Unlock Global Transactions with Convenient Forex Card Reloads

In today’s interconnected world, financial flexibility is paramount. Forex cards offer a convenient and cost-effective way to manage your finances while traveling abroad or making international transactions. However, the question often arises: “Can I reload my forex card from another bank account?” The answer is a resounding yes! Let us delve into the world of forex card reloads and explore how you can seamlessly manage your finances from multiple accounts.

Image: forexincontroleafreedownload1.blogspot.com

Understanding Forex Cards and Their Benefits

Forex cards are prepaid cards linked to a specific foreign currency. They are designed to provide hassle-free transactions in foreign countries, allowing you to avoid fluctuating exchange rates and high transaction fees associated with traditional bank accounts. Forex cards also offer added security, minimizing the risk of fraud or unauthorized access to your primary bank account.

Reloading Your Forex Card from Another Bank Account

The ability to reload your forex card from another bank account offers unparalleled convenience. This feature allows you to transfer funds from your preferred bank account to your forex card, ensuring you have sufficient funds for your purchases or expenses abroad.

The process of reloading your forex card varies depending on the provider. However, most providers offer convenient online platforms or mobile applications that simplify the process. Typically, you will be required to provide your forex card number, the amount you wish to reload, and the bank account details from which the funds will be transferred.

Why Reload Your Forex Card from Another Bank Account?

There are several advantages to reloading your forex card from another bank account:

-

Optimizing Exchange Rates: By reloading your forex card from a bank account with a favorable exchange rate, you can minimize conversion fees and save money on your transactions.

-

Consolidating Finances: Reloading your forex card from a single bank account helps you manage your finances more effectively. You can keep track of all your expenses in one place, streamlining your financial planning.

-

Enhanced Security: Reloading your forex card from another bank account provides an extra layer of security. Even if your forex card is compromised, the funds in your primary bank account remain safe.

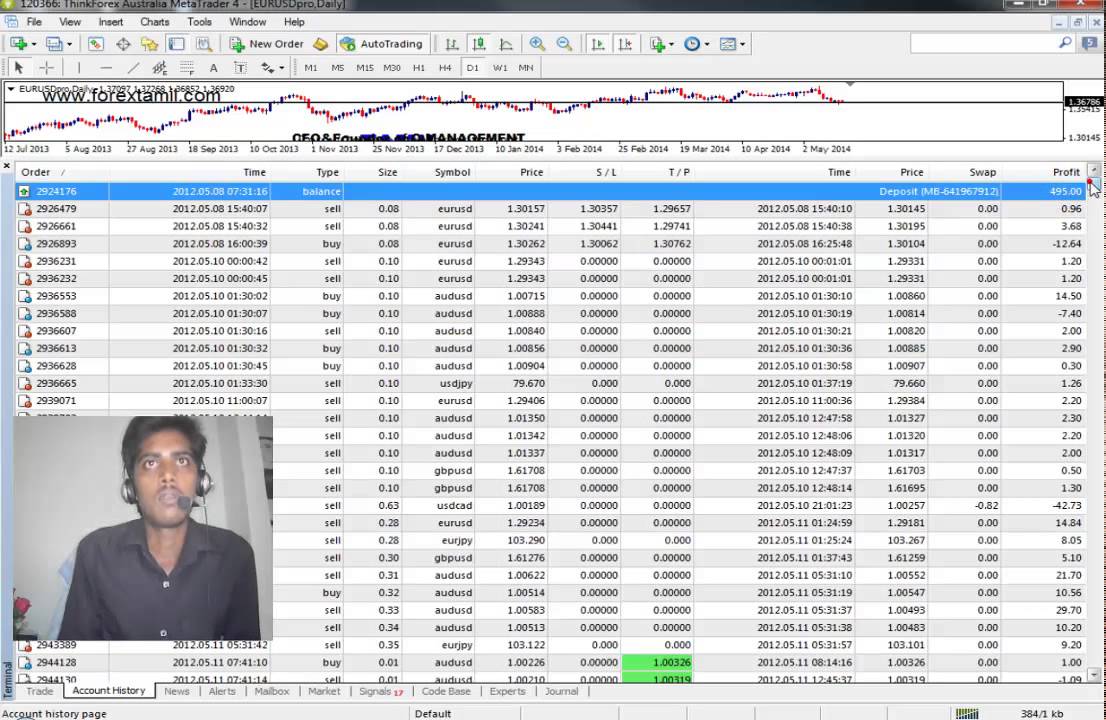

Image: blog.trading4giving.com

Step-by-Step Guide to Reloading Your Forex Card

-

Choose a Reputable Forex Card Provider: Research and select a provider that offers convenient reloading options and competitive exchange rates.

-

Create an Online Account: Most providers require you to create an online account to access reloading services.

-

Link Your Bank Account: Provide the details of your bank account from which you wish to reload your forex card.

-

Initiate the Reload: Specify the amount you want to transfer and confirm the transaction.

-

Monitor Your Reload: Track the status of your reload through the provider’s online platform or mobile app.

Additional Tips for Effective Forex Card Reload Management

-

Maximize Value: Reload your forex card when exchange rates are favorable to minimize transaction costs.

-

Monitor Fees: Be aware of any fees associated with reloading your forex card, such as transaction fees or exchange rate spreads.

-

Keep Records: Maintain records of your reloading transactions for tracking and budgeting purposes.

-

Explore Other Funding Options: Some providers may offer alternative funding methods, such as direct bank transfers or mobile wallet reloads.

Can I Reload Forex Card By Other Bank Account

Conclusion

The ability to reload your forex card from another bank account empowers you with greater financial flexibility and control. By optimizing exchange rates, consolidating finances, and enhancing security, you can maximize the benefits of using a forex card. Embrace the convenience of hassle-free international transactions and enjoy the peace of mind that comes with a secure and reliable way to manage your finances abroad.