Imagine the convenience of effortlessly spending your money abroad, without the hassle of currency conversion. Forex cards offer this idyllic solution, enabling travelers like you to seamlessly make purchases and withdrawals in foreign countries using your home currency. However, like any financial tool, it’s essential to be aware of the potential charges that come with using a Forex card in the United States, ensuring you make informed decisions to optimize your travel budget.

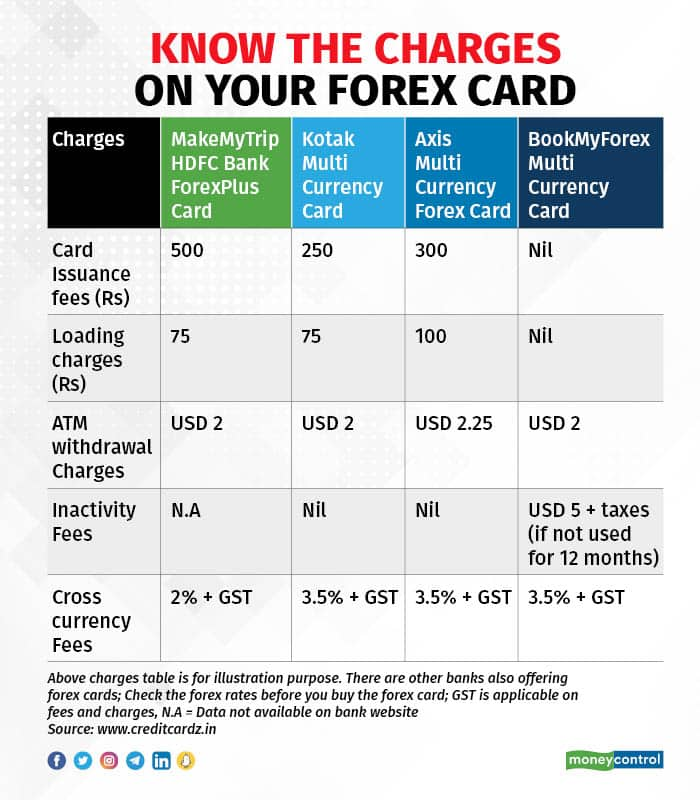

Image: www.moneycontrol.com

Understanding Forex Cards

Forex cards, also known as currency cards or travel cards, are prepaid cards that allow you to store multiple currencies, making international transactions a breeze. While they offer the advantage of locking in exchange rates and avoiding ATM fees charged by local banks, it’s important to note that Forex card providers often impose their own set of fees.

Charges to Consider

Comprehending the various charges associated with Forex cards is paramount to making the most of your travel funds. Let’s delve into the potential fees you may encounter:

-

Transaction Fees: Forex card providers may charge a transaction fee every time you use the card for purchases or withdrawals. Typically, these fees range from 1% to 3% of the transaction amount, chipping away at your spending power.

-

Loading Fees: When adding funds to your Forex card, some providers impose a loading fee, which can vary depending on the method of funding and the amount loaded. Understanding these fees will help you make informed decisions when replenishing your card balance.

-

Inactivity Fees: If your Forex card remains unused for an extended period, you may be subject to an inactivity fee. This fee aims to discourage prolonged dormancy and encourages regular usage of the card.

-

ATM Withdrawal Fees: While Forex cards may waive ATM fees charged by local banks abroad, they often impose their own withdrawal fees. These fees can vary depending on the provider and the withdrawal amount, potentially adding up over multiple transactions.

-

Currency Conversion Fees: Forex cards typically lock in exchange rates when funds are loaded onto the card. However, if you make a purchase or withdrawal in a currency not loaded onto your card, you may face an additional currency conversion fee. Understanding these fees ensures you choose the right card for your destination and spending habits.

Compare and Choose Wisely

To minimize the financial impact of Forex card charges, comparing different providers and their fee structures is essential. Consider the frequency of your travel, the countries you’ll visit, and your anticipated spending patterns. By carefully evaluating the available options, you can select a Forex card that aligns with your travel needs and helps you optimize your budget.

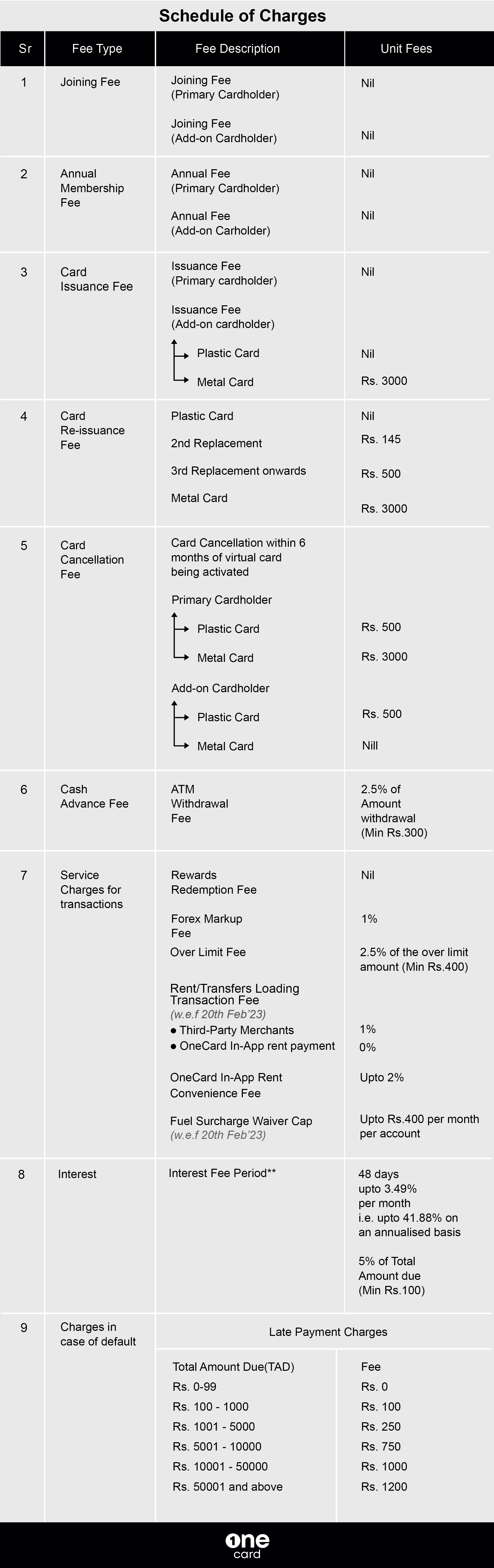

Image: www.getonecard.app

Maximize Your Savings

Apart from comparing providers, there are additional strategies you can employ to reduce the impact of Forex card charges. Here are some savvy tips to maximize your savings:

-

Load Larger Amounts: Loading larger sums onto your Forex card can help minimize the impact of loading fees and ensure you have sufficient funds for your travels, reducing the need for multiple top-ups.

-

Choose the Right Currency: If you anticipate spending primarily in a particular currency, consider loading that currency onto your Forex card to avoid currency conversion fees.

-

Make Fewer Withdrawals: Instead of making multiple small withdrawals, consolidate them into larger withdrawals to reduce the total number of transactions and minimize ATM withdrawal fees.

Charges Applicable On Use Of Forex Card In Usda

Conclusion

Using a Forex card in the United States can be an advantageous way to manage your travel expenses. However, understanding the potential charges associated with Forex cards empowers you with the knowledge to make informed decisions. By comparing providers, maximizing your savings, and using your card strategically, you can optimize your travel budget and focus on enjoying your journey without unnecessary financial burdens. Remember, a well-informed traveler is a savvy traveler, prepared to navigate the financial complexities of international spending and make the most of their adventure.