of individual charges incurred.

3. Plan Currency Conversions:

Identify the currencies you will need in advance and purchase them before departure. This allows you to secure favorable exchange rates and avoid unnecessary currency conversion fees.

4. Utilize ATMs Strategically:

Avoid using ATMs頻繁, especially in tourist areas, where withdrawal fees can be exorbitant. If possible, withdraw larger sums less frequently to minimize charges.

5. Monitor Your Account:

Regularly monitor your forex card account to track expenses and identify any unanticipated charges. Timely detection of discrepancies enables prompt action and potential cost savings.

Charges On Forex Card Sbi

Conclusion: Empowering Informed Travel Decisions

Understanding the charges associated with SBI forex cards is crucial for making informed travel financial decisions. By recognizing these hidden costs and implementing proactive strategies to minimize their impact, you can maximize your travel budget and enhance your overall travel experience. Remember, a little prudence and financial savvy can translate into significant savings, leaving you with more funds to create lasting travel memories.