From bustling financial hubs to thriving rural communities, the foreign exchange (forex) market plays a pivotal role in shaping India’s economic landscape. Understanding the nuances and transformative impact of forex is crucial for investors, businesses, and every Indian citizen.

Image: www.timesnownews.com

Forex in India: A Gateway to Global Trade

Forex enables seamless cross-border transactions, facilitating trade between India and the world. Businesses import raw materials, export finished goods, and engage in international investments. Through forex, companies can manage currency fluctuations and hedge against risks associated with international transactions.

**The Forex Market: A Dynamic Ecosystem**

The forex market is the largest and most liquid financial market globally, where currencies are traded 24 hours a day. Participants include banks, corporations, investment firms, and individuals. Factors such as economic data, political events, and central bank policies drive currency values, presenting both opportunities and challenges for traders.

**Historical Evolution and Impact on India**

India’s forex market has evolved significantly over time. From the pre-independence era to the post-liberalization period, the government has implemented various policies to regulate and promote forex trading. These initiatives have fostered economic growth, facilitated inward investment, and enhanced the country’s international trade position.

**Economic Impact: Connecting Global and Domestic Markets**

Forex plays a vital role in India’s economic development. It provides access to foreign capital, enhances export competitiveness, and stabilizes the value of the Indian rupee. Additionally, forex reserves serve as a buffer against external shocks, ensuring financial stability and supporting economic growth.

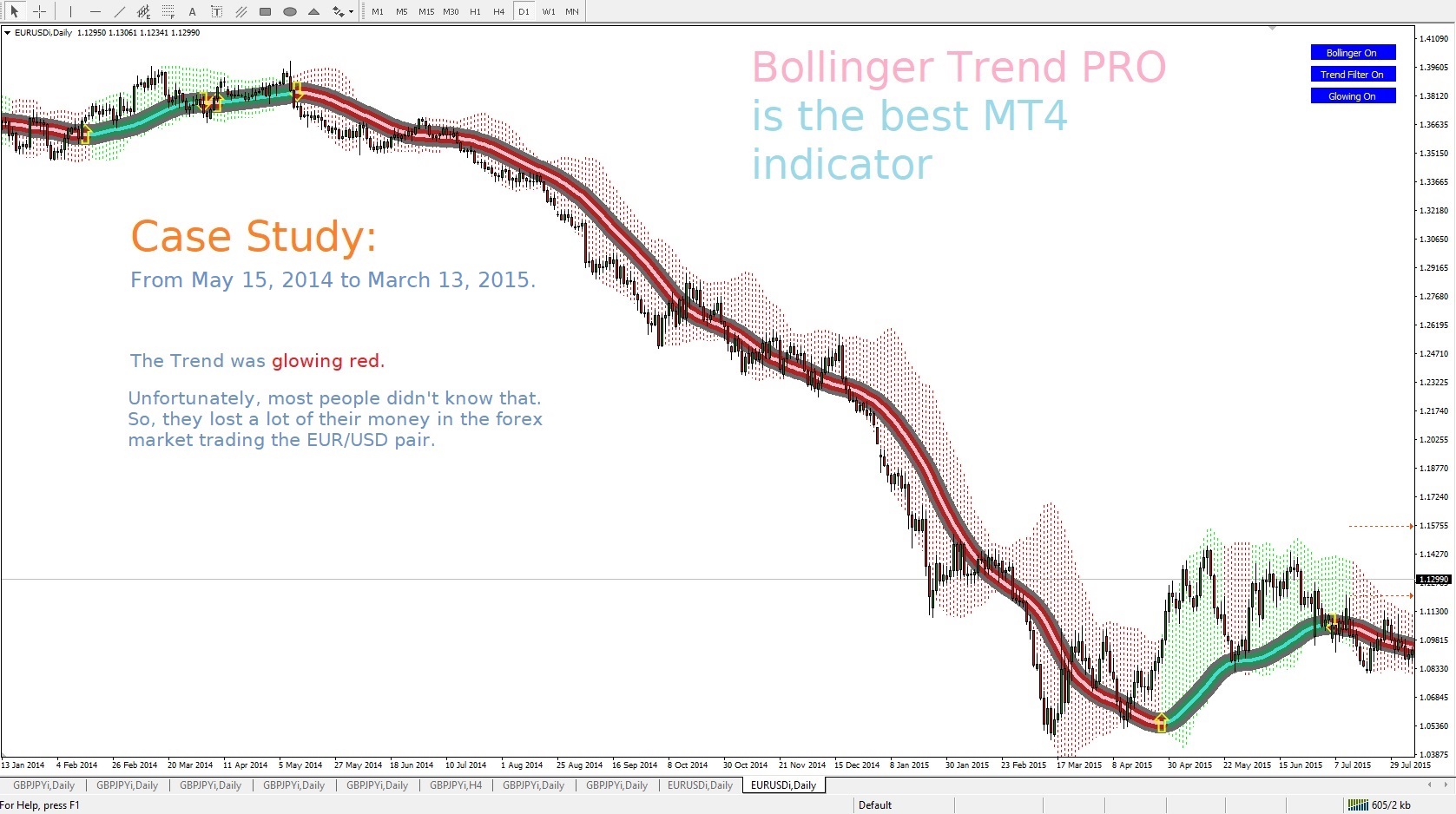

Image: www.mql5.com

**Regulatory Framework: Ensuring Market Integrity**

The Reserve Bank of India (RBI) regulates the forex market in India to ensure transparency, prevent volatility, and protect the interests of participants. Through regulations, the RBI controls market conduct, sets guidelines for forex transactions, and monitors market activities. This regulatory framework contributes to a well-functioning and ethical market environment.

**Latest Trends and Opportunities**

The forex market in India continues to evolve, driven by technological advancements and changing global economic dynamics. Artificial intelligence-powered trading platforms are gaining prominence, while innovative financial instruments, such as currency futures and options, offer new risk management and hedging strategies.

**Expert Advice and Tips for Success**

Navigating the forex market requires a clear understanding of its dynamics and strategies. Traders should:

- Develop a comprehensive trading plan and stick to it.

- Study market trends and stay informed about global economic events.

- Manage risk effectively through diversification and proper position sizing.

- Seek guidance from experienced traders and leverage educational resources.

**FAQs on Forex in India**

Q: What is the difference between spot forex and forward forex?

A: Spot forex involves trading currencies for immediate delivery, while forward forex involves contracts to buy or sell currencies at a specified rate on a future date.

Q: How can I trade forex in India?

A: Opening a trading account with a forex broker licensed by the RBI is a prerequisite for trading forex in India.

Q: Are there any restrictions on forex trading in India?

A: The RBI has imposed certain restrictions on forex trading in India, including limits on daily trading volumes and transactions with certain currencies.

Q: What are the benefits of trading forex?

A: Forex trading offers potential profits from currency fluctuations, 24-hour market access, and the opportunity to use leverage for increased returns.

Q: What are the risks associated with forex trading?

A: Forex trading carries inherent risks, including market volatility, fluctuating currency values, and the possibility of losing invested capital.

Case Study On Forex In India

https://youtube.com/watch?v=6agO9FaNHys

**Conclusion**

The foreign exchange market in India plays a pivotal role in the country’s economic prosperity. By providing access to global markets, fostering trade, and enabling financial stability, forex contributes significantly to India’s financial landscape. As the world economy becomes increasingly interconnected, understanding forex and leveraging its potential will continue to be crucial for India’s economic growth and global competitiveness.

Are you ready to explore the dynamic world of forex in India? Join us as we delve deeper into this fascinating and transformative topic!