Introduction:

Image: www.youtube.com

In the realm of international finance, the ability to seamlessly transfer funds across borders is crucial. For those holding forex cards, the question of whether they can transmit funds to their Chase accounts has often lingered. This comprehensive guide will unravel the intricacies of this process, empowering you with the knowledge and confidence to execute these transactions effortlessly.

Defined as prepaid cards issued by non-bank financial institutions, forex cards allow individuals to store multiple currencies and make overseas purchases conveniently. However, understanding the complexities of transferring funds from these cards to traditional bank accounts is essential to avoid potential pitfalls.

Exploring the Mechanics of Fund Transfers:

Step by Step

-

Initiating the Transfer:

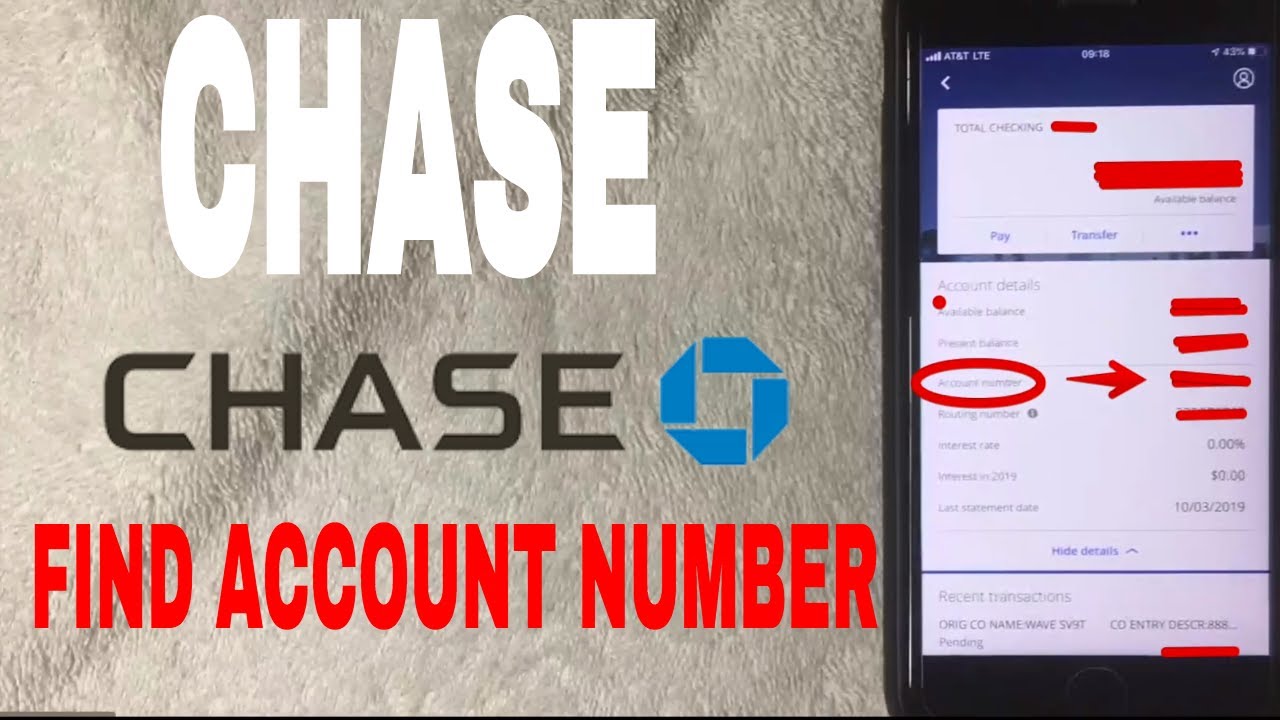

Initiate the transfer by accessing your Chase account online or via the mobile banking app. Select the “Transfer Money” option and choose “International Wire Transfer.” -

Forex Card as Origin:

In the “From Account” section, indicate your forex card as the source of funds. Enter the card number and expiry date carefully. -

Chase Account as Destination:

For the “To Account,” specify your Chase account details, including account number and routing number. Ensure the recipient information is accurate to prevent errors. -

Transaction Amount and Currency:

Input the desired transfer amount in the designated field. Double-check the currency conversion rates to ensure optimal value. -

Verification and Confirmation:

Thoroughly review the transfer details before submitting the transaction. Verify the recipient information, amount, and exchange rates. Once confirmed, authorize the transfer.

Delving into Key Considerations and Nuances:

-

Transaction Fees: Forex cards typically charge transaction fees for international transfers, varying depending on the card issuer and destination country. Anticipate these costs and factor them into your budget.

-

Conversion Rates: Forex card providers set their own exchange rates, which can differ from bank rates. Compare rates offered by multiple providers to obtain the most favorable conversion.

-

Transfer Time: Unlike domestic transfers, international wire transfers from forex cards to Chase accounts can take several business days to complete. Be patient and monitor the transaction status through Chase’s online platform.

-

Documentation Requirements: For large or frequent transfers, Chase may request additional documentation, such as proof of identity or the source of funds. Keep necessary documents readily available.

Unveiling Expert Insights and Practical Tips:

To ensure the smooth and secure transfer of funds, consider these expert recommendations:

-

Consult Your Forex Card Provider: Contact the forex card issuer for guidance on transaction fees, exchange rates, and any specific requirements.

-

Compare Exchange Rates: Research different forex card providers and compare their exchange rates to secure the best deal.

-

Consider Transfer Volume: If transferring substantial funds, consider using a wire transfer directly from your bank account instead of a forex card to minimize fees.

Image: www.chase.com

Can We Send Amount From Forex Card To Chase Account

Conclusion:

Mastering the intricate web of fund transfers from forex cards to Chase accounts empowers you to navigate the global financial landscape with ease. By meticulously following the outlined steps and incorporating these expert insights, you can seamlessly transfer funds across borders, bridging continents and unlocking a world of financial possibilities.