As an avid forex trader, I’ve learned firsthand the significance of risk management. And one crucial metric that helps me navigate the tumultuous market with confidence is the Sharpe ratio. Join me as we delve into the world of calculating the Sharpe ratio for forex, a game-changer in optimizing your trading strategy.

Image: www.vantagemarkets.co.uk

Sharpe Ratio: A Risk-Reward Compass

The Sharpe ratio is a quantitative measure that evaluates an investment’s excess return (return beyond the risk-free rate) relative to its volatility. It serves as a benchmark to gauge the efficiency of your trading strategies. A higher Sharpe ratio indicates that you’re reaping substantial returns for the level of risk you’re taking.

Calculating the Sharpe Ratio for Forex

To determine your forex trading Sharpe ratio, follow these steps:

- Calculate your average return: Determine the average return of your trading strategy over a specific period (e.g., 1 year).

- Subtract the risk-free rate: Adjust for the prevailing risk-free rate, which represents the return on a low-risk investment (e.g., government bonds).

- Calculate the standard deviation of returns: Measure the volatility of your trading returns by calculating the standard deviation.

- Divide excess return by standard deviation: Divide the difference between the average return and the risk-free rate by the standard deviation.

The resulting value is your Sharpe ratio.

Interpreting Your Sharpe Ratio

Once you’ve calculated your Sharpe ratio, interpret it as follows:

- Positive Sharp Ratio: Indicates that your trading strategy is generating positive excess returns beyond the risk-free rate.

- Negative Sharp Ratio: Suggests that your trading strategy is underperforming the risk-free rate.

- Higher Sharpe Ratio: Implies that you’re achieving high returns for the level of risk you’re taking.

- Lower Sharpe Ratio: Signals that your risk-adjusted returns are lower.

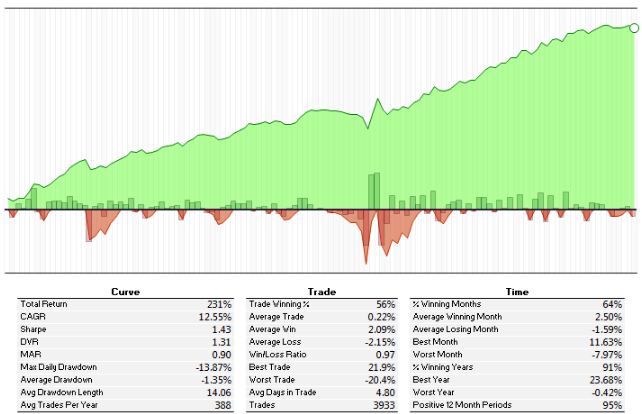

Image: www.forex.academy

Tips for Maximizing Your Sharpe Ratio

Here are some expert tips to help you improve your Sharpe ratio:

- Educate Yourself: Continuously expand your knowledge of forex trading and risk management.

- Test Your Strategies: Validate your trading strategies through backtesting and simulations.

- Diversify Your Portfolio: Spread your trading activities across different currency pairs and trading styles.

- Manage Risk Efficiently: Implement sound risk management techniques like stop-loss orders and position sizing.

FAQs on Calculating the Sharpe Ratio for Forex

Let’s address some common questions you may have:

- Q: How often should I calculate my Sharpe ratio?

A: Calculating your Sharpe ratio regularly (e.g., monthly or quarterly) allows you to monitor your performance and make necessary adjustments. - Q: What are some limitations of the Sharpe ratio?

A: While the Sharpe ratio is a valuable metric, it assumes a normal distribution of returns. In reality, forex returns may not always follow a normal distribution. - Q: Can I compare my Sharpe ratio to other traders?

A: Comparing Sharpe ratios can provide insights, but it’s crucial to consider individual risk tolerance and trading strategies.

Calculating Sharpe Ratio For Forex

Conclusion

Calculating the Sharpe ratio for forex is an indispensable tool for risk-aware traders. It empowers you to assess your trading strategies, optimize your risk-reward balance, and maximize your potential returns. Embrace this powerful metric to elevate your forex trading game and achieve greater success in the ever-evolving currency markets.

Now, I’d like to ask you: Are you ready to explore the exciting world of Sharpe ratio calculation and unlock the potential to refine your forex trading strategies? Share your thoughts and experiences in the comments section below.