Liberating Financial Frontiers: A Global Wallet in Your Pocket

In today’s interconnected world, international travel and business ventures have become commonplace. Accessing funds abroad often requires a convenient and secure solution. Enter the forex card, a lifeline for global transactions, issued by many Indian banks. This article explores the world of forex cards, examining their benefits, offering expert tips, and answering common queries, empowering you to navigate financial borders seamlessly.

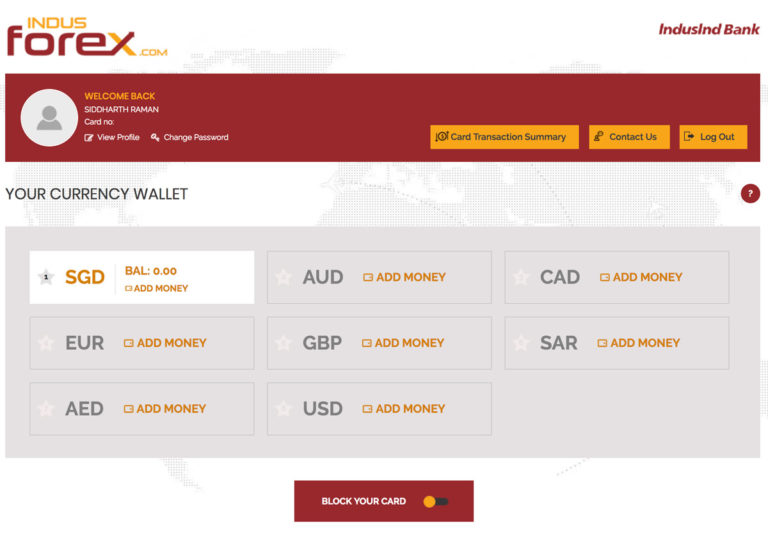

Image: www.cardexpert.in

Unlocking the Potential of Forex Cards

A forex card is a prepaid card that enables seamless multicurrency transactions. Unlike traditional debit or credit cards limited to a single currency, forex cards allow withdrawals and payments in multiple currencies. This versatility caters to globetrotters and business travelers who encounter diverse currency zones. Moreover, forex cards offer competitive exchange rates compared to other currency conversion methods, making them an economical choice for extended stays or frequent transactions.

Types of Forex Cards in India

Indian banks offer various types of forex cards, including basic, premium, and multicurrency cards. Basic cards are designed for occasional travelers, offering essential features such as currency conversion and ATM withdrawals. Premium cards provide additional benefits like lounge access, travel insurance, and higher transaction limits. Multicurrency cards enable transactions in multiple currencies, further enhancing convenience and flexibility.

Latest Trends and Developments

The forex card industry is constantly evolving, embracing technological advancements and market trends. Instant forex cards, available digitally and linked to bank accounts, offer quick access to funds abroad. Contactless payments, QR code scanning, and even blockchain-based forex cards are gaining popularity, enhancing security and convenience. Additionally, partnerships between banks and travel agencies result in customized forex cards with tailored benefits for frequent travelers.

Image: www.scribd.com

Tips for Using Forex Cards

Research and Compare: Before selecting a forex card, research and compare the offerings of different banks. Consider factors such as fees, exchange rates, and additional benefits.

Load Your Card Wisely: Determine your travel budget and load your forex card accordingly to avoid unnecessary fees or card blockage due to low balance.

Notify Your Bank: Inform your bank about your travel plans to prevent card blocking due to suspicious activity.

Use ATMs Judiciously: Avoid using ATMs with high surcharges. Opt for bank-affiliated ATMs or partner ATMs to minimize fees.

Track Your Transactions: Regularly check your forex card statement or online banking portal to monitor transactions and keep track of expenses.

FAQs on Forex Cards

Q: Which Indian banks offer forex cards?

A: Most leading Indian banks, including SBI, HDFC Bank, ICICI Bank, Axis Bank, and Kotak Mahindra Bank, issue forex cards.

Q: What is the validity period of a forex card?

A: Forex cards typically have a validity period of 2-4 years.

Q: Can I reload my forex card after it expires?

A: Usually, forex cards cannot be reloaded after they expire. You will need to purchase a new card.

Q: Are there any annual fees associated with forex cards?

A: Some banks may charge an annual fee for premium forex cards.

Q: How secure are forex cards?

A: Forex cards employ advanced security measures such as EMV chips and PIN protection. Notify your bank immediately in case of card loss or theft.

Can Indian Banks Issuing Forex Card

Conclusion

Forex cards have revolutionized global transactions, empowering Indian travelers and businesses with convenience, cost-effectiveness, and security. By researching, choosing the right card, and following expert advice, you can unlock the full potential of forex cards. Whether traversing continents for adventure or expanding business frontiers, forex cards serve as indispensable financial companions, enabling you to navigate monetary borders with confidence and ease. Are you ready to explore the world with the power of forex cards?