In the realm of financial markets, where knowledge is paramount, copy trading has emerged as a game-changer. Imagine being able to tap into the insights of seasoned traders and replicate their winning strategies. This revolutionary concept has democratized trading, empowering novice and experienced investors alike.

Image: primexbt.com

But what exactly is copy trading and how can it’s transformative potential benefit you? Delve into this comprehensive guide to unravel the mysteries of copy trading and discover its remarkable advantages.

Defining Copy Trading: A Paradigm Shift in Financial Empowerment

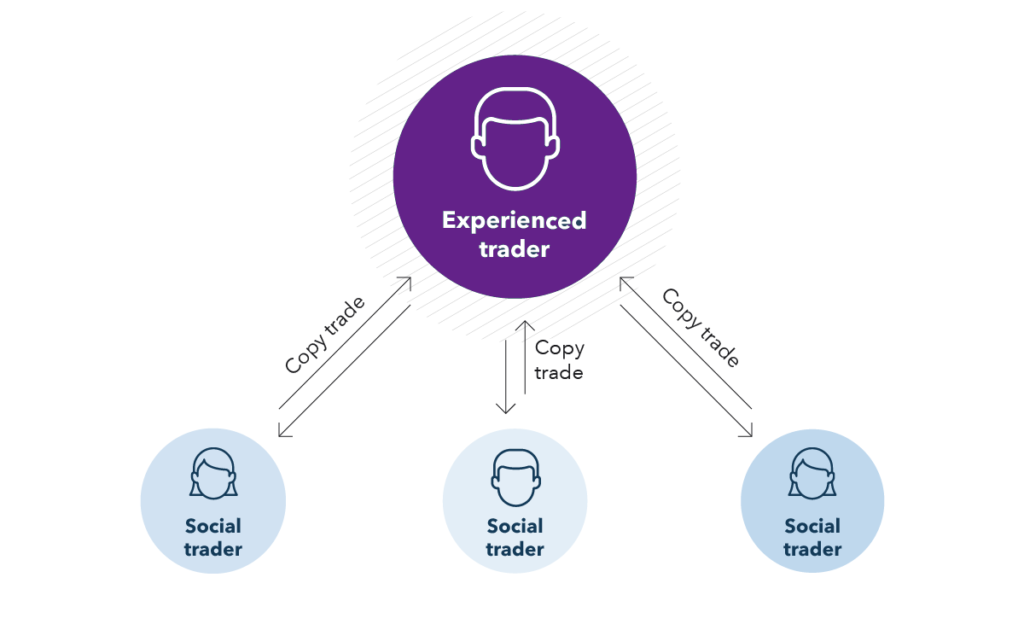

Copy trading, also known as social trading, allows you to mirror the trades of expert traders, known as “signal providers.” It’s akin to having a seasoned mentor by your side, guiding you through the complexities of the financial markets. As the signal provider executes trades, they are automatically replicated in your trading account, empowering you to harness their expertise and market insights.

This innovative approach to trading has several advantages. Firstly, it eliminates the need for extensive market knowledge or complex technical analysis. By entrusting the decision-making to experienced traders, you can bypass the steep learning curve associated with traditional trading.

How Copy Trading Works: Unlocking the Secrets of Success

To engage in copy trading, you typically need to open an account with a broker that offers this service. Once your account is set up, you can browse through a database of signal providers, each with their unique trading history, strategies, and risk profiles. It’s crucial to conduct thorough research and select a signal provider that aligns with your investment goals and risk tolerance.

Once you’ve identified a suitable signal provider, you can determine the amount of capital you wish to allocate to their trades. The funds allocated will be used to execute the replicated trades in your account, mirroring the size and direction of the signal provider’s trades. This seamless process allows you to harness the knowledge and expertise of seasoned traders, potentially enhancing your profitability.

A Glimpse into Copy Trading Trends and Developments

The copy trading landscape is constantly evolving, with new innovations and insights emerging regularly. To stay abreast of the latest trends and developments, it’s prudent to engage with online forums, social media platforms, and industry publications. These valuable resources offer a wealth of information, enabling you to stay updated on market trends, signal provider performance, and cutting-edge trading strategies.

By leveraging these channels, you can refine your copy trading approach, mitigate risks, and maximize your earning potential in the dynamic financial markets.

Image: investbro.id

Expert Tips and Insights for Copy Trading Success

To maximize your copy trading experience and increase your chances of success, consider the following expert tips and advice:

- Research Thoroughly: Before selecting a signal provider, dedicate ample time to understanding their trading history, strategies, and risk management practices.

- Consider Risk Management: Copy trading doesn’t eliminate market risks entirely. Determine your risk tolerance and allocate capital accordingly to minimize potential losses.

- Start Small: Begin with a modest allocation of capital and gradually increase your investment as you gain confidence and experience.

- Diversify Your Portfolio: Spread your investments across multiple signal providers with diverse strategies to mitigate risk and enhance potential returns.

- Monitor Performance: Regularly review the performance of your signal providers and make adjustments based on their ongoing success.

FAQs: Tackling Copy Trading Queries

To address some common queries related to copy trading:

- Q: Is copy trading suitable for all investors?

A: Copy trading can be appropriate for investors of all levels, but it’s especially beneficial for those without extensive trading knowledge or time to research the markets. - Q: Are there any risks involved in copy trading?

A: As with all financial investments, copy trading carries inherent risks due to market volatility and the potential for signal provider underperformance. - Q: How much capital does copy trading require?

A: The minimum capital required varies depending on the broker and signal provider you choose. It’s often advisable to start with a small investment and increase it gradually.

What Is Copy Trading

Conclusion: Empowerment Through Copy Trading

Copy trading has revolutionized the financial landscape, unlocking opportunities for investors to reap the benefits of market expertise without the need for extensive knowledge or experience. By embracing this innovative approach, you can gain access to the insights of seasoned traders and amplify your earnings potential.

So, are you ready to delve into the realm of copy trading and harness the power of collective knowledge? Embark on this empowering journey today and unlock the gateway to financial success.