When traversing the global market for currency exchange, a multitude of payment options arise, each catering to specific needs and preferences. Among them, the use of cheques has long been a subject of inquiry, particularly at forex exchanges. To shed light on this matter, this detailed guide will explore the intricacies and nuances surrounding the acceptance of cheques as a payment method in forex transactions.

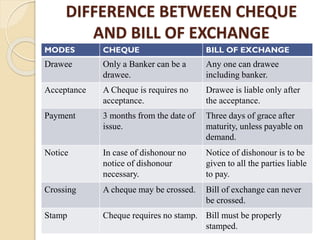

Image: www.slideshare.net

Cheques: A Payment Option with a Rich History

Cheques, also known as checks in some regions, have a long and storied history, dating back to the 17th century in Europe. Initially conceived as a means to facilitate seamless monetary transfers, they have evolved into a widely accepted form of payment. Cheques offer several advantages, including the provision of a recorded and auditable trail of transactions, increased security compared to cash, and the convenience of deferred payment.

Forex Exchanges: A Nexus for Currency Conversion

Forex exchanges, commonly abbreviated as FX exchanges, serve as specialized venues where individuals and businesses can convert currencies between different countries. These exchanges play a crucial role in facilitating international trade, tourism, and personal financial transactions. By offering competitive exchange rates and convenient access to a wide range of currencies, forex exchanges cater to the diverse needs of their clientele.

Cheque Acceptance at Forex Exchanges: A Mixed Picture

The acceptance of cheques as a payment method at forex exchanges can vary depending on several factors. Some forex exchanges may readily accept cheques, while others may impose certain restrictions or decline them altogether. Such variations often stem from the varying policies and risk assessment mechanisms employed by individual exchange operators.

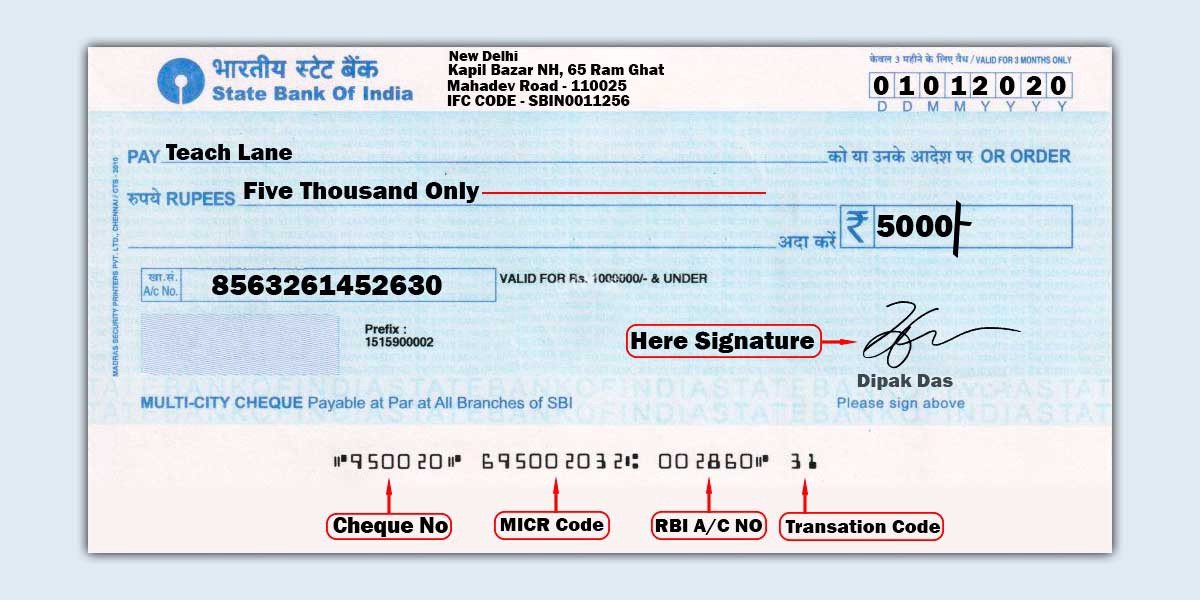

Image: www.vrogue.co

Factors Influencing Cheque Acceptance

Several factors can influence a forex exchange’s decision regarding the acceptance of cheques. These include:

• Exchange Policies: Each forex exchange establishes its own set of policies governing payment options, including the acceptance or declination of cheques.

• Risk Assessment: Forex exchanges carefully assess the potential risks associated with accepting cheques, considering factors such as cheque fraud, forgery, and insufficient funds.

• Transaction Volume: The volume of cheque transactions processed by a forex exchange can impact their willingness to accept cheques as a payment method.

• Cheque Issuing Bank: The reputation and credibility of the bank that issued the cheque can influence its acceptability at a forex exchange.

Advantages of Using Cheques at Forex Exchanges

Despite the varying acceptance rates, cheques offer several advantages when used at forex exchanges:

• Security: Cheques provide a more secure payment option compared to cash, as they leave a verifiable record of the transaction.

• Convenience: Cheques allow for deferred payment, enabling individuals to secure their desired currency without immediate cash outlay.

• Audit Trail: Cheques provide a documented record of the transaction, facilitating accounting and reconciliation processes.

Limitations of Using Cheques at Forex Exchanges

While cheques offer certain advantages, they also have some limitations:

• Processing Time: Cheques require processing time before funds become available, which can be a drawback for urgent transactions.

• Acceptance Limitations: Not all forex exchanges accept cheques as a payment method, and those that do may impose restrictions or limitations.

• Fraud Risk: Cheque fraud remains a concern, and forex exchanges must exercise due diligence to mitigate this risk.

Alternative Payment Options at Forex Exchanges

In addition to cheques, forex exchanges typically offer a range of alternative payment options, including:

• Cash: Cash remains a widely accepted payment method at forex exchanges, offering immediate settlement.

• Debit/Credit Cards: Debit and credit cards provide a convenient and widely accepted payment option, but may incur transaction fees.

• Bank Transfers: Bank transfers offer a secure and reliable way to transfer funds between banks, but can take some time to process.

• Online Payment Services: Forex exchanges may offer online payment services that facilitate seamless and secure transactions.

Can You Pay In Cheque At Forex Exchange

Conclusion

The acceptance of cheques at forex exchanges is a complex issue that varies depending on factors such as exchange policies, risk assessment, and cheque legitimacy. While cheques offer advantages like security and convenience, they also have limitations such as processing time and acceptance restrictions. Ultimately, the availability of cheques as a payment option at a specific forex exchange is subject to the policies and procedures established by the exchange operator.