Buying forex from Western Union offers a convenient and secure way to access foreign currencies for international transactions. As a globally recognized money transfer service, Western Union has established a strong presence in the forex market, providing competitive exchange rates and a seamless transaction process. In this article, we’ll delve into the intricate details of buying forex from Western Union, exploring its benefits, procedures, and potential implications.

Image: www.victoriana.com

Benefits of Buying Forex from Western Union

- Convenience: With a vast network of physical locations and online platforms, Western Union makes it easy to purchase forex anytime, anywhere.

- Security: Western Union employs robust security measures to protect customer funds and sensitive information during transactions.

- Competitive Exchange Rates: Western Union offers competitive exchange rates compared to other currency exchange providers, ensuring that customers get the best value for their money.

- Global Presence: Western Union operates in over 200 countries and territories, facilitating forex transactions across diverse regions.

- Speed and Efficiency: Western Union processes forex transactions efficiently, often providing same-day delivery for essential currencies.

How to Buy Forex from Western Union

- Step 1: Choose a Method: You can purchase forex from Western Union either through their physical locations or online platforms.

- Step 2: Find Exchange Rates: Compare exchange rates from different Western Union locations or online platforms to select the best deal.

- Step 3: Create an Account (Online Only): If you’re purchasing forex online, create a Western Union account to streamline the process.

- Step 4: Select Currencies: Choose the currencies you wish to buy and sell.

- Step 5: Enter Amount: Specify the amount of forex you want to purchase.

- Step 6: Make Payment: Pay for your forex transaction via debit card, credit card, or bank transfer.

- Step 7: Receive Forex: Collect your forex from the designated Western Union location or have it delivered to your doorstep (subject to availability).

Considerations Before Buying Forex from Western Union

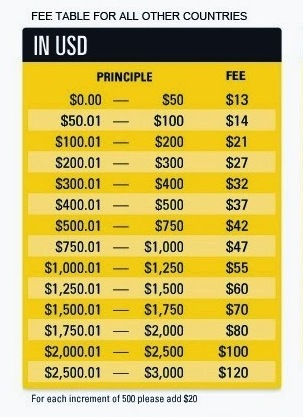

- Transfer Fees: Western Union charges transfer fees for forex transactions, which can vary depending on factors such as the amount of forex purchased, the chosen currency pair, and the transaction method.

- Exchange Rate Fluctuations: Forex exchange rates are subject to constant fluctuations; monitor the market before making a transaction to minimize potential losses.

- Transaction Limits: Western Union imposes transaction limits for forex purchases, both in terms of daily amounts and overall account limits.

- Verification Requirements: Western Union may require identity and address verification when purchasing forex above certain amounts or for first-time transactions.

Image: www.noeimage.org

Applications of Buying Forex from Western Union

- International Travel: Buy forex for travel expenses to avoid high currency exchange rates at airports or tourist destinations.

- Remittances: Send money to loved ones overseas using Western Union’s forex services.

- Business Transactions: Conduct cross-border business transactions by purchasing forex for payments and remittances.

- Investment: Invest in foreign markets by purchasing forex and trading in global currencies.

- Hedging: Reduce currency risks for international businesses and individuals by buying forex as a hedge against exchange rate fluctuations.

Buy Forex From Western Union

Conclusion

Buying forex from Western Union offers a secure and accessible way to fulfill international financial needs. With competitive exchange rates, global reach, and efficient transaction processes, Western Union has established itself as a trusted partner for forex transactions. However, it’s essential to consider transfer fees, exchange rate fluctuations, transaction limits, and verification requirements before making a purchase. Understanding the fundamentals of forex trading and monitoring currency markets can help maximize benefits and minimize potential drawbacks.