Introduction

Forex trading, or foreign exchange trading, involves buying and selling currencies with the aim of profiting from exchange rate fluctuations. Interactive Brokers is a popular online brokerage platform that offers a range of features and tools for forex traders, including advanced charting, risk management functionalities, and comprehensive market data.

Image: cabronesmc.com

Understanding Profit Calculation

To calculate profit in forex trading, you must first determine the difference between the entry and exit prices of the traded currency pair. If you bought a currency pair at a lower price and sold it at a higher price, you have made a profit. Conversely, if you bought at a higher price and sold at a lower price, you have incurred a loss.

Example:

Let’s say you bought EUR/USD (Euro against the US Dollar) at 1.1000 and sold it at 1.1050. The difference in price is 0.0050, which represents a profit of 50 pips (points in percentage). Assuming a trade size of 1 standard lot (100,000 currency units), your profit would be 500 USD.

Factors Affecting Profitability

Numerous factors can influence your profit potential in forex trading with Interactive Brokers:

Image: www.switchmarkets.com

High market volatility offers greater profit opportunities but also carries higher risk. When currencies fluctuate significantly, you can potentially make or lose more profits in a shorter timeframe.

The spread is the difference between the bid and ask prices of a currency pair. Interactive Brokers typically offers competitive spreads, which can significantly impact your profitability.

Leverage allows you to trade with more capital than you have, potentially increasing your profit potential but also amplifying your risk.

Your trading strategy heavily influences your profitability. Develop a well-defined strategy based on thorough research and technical analysis.

How Interactive Brokers Enhances Profit Optimization

Interactive Brokers provides traders with several tools to enhance profit optimization:

Interactive Brokers offers advanced charting capabilities, technical indicators, and order types that empower traders to make informed trading decisions.

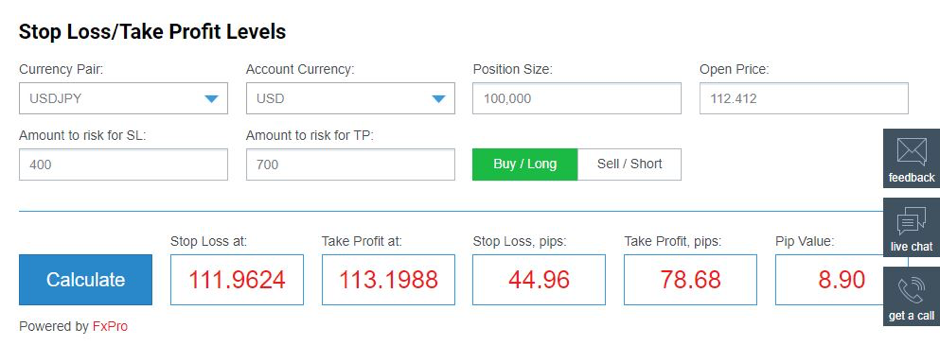

The platform includes stop-loss and take-profit orders, which can automatically close your positions at pre-determined levels, helping to limit losses and protect profits.

Interactive Brokers provides traders with real-time market data, news, and economic events that can influence currency prices, facilitating informed trading.

The Trader Workstation platform supports automated trading through APIs, allowing traders to create and execute sophisticated trading strategies.

Strategies for Maximizing Profits

Here are some tips on how to maximize profits when trading forex with Interactive Brokers:

Pairs with high volatility offer greater profit opportunities but come with higher risk.

Leverage can enhance profits, but it also magnifies losses. Use leverage cautiously and in accordance with your risk tolerance.

Stay informed about economic events and news that can impact currency prices.

Use stop-loss and take-profit orders to limit potential losses and secure profits.

Develop a well-defined trading strategy and constantly refine it based on performance analysis.

Calculate Profit In Forex Interactive Brokers

Conclusion

Calculating profit in forex trading with Interactive Brokers is relatively straightforward, but several factors influence your profitability. By understanding these factors and leveraging the advanced features provided by Interactive Brokers, you can optimize your trading strategy and increase your chances of success.