Embracing the Financial Arena

As the global financial landscape expands, the allure of forex trading entices individuals seeking financial freedom and the thrill of market fluctuations. For Indians residing in Dubai, a thriving commercial hub, the opportunity to partake in this dynamic realm presents itself. Embarking on a forex trading journey requires careful consideration of legal regulations, market dynamics, and trading strategies.

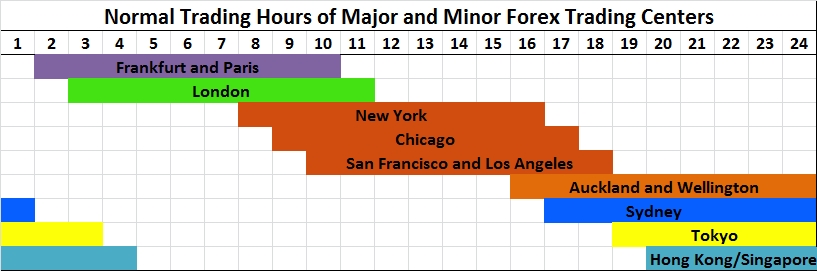

Image: bank2home.com

Navigating Indian Forex Regulations in Dubai

Indian citizens residing in Dubai interested in venturing into forex trading must adhere to the regulatory frameworks established by both countries. The Reserve Bank of India (RBI) imposes certain restrictions on forex trading by Indians, including limits on investment amounts and the prohibition of trading on margin. However, it’s important to note that these regulations apply to Indian nationals trading on platforms based in India. Once an Indian citizen establishes residency in Dubai, they become subject to the regulations imposed by the Dubai Financial Services Authority (DFSA).

The DFSA has a robust regulatory framework in place to ensure transparency and investor protection in the forex market. Indian traders based in Dubai can legally participate in forex trading through regulated brokers licensed by the DFSA. These brokers must meet stringent capital adequacy requirements and adhere to ethical guidelines, offering traders a safe and secure trading environment.

Exploring Forex Trading Strategies

The forex market provides a vast array of trading strategies, each tailored to traders’ risk tolerance and trading objectives. Understanding the nuances of these strategies is crucial for موفقیت. Some of the popular forex trading strategies include:

- Scalping: Involves entering and exiting numerous trades within a short time frame, profiting from small price changes.

- Day Trading: Traders open and close positions within a single trading day, taking advantage of intraday price volatility.

- Trend Trading: Capitalizes on long-term price trends, identifying and aligning trades with the overall market direction.

- Carry Trading: Involves borrowing a currency with low interest rates to invest in a currency with higher interest rates, profiting from the interest rate differential.

Choosing an appropriate trading strategy requires careful self-assessment, consideration of available resources, and thorough research into the complexities of the forex market.

Tips for Successful Forex Trading

Embarking on a forex trading journey can be both rewarding and challenging. To enhance your chances of success, consider these expert tips:

- Educate Yourself: Immerse yourself in the world of forex trading, studying market dynamics, trading strategies, and risk management techniques.

- Practice with a Demo Account: Utilize demo accounts offered by brokers to gain practical experience without risking real capital.

- Manage Your Risk: Forex trading entails inherent risks. Establish a comprehensive risk management plan, including stop-loss orders and position sizing.

- Stay Disciplined: Adhere to your trading plan, avoiding emotional decision-making. Consistency and discipline are key to long-term survival.

- Monitor the Market: Stay updated with financial news, market trends, and economic indicators to make informed trading decisions.

Image: newestforexea.blogspot.com

Can An Indian Trade Forex In Dubai

Frequently Asked Questions (FAQs)

Q: Is forex trading legal for Indians in Dubai?

A: Yes, Indian residents in Dubai can legally participate in forex trading through DFSA-regulated brokers.

Q: What are the limitations imposed on Indians trading forex in Dubai?

A: There are no specific limitations imposed by Dubai regulations. However, Indian citizens should adhere to RBI regulations when trading through platforms based in India.

Q: What is the minimum capital required to start forex trading in Dubai?

A: The minimum capital requirements may vary depending on the broker you choose. It is advisable to start with a manageable amount and gradually increase your investment as you gain experience and confidence.

Q: Is it possible to make a living from forex trading in Dubai?

A: While it is possible to generate substantial profits through forex trading, it requires a deep understanding of the market, a disciplined approach, and significant dedication. Treating it as a primary source of income should be approached with caution.

Conclusion

Forex trading offers a lucrative opportunity for Indians residing in Dubai to venture into the world of financial markets. Embracing the regulatory frameworks, understanding market dynamics, and implementing sound trading strategies are essential for success in this dynamic arena. Whether you seek a supplemental income stream or aspire to harness the power of the forex market, embarking on this journey requires a blend of knowledge, discipline, and perseverance. Are you ready to unlock the potential of forex trading as an Indian in Dubai? Embrace the challenge and start your journey today.