Introduction:

Image: www.myriadstory.com

In a world increasingly connected and globalized, the ability to access your funds conveniently and securely while traveling abroad has become essential. Introducing forex cards, a game-changer for travelers seeking financial freedom on the road. This comprehensive guide will delve into the ins and outs of forex cards, empowering you to unlock the world of cashless convenience at ATMs.

Understanding Forex Cards:

Forex cards, also known as travel cards or multi-currency cards, are prepaid cards that store multiple currencies. They offer a secure and versatile alternative to traditional cash or credit cards when traveling. By loading your forex card with the desired currencies, you can avoid exchange rate fluctuations and enjoy transparent transaction fees.

Advantages of Using Forex Cards at ATMs:

- Convenience: Forex cards provide unparalleled convenience by allowing you to withdraw local currency directly from ATMs worldwide. This eliminates the hassle of carrying large amounts of cash or searching for currency exchange services.

- Cost-Efficiency: Forex cards often offer competitive exchange rates compared to banks or currency exchange bureaus. Additionally, they charge relatively low withdrawal fees, saving you money on international transactions.

- Security: Forex cards are equipped with advanced security features such as chip-and-PIN and EMV technology. This ensures secure transactions, reducing the risk of fraud or unauthorized access.

- Control and Tracking: Forex cards come with mobile apps or online platforms that provide real-time updates on your account balance and transaction history. This allows for easy monitoring and control over your spending.

- Wide Acceptance: Forex cards are accepted at millions of ATMs worldwide, giving you access to local currency in most countries and currencies.

Choosing the Right Forex Card:

Choosing the best forex card depends on your specific travel needs and preferences. Here are some factors to consider:

- Fees: Compare withdrawal fees, currency conversion fees, and other associated charges. Look for cards with low or transparent fees.

- Currency Coverage: Ensure the card supports the currencies you will need during your travels.

- Withdrawal Limits: Consider the daily or monthly withdrawal limits and whether they align with your spending habits.

- Security Features: Opt for forex cards with robust security measures such as chip-and-PIN, EMV technology, and transaction alerts.

- Mobile App and Customer Support: Look for cards that offer user-friendly mobile apps and responsive customer support for assistance while abroad.

Using Forex Cards at ATMs:

- Activate Your Card: Before using your forex card at an ATM, activate it by following the instructions provided by the issuer.

- Insert Your Card: Insert your forex card into the ATM and select your preferred language.

- Choose ‘International Transaction’: Select the ‘International Transaction’ option on the screen.

- Enter Your PIN: Enter your four-digit PIN to authorize the withdrawal.

- Select Withdrawal Amount: Choose the amount you wish to withdraw in the local currency.

- Confirm and Collect: Confirm the transaction details and collect your cash.

Conclusion:

Forex cards empower travelers with unparalleled convenience, cost-efficiency, security, and

Image: www.youtube.com

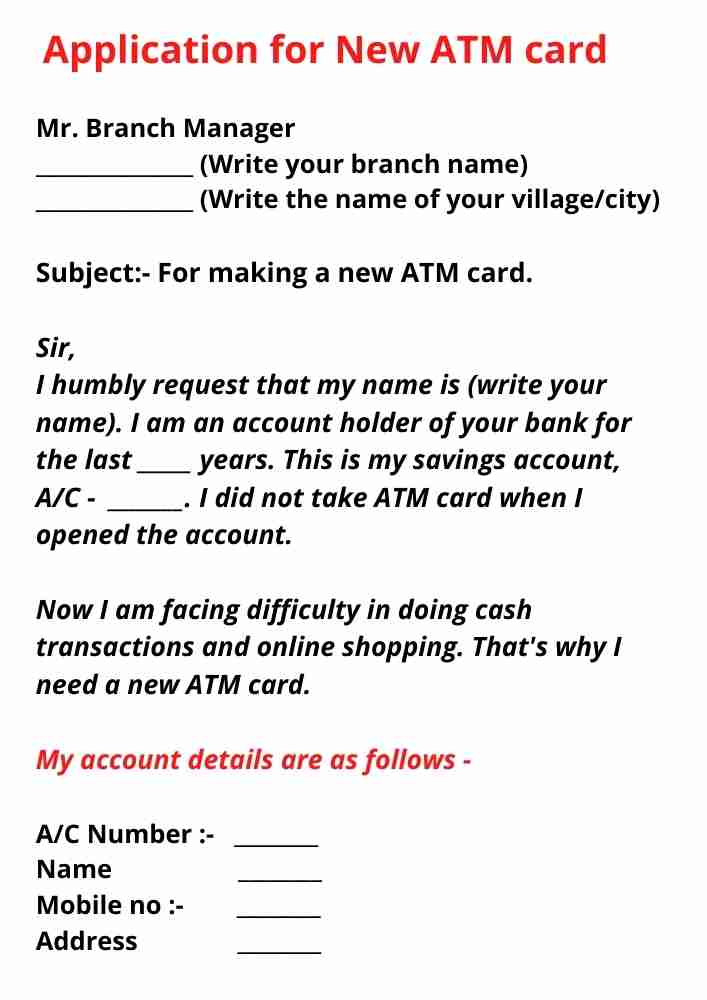

Can Forex Card Be Used In Atm