The foreign exchange (forex) market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $5 trillion. However, unlike other financial markets such as stocks or bonds, the forex market is not exchange-traded. Instead, it is an over-the-counter (OTC) market, meaning that trades are executed directly between two parties without the involvement of a centralized exchange.

Image: aytoo.ma

There are several reasons why the forex market is not exchange-traded. First, the forex market is highly fragmented, with participants located all over the world. This makes it difficult to establish a single physical exchange that would be accessible to all traders.

Second, the forex market is very dynamic, with prices constantly fluctuating. This makes it difficult to maintain a central order book that would reflect the current market price.

Despite these challenges, there have been several attempts to create exchange-traded products that would allow investors to gain exposure to the forex market. These products include forex exchange-traded funds (ETFs) and forex futures contracts.

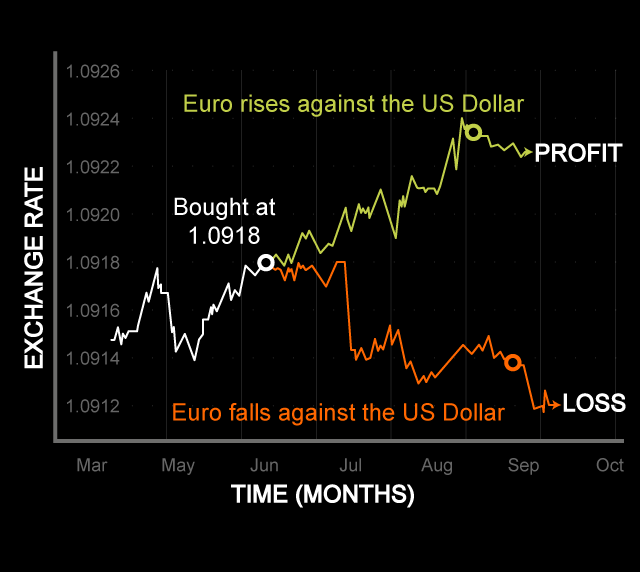

Forex ETFs are baskets of currencies that track the value of a particular currency pair. For example, the CurrencyShares Euro Trust (FXE) tracks the value of the euro against the US dollar.

Forex futures contracts are agreements to buy or sell a certain amount of currency at a specified price on a future date. Forex futures are traded on exchanges, and they allow investors to speculate on the future direction of currency prices.

While forex ETFs and forex futures contracts provide some exposure to the forex market, they do not offer the same level of flexibility and liquidity as trading directly in the OTC market.

Here are some of the benefits of trading forex in the OTC market:

- Flexibility: The OTC market allows traders to trade any currency pair they want, in any amount they want, at any time of day or night.

- Liquidity: The forex market is the most liquid financial market in the world, with a daily trading volume exceeding $5 trillion. This liquidity ensures that traders can get filled at their desired price, even for large orders.

- Cost-effective: Trading forex in the OTC market is relatively cost-effective, as there are no exchange fees or commissions.

- Access to global markets: The OTC market allows traders to access global markets from anywhere in the world.

However, there are also some risks associated with trading forex in the OTC market:

- Counterparty risk: When trading in the OTC market, traders are exposed to the risk that their counterparty will not fulfill their obligations.

- Volatility: The forex market is very volatile, and prices can fluctuate rapidly. This can result in losses for traders who are not properly prepared.

- Lack of regulation: The OTC market is not regulated, which means that there is no protection for traders against fraud or abuse.

Overall, the forex market is a complex and challenging market to trade. However, it also offers the potential for high returns. Traders who are willing to take on the risks can find the forex market to be a rewarding place to trade.

:max_bytes(150000):strip_icc()/Forex_Final_4196203-e44848b06f2642378b12bc162951a818.png)

Image: www.investopedia.com

Can Forex Market Be Exchange Trade